- United States

- /

- Banks

- /

- NYSE:WFC

Assessing Wells Fargo (WFC) Valuation After Its Strong Share Price Rally

Reviewed by Simply Wall St

Wells Fargo (WFC) has been quietly rewarding patient shareholders, with the stock up about 35% over the past year and roughly 33% year to date, comfortably outpacing the broader market.

See our latest analysis for Wells Fargo.

The recent leg higher in Wells Fargo’s share price, now around $93.01, reflects investors warming to steadier earnings, improving credit trends, and a cleaner regulatory backdrop. Both short term share price momentum and long term total shareholder returns are firmly positive.

If Wells Fargo’s run has you rethinking your bank exposure, it might be worth scanning fast growing stocks with high insider ownership for other under the radar names that management teams are backing with their own capital.

With earnings and credit trends moving in the right direction and the share price sitting just below analyst targets, the key question now is simple: Is Wells Fargo still undervalued or is the market already pricing in future growth?

Most Popular Narrative: 1.6% Undervalued

With Wells Fargo last closing at $93.01 against a narrative fair value of $94.50, the story leans toward modest upside driven by earnings quality.

The analysts have a consensus price target of $87.0 for Wells Fargo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $72.0.

Want to see what justifies a higher fair value than the Street target? The narrative leans on steady growth, resilient margins, and a richer future earnings multiple. Curious which specific long range profit assumptions power that view? Open the full narrative to see the numbers behind this valuation call.

Result: Fair Value of $94.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory burdens or a slower than expected digital transformation could erode margins and stall the rerating that underpins this optimistic view.

Find out about the key risks to this Wells Fargo narrative.

Another Angle on Value

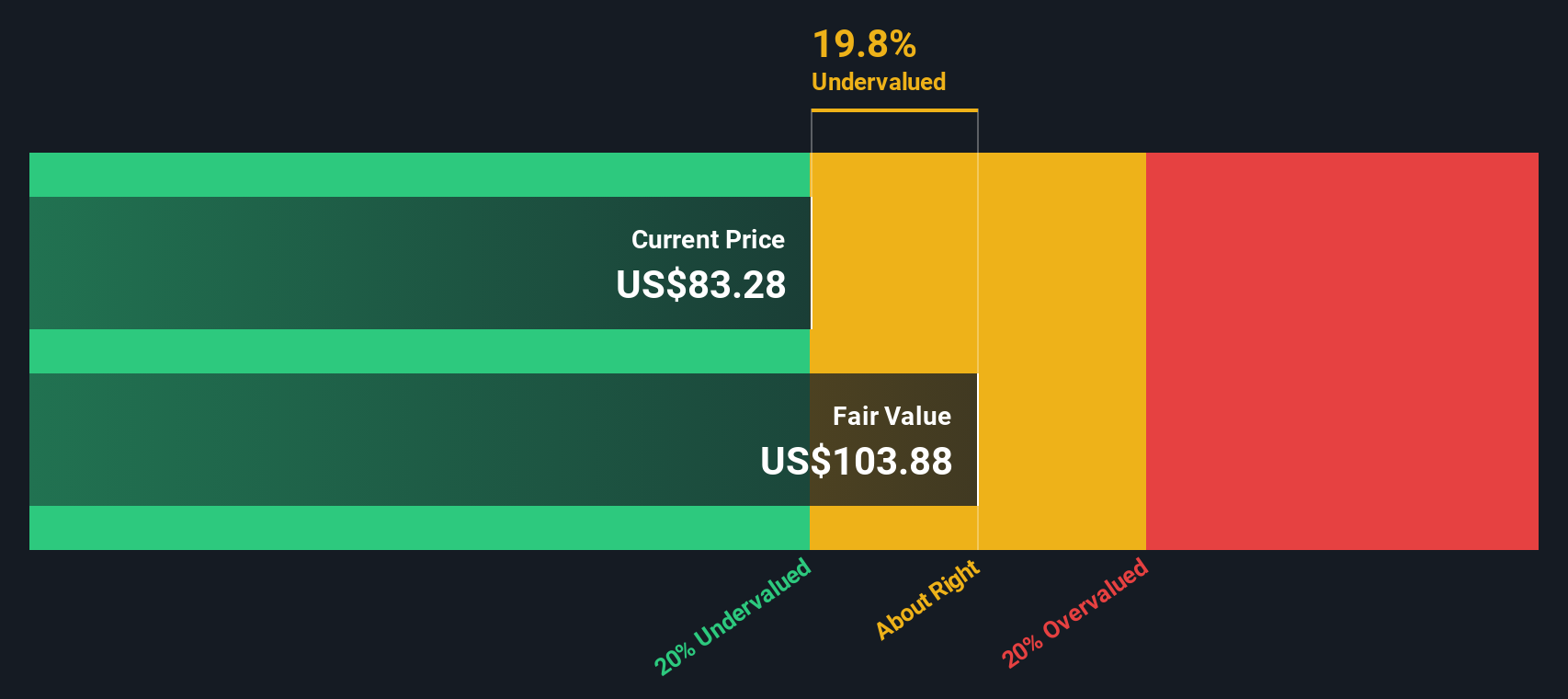

Our DCF model suggests a stronger upside case than the narrative fair value. Wells Fargo is trading about 17.7% below its estimated intrinsic value of $113.02. If cash flows support a much higher price than sentiment implies, is the market underestimating the long term earnings power here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Wells Fargo Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Wells Fargo in context by comparing it with other high potential opportunities using our powerful, data driven Simply Wall Street Screener.

- Capitalize on mispriced opportunities by scanning these 913 undervalued stocks based on cash flows built on rigorous cash flow analysis rather than hype.

- Ride structural growth trends by targeting innovators shaping tomorrow’s economy with these 24 AI penny stocks at the forefront.

- Strengthen your passive income strategy by hunting for reliable payers via these 12 dividend stocks with yields > 3% delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion