- United States

- /

- Banks

- /

- NYSE:WFC

Does Wells Fargo’s New Texas Campus Signal a Shift in Long-Term Growth Strategy for WFC?

Reviewed by Sasha Jovanovic

- Wells Fargo recently marked a major milestone with the grand opening of its new Las Colinas campus in Irving, Texas, reflecting a significant investment in the Dallas-Fort Worth region and Texas as a whole.

- Standout features include the campus' energy net-positive design and advanced sustainability technologies, underscoring Wells Fargo's focus on modern workplace innovation and community engagement.

- We'll examine how Wells Fargo's expanded physical and community presence in Texas may influence its investment narrative and future growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Wells Fargo Investment Narrative Recap

For Wells Fargo shareholders, the core thesis remains tied to the bank’s ability to drive growth following the removal of regulatory asset caps and ongoing investments in physical and digital infrastructure. The grand opening of the Las Colinas campus showcases a commitment to operational expansion and sustainability, yet does not materially alter the major short-term catalyst, balance sheet growth unlocked by recent regulatory relief, nor does it overshadow ongoing risks tied to regulatory scrutiny and digital innovation competition.

Among the latest announcements, the confirmation of steady net interest income guidance for 2025 stands out. Stability in this key metric directly supports the growth narrative enabled by the asset cap removal and reassures investors amid a backdrop of potential risks, including industry-wide legal challenges and the need for ongoing regulatory compliance.

However, what investors should watch closely is the ongoing risk from regulatory and compliance obligations, which, despite recent progress, continue to require significant resources and may influence Wells Fargo’s ability to...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's outlook anticipates $90.6 billion in revenue and $22.1 billion in earnings by 2028. This scenario assumes annual revenue growth of 5.3% and an earnings increase of $2.6 billion from the current $19.5 billion level.

Uncover how Wells Fargo's forecasts yield a $91.44 fair value, a 5% upside to its current price.

Exploring Other Perspectives

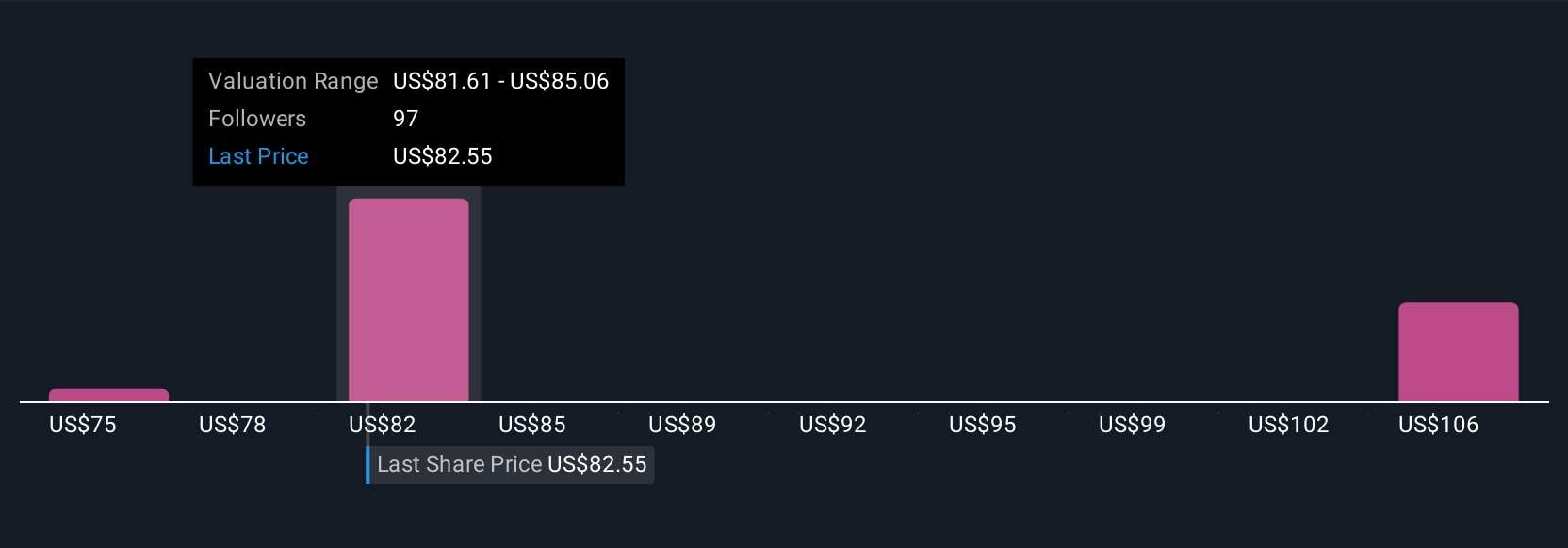

Five fair value estimates from the Simply Wall St Community range from US$74.70 to US$105.75 per share. While many see strong potential linked to expanding the balance sheet post-asset cap, you will find highly varied opinions, consider reviewing multiple perspectives to inform your view.

Explore 5 other fair value estimates on Wells Fargo - why the stock might be worth 14% less than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives