- United States

- /

- Banks

- /

- OTCPK:QNBC

QNB (QNBC) Profit Margin Rise Challenges Cautious Growth Outlook

Reviewed by Simply Wall St

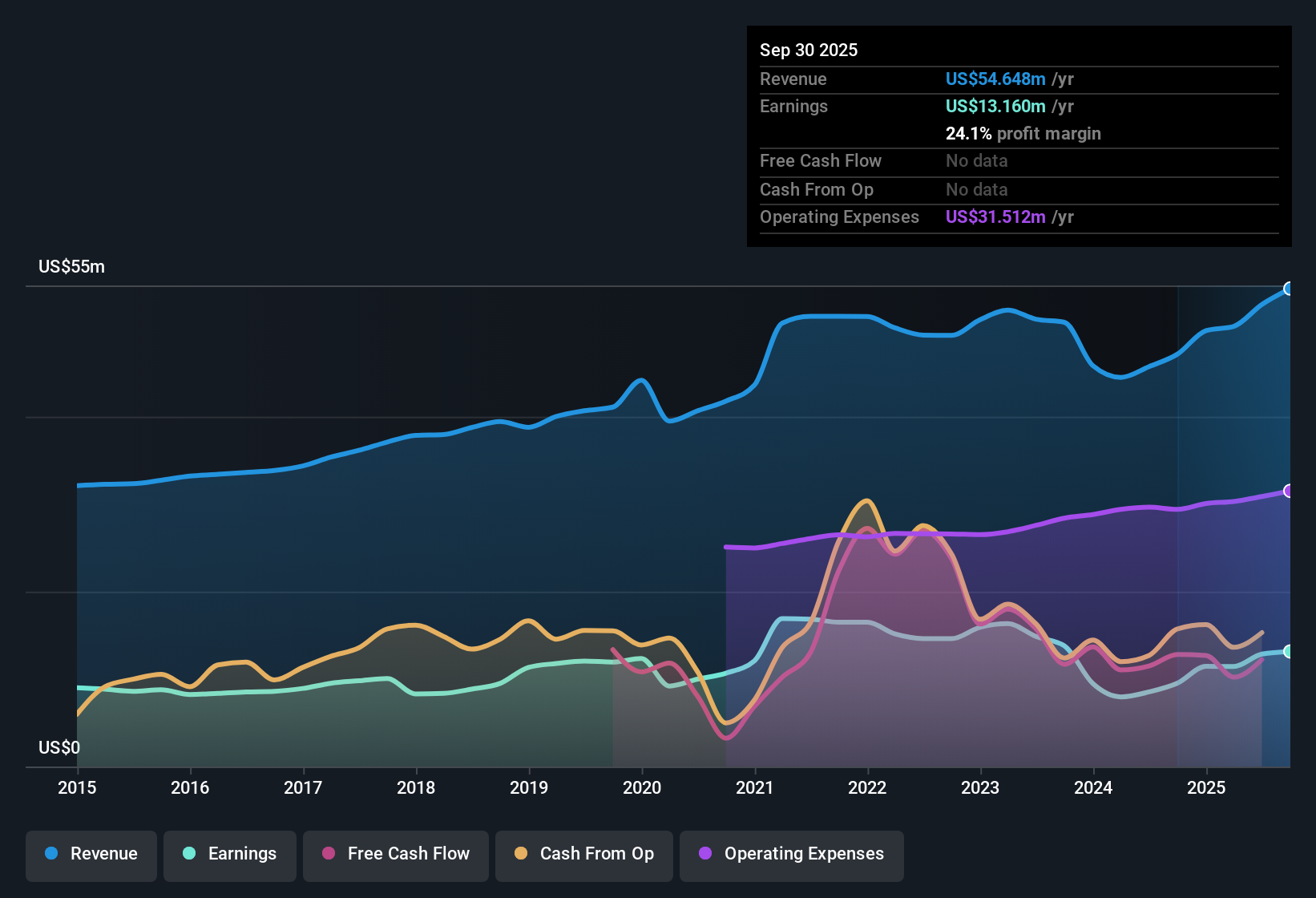

QNBC (QNBC) posted a net profit margin of 24.1% in the most recent period, up from 20.2% the year before, and recorded annual earnings growth of 38.1%. That marks a sharp turnaround from the company’s five-year average annual earnings decline of 7%. Investors may see the combination of rising profit margins, attractive dividends, and strong annual earnings as signals of operational improvement and relative value, especially with shares currently trading at $34.74, which is well below the estimated fair value of $65.8.

See our full analysis for QNB.Next, we will see how these headline numbers stack up against the current market narrative. Some expectations may get confirmed, while others could face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Jump Narrows Peer Gap

- QNBC’s net profit margin climbed to 24.1% for the most recent period, a notable rise from 20.2% the year prior. This brings the company more in line with quality regional banks.

- What stands out in the prevailing view is how this margin expansion, paired with the company’s shift from a 5-year average earnings decline of 7% to 38.1% growth this year, strongly supports optimism about a structural turnaround for QNBC.

- This kind of profit margin recovery is viewed as a strong sign of improved operational discipline and revenue stability, factors that bullish investors often highlight in the banking sector.

- Nonetheless, the shift must be weighed against future outlook, as sustaining these improved margins will be crucial for QNBC’s narrative going forward.

Low 9.8x P/E Undercuts Industry Multiples

- At just 9.8x price-to-earnings, QNBC’s valuation stands below the US Banks industry average of 11.2x and its peer average of 12.2x. This reinforces the company’s positioning as a value opportunity.

- While this discount aligns with the view that investors are attracted by undemanding multiples and steady earnings, the prevailing analysis reminds us to watch whether the recent earnings jump proves durable.

- If profit margins can remain at these higher levels, the low P/E may look increasingly attractive to value-focused investors.

- However, if growth stalls as some risk factors suggest, the valuation gap could persist or even widen versus peers.

DCF Fair Value Points to Nearly Double Upside

- QNBC’s current share price of $34.74 sits well below its calculated DCF fair value of $65.80, highlighting a possible upside of almost 90% if valuation targets are realized.

- From the analytical perspective, this wide fair value gap sets up a clear tension for investors.

- On one hand, value-oriented investors will take comfort in the stock trading at a deep discount to intrinsic estimates, especially given recent profit margin gains.

- On the other hand, the primary risk flagged is the lack of clarity around future revenue and earnings growth, which calls into question how quickly or fully this upside might be unlocked.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on QNB's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While QNBC’s rapid profit margin recovery stands out, the biggest question mark is whether it can consistently sustain earnings and revenue growth from this point forward.

If you want reliable compounding instead of uncertainty, focus on steady performers by using stable growth stocks screener (2127 results) to find companies delivering growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QNB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:QNBC

QNB

Operates as the bank holding company for QNB Bank that engages in the provision of commercial and retail banking products, and retail brokerage services in the United States.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives