- United States

- /

- Banks

- /

- OTCPK:MSWV

Main Street Financial (MSWV) Margin Surge Reinforces Bullish Narratives on Efficiency and Profitability

Reviewed by Simply Wall St

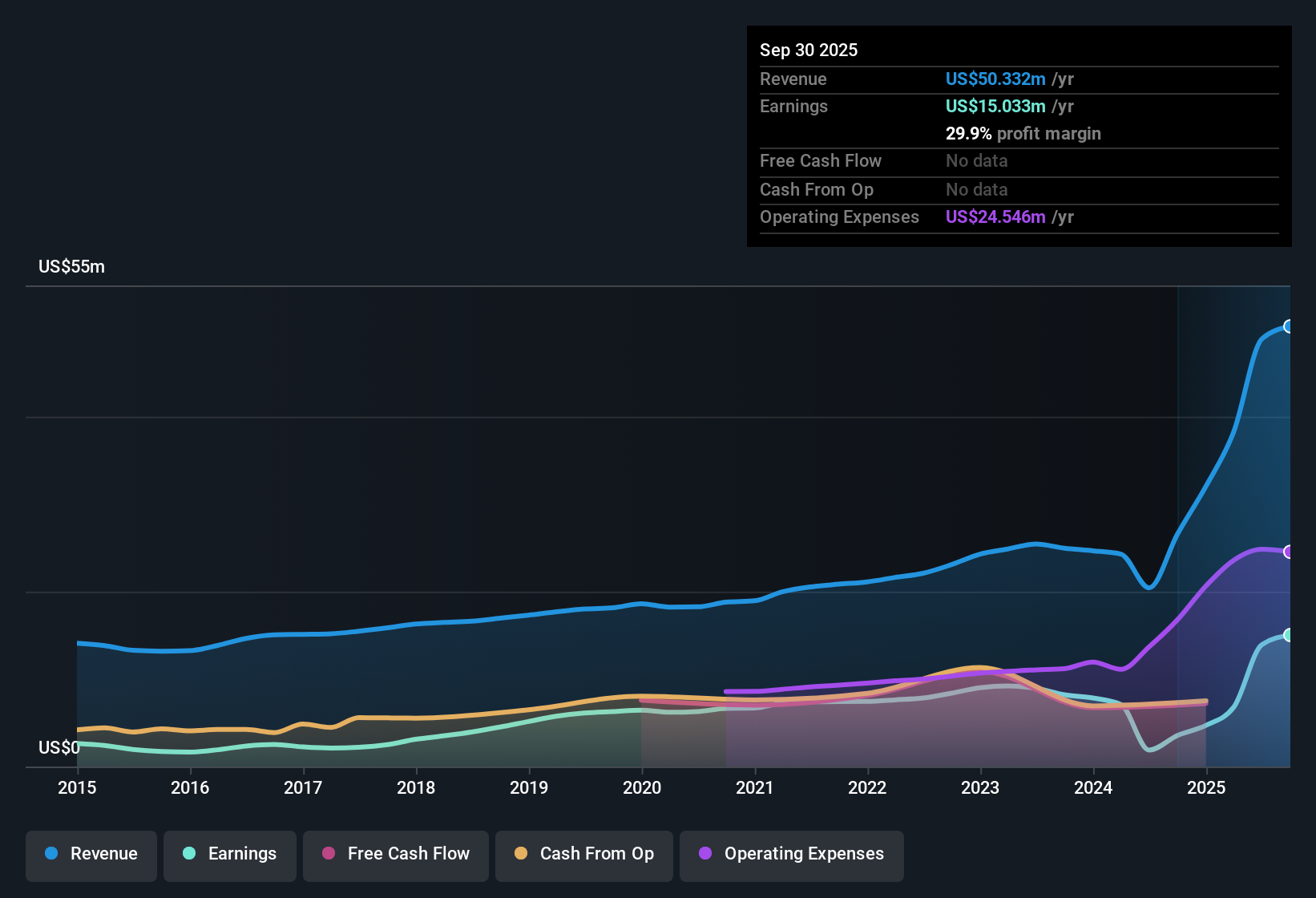

Main Street Financial Services (MSWV) delivered exceptional gains in its latest earnings report, with five-year annual earnings growth averaging 4.9%. The most recent year saw a dramatic 323% surge in earnings. Net profit margins also climbed sharply to 29.9% from last year’s 13.4%, highlighting a major leap in profitability. Investors are likely to take this as a positive signal, especially with the current price-to-earnings ratio of 8.4x undercutting both industry and peer averages. This supports the view that MSWV offers strong value for its earnings power.

See our full analysis for Main Street Financial Services.Next, we’ll see how these headline results stack up against the wider community narratives and expectations. Some will be validated, while others could face some tough questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Signals Operational Strength

- Net profit margin increased to 29.9%, a major improvement from 13.4% the previous year. This marks a sharp uptick in operational efficiency and profitability.

- What stands out from the prevailing market view is how the higher margin aligns with investor optimism around MSWV’s ability to manage costs and deliver consistent profit:

- Margin gains directly challenge any lingering doubts about scalability, with efficiency improvements evident in back-to-back annual disclosures.

- Bulls often highlight consistent margin growth as proof that the company’s competitive positioning remains intact, even as the industry faces pressure.

Valuation at a Steep Discount to DCF Fair Value

- With shares trading at $16.20, well below the DCF fair value estimate of $45.94, MSWV currently sits at a price-to-earnings ratio of 8.4x. This level is lower than both the US banks average (11.2x) and its peer group (9.7x).

- The prevailing market view heavily supports the case that MSWV represents a value opportunity:

- The significant gap between share price and DCF fair value amplifies the notion of undervaluation, especially given positive margin and profit growth trends.

- A lower price-to-earnings ratio compared to industry norms presents a compelling relative value for long-term investors, supported by sustained earnings momentum.

Consistent Earnings Growth Builds Long-Term Appeal

- MSWV has delivered 4.9% average annual earnings growth over five years, culminating in a recent one-year leap of 323%, far outpacing its historical trend.

- The prevailing market view considers this durable growth a signal of resilience and upside potential:

- Steady, compounding gains over multiple years build the case for earnings durability, even as market cycles ebb and flow.

- The outsized jump this year signals management’s ability to act decisively when favorable conditions arise, reinforcing the narrative of a well-run business positioned for growth.

See our latest analysis for Main Street Financial Services.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Main Street Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive profit growth, MSWV’s rapid earnings jump may be hard to sustain. This could signal volatility rather than the steady trajectory many investors prefer.

If you find consistent results more appealing, discover stable growth stocks screener (2098 results) and focus on companies delivering steady earnings and growth through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:MSWV

Main Street Financial Services

Operates as the holding company for Main Street Bank Corp.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives