- United States

- /

- Banks

- /

- OTCPK:ARBV

American Riviera Bancorp (ARBV): Net Profit Margin Surges to 21.2%, Challenging Flat Growth Narrative

Reviewed by Simply Wall St

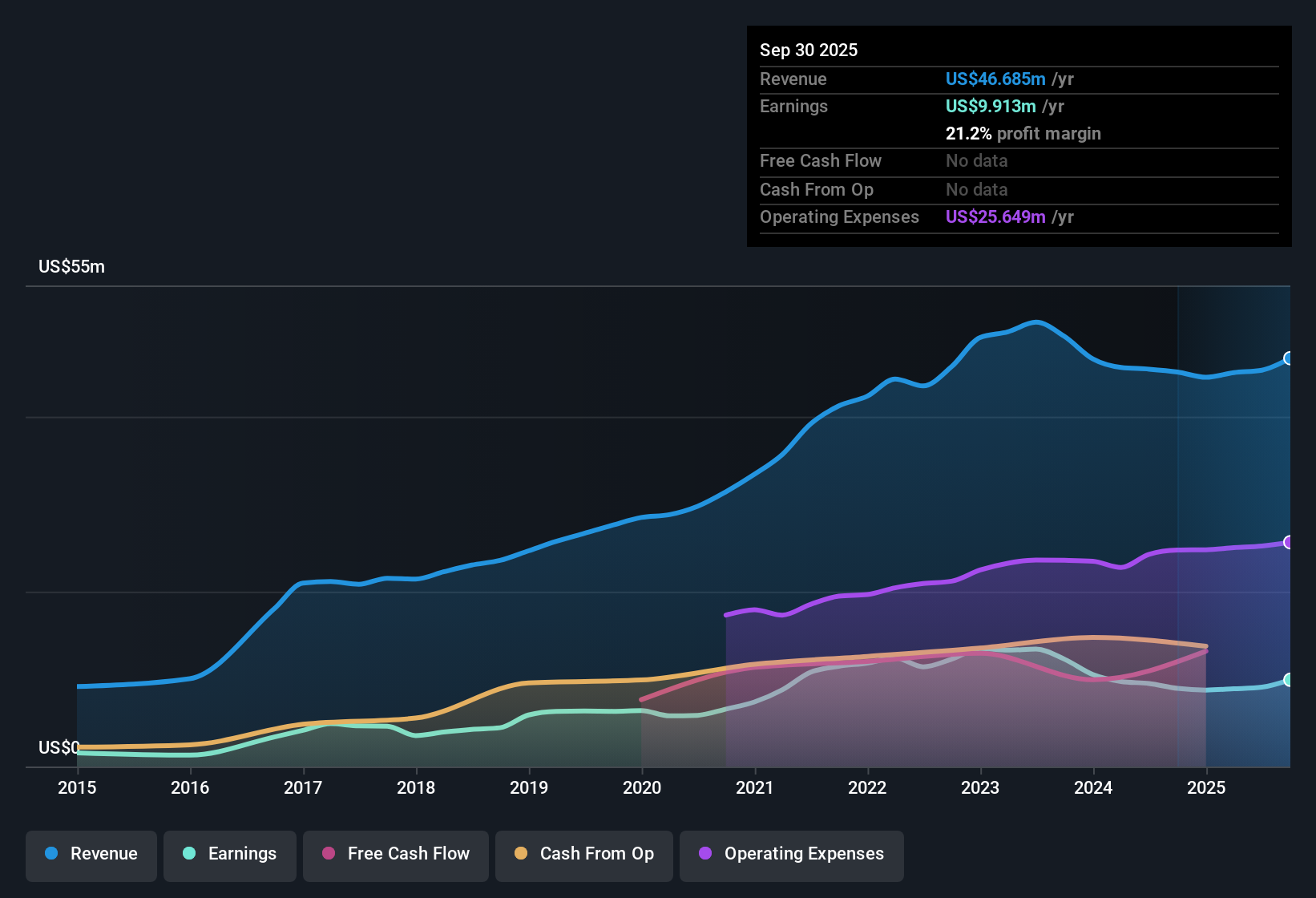

American Riviera Bancorp (ARBV) posted net profit margins of 21.2%, a notable improvement from 19.8% a year ago. Annual earnings jumped 11%, outperforming its own five-year average rate of -0.3% per year. Despite this momentum, the longer-term trend remains flat, with five-year earnings dipping by an average of 0.3% each year. Against this backdrop, investors are likely to focus on both the encouraging uptick in profitability and the stock's potential undervaluation, balanced by lingering questions about future growth prospects.

See our full analysis for American Riviera Bancorp.Next up, we will put these numbers head-to-head with the most widely followed narratives around ARBV to reveal where sentiment matches reality and where it might get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Break Out Above 21% Despite Flat Five-Year Trend

- Net profit margin increased to 21.2%, up from 19.8% last year. However, measured over five years, average earnings decreased by 0.3% per year even as the latest annual growth reached 11%.

- Bulls often focus on the current margin jump to argue ARBV is emerging stronger than many regional bank peers. What stands out is that five-year average earnings have still been negative.

- This margin surge bolsters the view that the bank delivers in resilient periods,

- but it highlights that ARBV has not consistently outpaced the sector over a longer window, tempering excessive bullishness based on a single year's improvement.

P/E Leads Sector Peers But Not Entire Industry

- ARBV's price-to-earnings ratio stands at 12.4x, which is slightly below the peer average of 12.9x but higher than the broader US banks industry average of 11.2x.

- These mixed valuation signals invite debate about how attractively ARBV is priced in the current environment.

- Supporters argue the peer-relative discount positions ARBV as a value candidate within its immediate competitive set,

- but critics can point to the wider industry’s even lower multiples, suggesting the shares are not a blanket bargain given sector headwinds.

DCF Fair Value Flags Deep Discount

- The share price of $21.48 trades well below the DCF fair value estimate of $31.52, opening a potential discount opportunity for value-oriented investors.

- Market observers highlight that such a significant gap between market price and DCF fair value can prompt re-rating catalysts.

- While improved margins justify optimism about ARBV’s core profitability,

- the persistent absence of visible revenue or earnings growth drivers may keep this discount in place absent new momentum.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on American Riviera Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite ARBV’s recent margin surge, its uninspiring five-year earnings trend and lack of clear growth drivers raise concerns about consistently stable long-term performance.

If dependable results matter most to you, check out our stable growth stocks screener (2101 results) for companies that deliver steady revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ARBV

American Riviera Bancorp

Provides a range of community banking products and services for businesses and consumers in California.

Flawless balance sheet and fair value.

Market Insights

Community Narratives