- United States

- /

- Banks

- /

- OTCPK:CBCY

Are Central Bancompany’s (CBCY) Earnings Gains a Sign of Sustainable Profitability Improvements?

Reviewed by Sasha Jovanovic

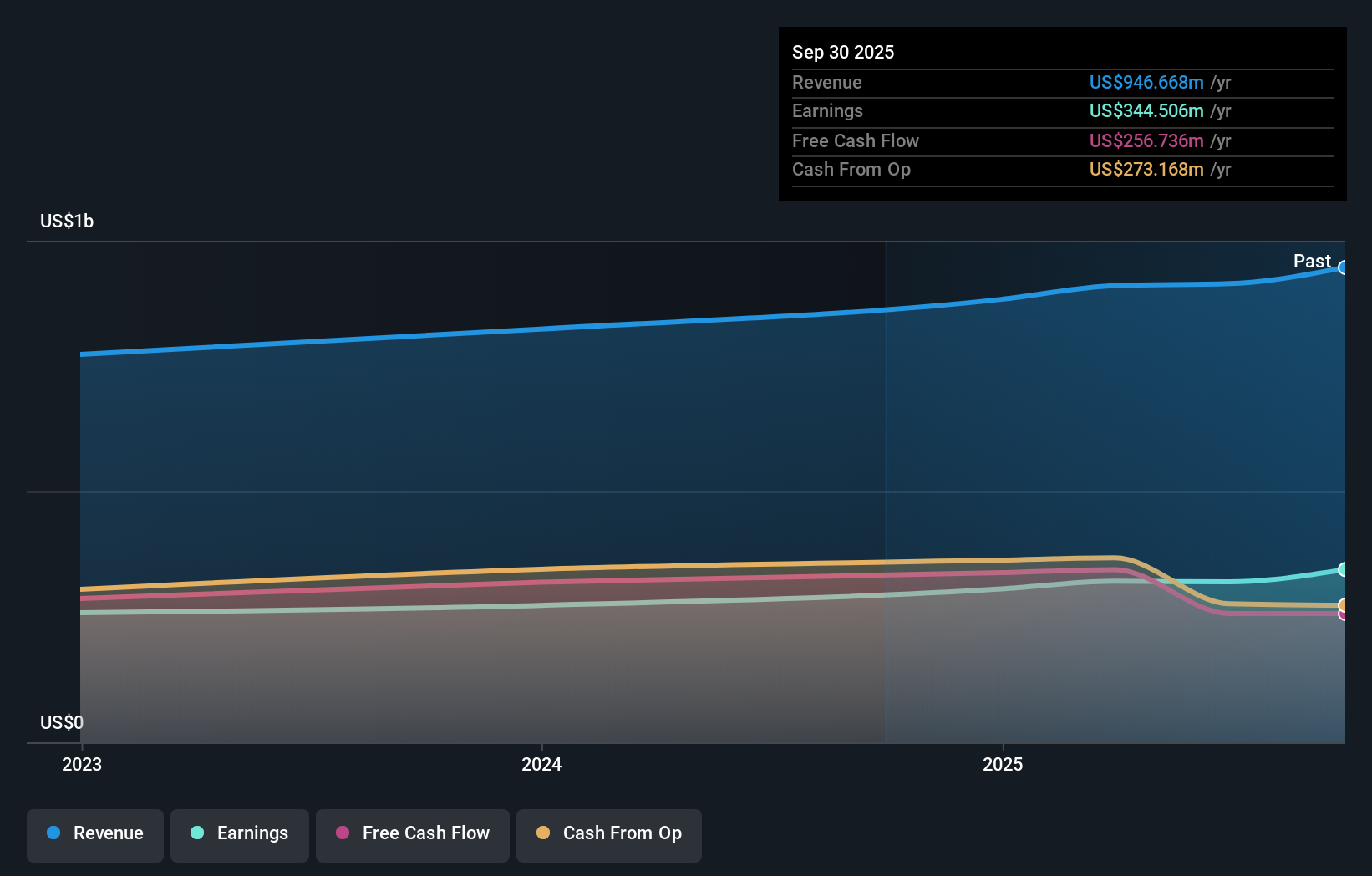

- Central Bancompany, Inc. recently announced earnings results for the nine months ended September 30, 2025, reporting net interest income of US$583.2 million and net income of US$283.26 million, both higher than the prior-year period.

- This increase in profitability was reflected in basic and diluted earnings per share rising to US$1.28 from US$1.10 a year ago, highlighting operational improvements.

- We’ll now explore how Central Bancompany’s rising net interest income and earnings shape the company’s investment narrative moving forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Central Bancompany's Investment Narrative?

To be a shareholder in Central Bancompany right now, you’d need to believe in the bank’s ability to turn rising net interest income and recent earnings momentum into sustainable performance, even as its Price-To-Earnings Ratio stays above the industry average. The surge in net income and EPS reported for the first nine months of 2025 suggests operational improvements are taking hold, which could support confidence ahead of the IPO and after the recent 50:1 stock split. On the other hand, with only modest clarity around future revenue growth and a Return on Equity that remains on the lower end at 10.5%, the upside isn’t guaranteed. The earnings announcement appears to back up profits seen year-to-date and could strengthen short-term catalysts, but risks such as persistently expensive valuations and limited earnings growth forecasts still demand attention.

Yet not all risks are captured by headline earnings or recent price gains alone. Central Bancompany's shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Central Bancompany - why the stock might be a potential multi-bagger!

Build Your Own Central Bancompany Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Bancompany research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Central Bancompany research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Bancompany's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CBCY

Central Bancompany

Operates as the bank holding company for The Central Trust Bank that provides consumer, commercial and wealth management products and services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives