- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (WFC): Examining If Recent Gains Leave More Room for Upside in Valuation

Reviewed by Simply Wall St

See our latest analysis for Wells Fargo.

Momentum has been building for Wells Fargo as the stock notched a 20.7% year-to-date share price return, supported by improved financials and shifting investor risk appetite. Over the past year, a total shareholder return of nearly 19% highlights solid longer-term performance despite recent sector volatility.

If you're keeping an eye on financial momentum, it's a great time to look beyond the headlines and discover fast growing stocks with high insider ownership

Yet with Wells Fargo trading about 22% below its estimated intrinsic value and still about 10% below average analyst price targets, the key question is whether the current share price leaves room for future upside or if investor optimism is already fully reflected in the market.

Most Popular Narrative: 9% Undervalued

Against Wells Fargo's last close at $84.70, the most popular narrative suggests a fair value nearly $8.50 higher, hinting at notable headroom versus current pricing. The consensus narrative brings together bullish and bearish analyst perspectives and quantifies fair value using anticipated profit growth, margins, and a sector-level discount rate.

The removal of the asset cap and resolution of multiple regulatory orders unlocks Wells Fargo's ability to aggressively grow its balance sheet, including deposits, loans, and trading assets, after years of constraint. This is likely to result in higher revenue and earnings growth over the coming quarters and years. A strong focus on digital banking and client experience improvements has driven consistent gains in mobile banking adoption, digital account openings, and customer satisfaction. This positions Wells Fargo for scalable growth and cost efficiencies, supporting both revenue growth and net margin expansion as more banking activity shifts online.

Want a behind-the-scenes look at the numbers supporting this valuation upside? The narrative rides on ambitious growth projections and a future profit multiple usually reserved for industry leaders. Craving the key assumption that drives this fair value? Dive in and see the forecast Wall Street is betting on.

Result: Fair Value of $93.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive threats from both banks and fintechs, along with lingering regulatory challenges, could still pose risks to Wells Fargo's optimistic growth narrative.

Find out about the key risks to this Wells Fargo narrative.

Another View: What About Earnings Compared to Peers?

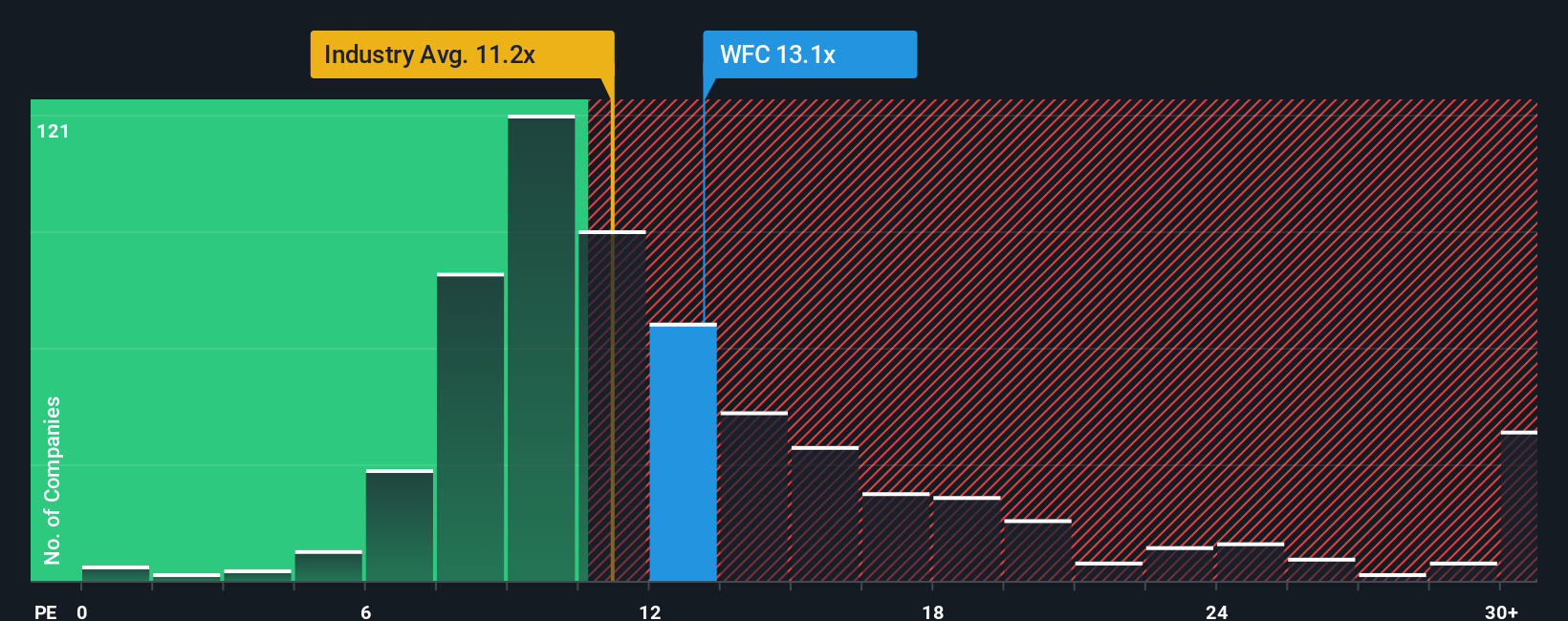

While fair value models suggest Wells Fargo is trading below its true worth, a look at its price-to-earnings ratio paints a more cautious picture. The stock trades at 13.3x earnings, higher than both the US Banks industry average of 11.1x and peers at 12.4x. Although this is close to the fair ratio of 13.9x, it suggests investors may be paying a premium. This raises the question of whether the potential reward justifies the risk at current levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wells Fargo Narrative

If you'd rather dig into the numbers yourself or have a different perspective on Wells Fargo's outlook, you can quickly craft your own narrative and see how it stacks up using Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your research stop here. With the Simply Wall Street Screener, you could unlock powerful new strategies and fresh growth ideas others might overlook.

- Capitalize on cutting-edge breakthroughs in medicine by checking out these 31 healthcare AI stocks with the strongest artificial intelligence edge in healthcare innovation.

- Boost your income strategy and seek reliable cash flow from these 15 dividend stocks with yields > 3% with yields above 3% for steady long-term returns.

- Seize the upside in technology by targeting these 27 AI penny stocks at the forefront of artificial intelligence advancement and rapid market disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives