- United States

- /

- Banks

- /

- OTCPK:NODB

North Dallas Bank & Trust (NODB) Margin Surge Challenges Cautious View on Profit Trend

Reviewed by Simply Wall St

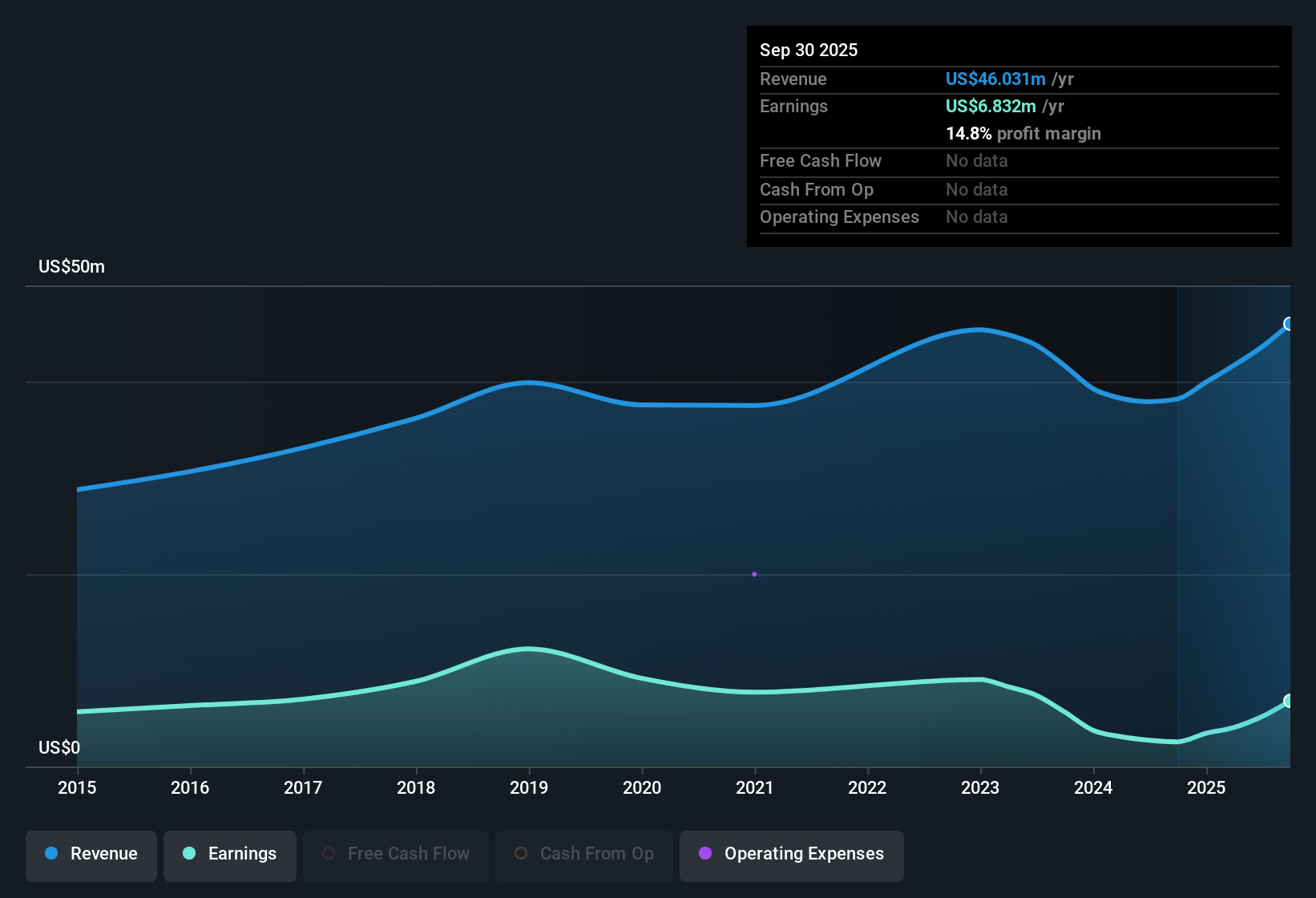

North Dallas Bank & Trust (NODB) reported net profit margins of 11.9%, up from 7.2% a year ago. This comes even as its earnings have declined at a 25.3% annual rate over the past five years. In the most recent year, however, earnings growth surged 89.9%, marking a sharp reversal from the longer-term trend. Management highlighted the high quality of these results. At the same time, the stock trades at a price-to-earnings ratio of 29x, well above both its peer average of 9.1x and the U.S. Banks industry average of 11.2x. Its share price stands at $58.5, which far exceeds an estimated fair value of $7.8.

See our full analysis for North Dallas Bank & Trust.The next section takes these headline numbers and sets them against the most widely discussed narratives in the market, revealing where the consensus holds up and where the data could prompt a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Defies Longer-Term Decline

- Net profit margin rose to 11.9%, up from 7.2% the year before. This contrasts with a five-year annual earnings decline of 25.3% per year.

- Recent performance heavily supports the view that stable management can deliver quality results in volatile environments. However:

- While the latest 89.9% one-year earnings growth is striking, it stands against the backdrop of years of annual declines.

- Prevailing analysis stresses that without more evidence of consistent improvement, cautious optimism is warranted rather than exuberance.

No Clear Catalysts Signals Investor Patience

- Despite a sharp profit margin uptick and recent earnings surge, management has offered no explicit guidance or outlook for further revenue or earnings growth.

- Bulls may highlight the high quality of the latest margin improvement, but prevailing sentiment notes:

- The lack of clear drivers for ongoing growth means the company’s future trajectory remains uncertain, especially after five years of negative earnings trends.

- Recent gains may not be enough to attract new buyers without visible, sustained progress or announced catalysts.

Valuation Far Exceeds Fair Value Benchmarks

- Shares now trade at $58.50, which is over 7 times the DCF fair value of $7.80 and at a 29x price-to-earnings ratio. This is much higher than both the industry average (11.2x) and peer average (9.1x).

- Prevailing narrative points out that the steep premium over both intrinsic value and sector benchmarks presents a material risk for investors:

- This lofty valuation stands in contrast to limited near-term growth prospects, raising questions about how much stability investors are really paying for.

- Bears argue such a gap between price and fundamentals often signals longer-term caution, unless the trend in earnings growth proves sustainable.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on North Dallas Bank & Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

North Dallas Bank & Trust's lofty valuation and recent gains contrast with years of profit declines as well as a lack of clear catalysts for sustained growth.

Concerned about paying too much for uncertain prospects? Find stronger value by searching for opportunities among these 877 undervalued stocks based on cash flows that are backed by healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Dallas Bank & Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:NODB

North Dallas Bank & Trust

Provides personal and business banking products and services in Texas.

Proven track record with very low risk.

Similar Companies

Market Insights

Community Narratives