- United States

- /

- Banks

- /

- OTCPK:CWBK

CW Bancorp (CWBK) Margin Decline Challenges Bullish Valuation Narrative for Undervalued Shares

Reviewed by Simply Wall St

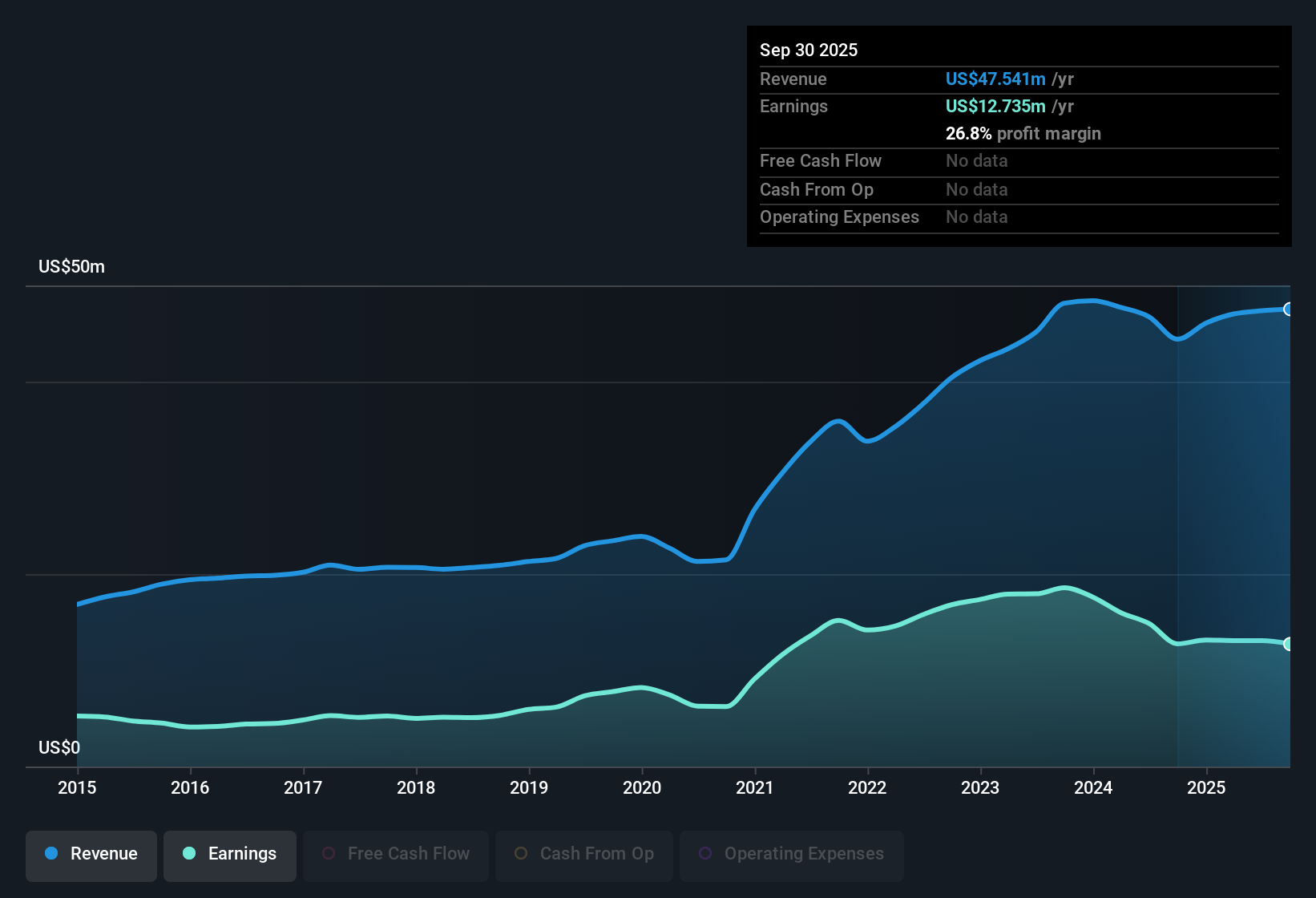

CW Bancorp (CWBK) closed the year with a net profit margin of 26.8%, down from 28.7% a year ago. The company posted negative earnings growth over the past twelve months compared to a 5-year annual earnings growth rate of 4.1%. The company's market valuation stands out, with shares trading at 8x earnings, notably below both the US Banks industry average of 11x and the peer average of 11.5x. The share price of $34.75 is well under its estimated fair value of $86.43. With high quality earnings and no flagged risk factors, investors appear most focused on the compelling valuation and history of profit growth, while keeping an eye on recent margin tightening and growth setbacks.

See our full analysis for CW Bancorp.Next, we will set these earnings side by side with the key narratives shaping sentiment around CW Bancorp to see what matches up and where expectations might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Squeeze Signals Shift

- The net profit margin dropped from 28.7% last year to 26.8% this year, showing that profitability is being squeezed even though the company’s overall margin remains robust for its sector.

- What is surprising is that, even as margin pressure emerges, the company still boasts high quality earnings.

- This combination sharply illustrates the tension between resilient fundamentals and recent growth setbacks. Negative earnings growth stands out against a consistent 5-year annual growth rate of 4.1%.

- Stable margin levels, while a bit lower, reinforce claims that management keeps costs in check despite sector-wide pressures. Yet, investors must weigh how much further margins can tighten before it chips away at quality perceptions.

Resilient Valuation Discount to Peers

- CW Bancorp’s price-to-earnings multiple is 8x, undercutting both the US Banks industry average of 11x and the peer average of 11.5x. This highlights a rare valuation discount that stands out in today’s market.

- While the prevailing narrative for banks anticipates conservative pricing due to sector volatility, CW Bancorp’s discount looks unusually steep relative to both trends and fundamentals.

- The current share price of $34.75 sits far below its DCF fair value estimate of $86.43. This deep gap heavily supports arguments that shares are undervalued and could attract attention as sentiment in the sector recovers.

- Peers with similar earnings profiles typically see more modest valuation gaps, so the sheer size of CW Bancorp’s discount hints at opportunity if the company maintains stability amid industry headwinds.

No Risk Flags Amid Sector Jitters

- The company posted no flagged risk factors in recent filings, a notable contrast against a broader banking landscape marked by high-profile sector stresses and caution from investors.

- What stands out is that, while some narratives for regional banks caution about commercial real estate or deposit flight, there is no evidence from current disclosures that such risks have impacted CW Bancorp’s results.

- No new risk warnings have emerged. Even as peers have weathered regulatory issues and credit concerns, this reinforces confidence in CWBK’s risk controls.

- This backdrop fuels stable sentiment around capital preservation. Barring fresh macro shocks, investors can focus more on valuation and profit quality than on immediate risk headlines.

Sentiment may shift quickly if the gap between valuation and fundamentals closes or if sector risks re-emerge, so keep your analysis grounded in these hard numbers as you follow the story.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CW Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite attractive valuation, CW Bancorp's declining margins and negative recent earnings growth cast doubt on the sustainability of its performance.

If you want more consistency, use our stable growth stocks screener (2087 results) to zero in on companies delivering steady revenue and profit expansion regardless of the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CWBK

CW Bancorp

Operates as a holding company for CommerceWest Bank that provides various commercial banking products and services for small and mid-sized businesses in California.

Good value with adequate balance sheet.

Market Insights

Community Narratives