- United States

- /

- Banks

- /

- NYSE:WFC

Assessing Wells Fargo Shares After 23% Rally and Fresh Sector Optimism in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with your Wells Fargo shares, or just wondering if now is the time to buy in? You are definitely not alone. With its recent run higher, Wells Fargo has been turning heads. Its share price closed at $86.41, having climbed 3.8% in the past week and an impressive 23.1% year-to-date. The bank has delivered a whopping 351.7% return over the past five years, so it is not surprising that investors are paying close attention.

A few developments have added to the conversation. Shifts in the regulatory outlook, plus broad gains for the financial sector, have attracted risk-tolerant buyers who see fresh momentum in the stock. The market’s recent optimism partially reflects expectations for higher interest rates, which have typically favored traditional banks like Wells Fargo. At the same time, news around banking sector stability has reminded investors that risks do remain, keeping long-term valuation questions firmly in focus.

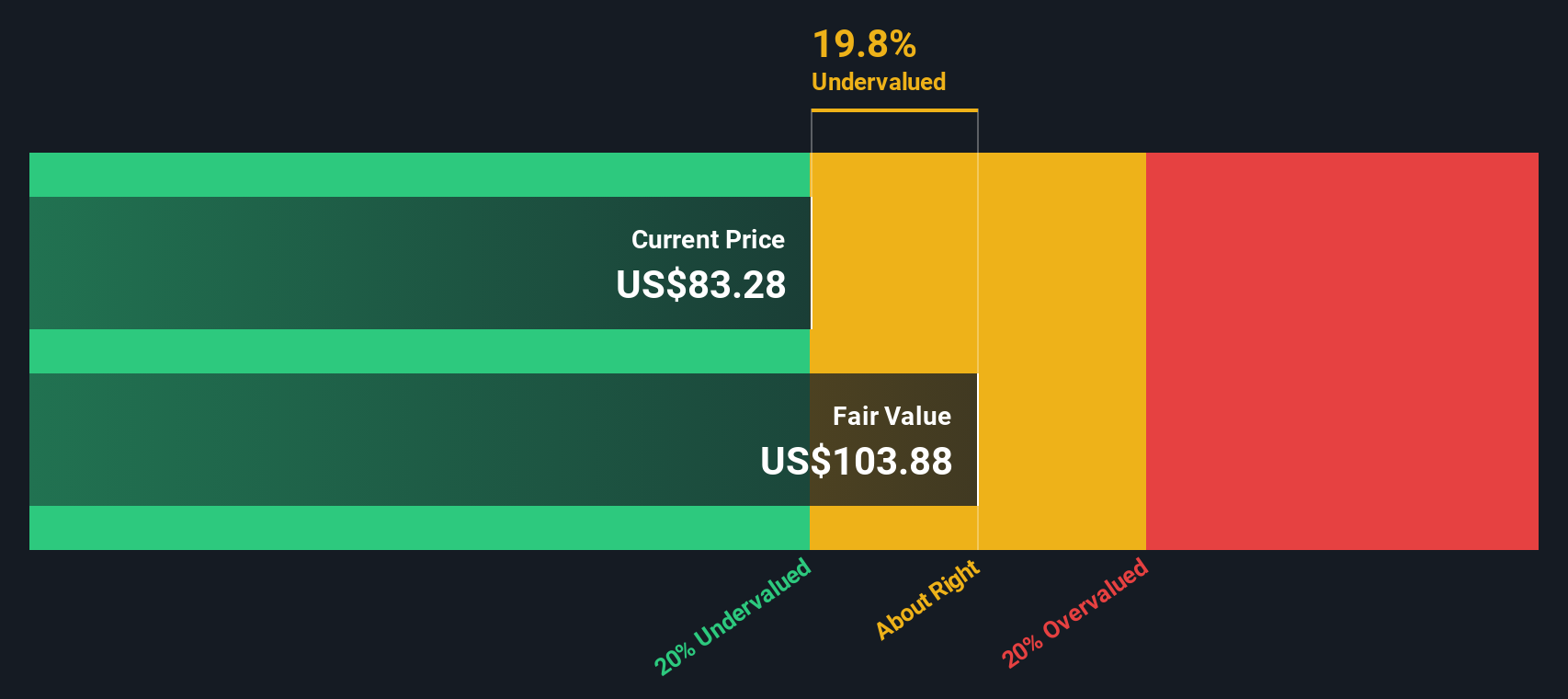

So, is Wells Fargo undervalued or has its price already run ahead too far? Using several commonly used valuation checks, the company's score comes in at 2 out of 6—not exactly screaming "bargain," but not out of contention, either. Next, we will break down these valuation approaches to see how Wells Fargo really stacks up, and later, I will share another way to view its value that could make all the difference for your decision-making.

Wells Fargo scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wells Fargo Excess Returns Analysis

The Excess Returns valuation model examines how effectively a company uses its shareholders’ equity to generate returns above its cost of capital. Simply put, it measures how much profit Wells Fargo produces relative to what it could earn by just covering the cost of its equity. This provides insight into the true economic value being created.

For Wells Fargo, the latest data show a Book Value of $52.25 per share, with an Average Return on Equity of 12.86%. Analysts expect a stable Earnings Per Share (EPS) of $7.12, based on projections from 17 analysts. The Cost of Equity is $4.55 per share, so the Excess Return generated is $2.57 per share. The Stable Book Value is anticipated to rise to $55.36, according to consensus estimates from 14 analysts.

Based on the Excess Returns model, the intrinsic value of Wells Fargo is estimated at $105.46 per share. With the current share price at $86.41, this suggests the stock is trading at an 18.1% discount to its intrinsic value. This may indicate the stock is undervalued at present.

Result: UNDERVALUED

Our Excess Returns analysis suggests Wells Fargo is undervalued by 18.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

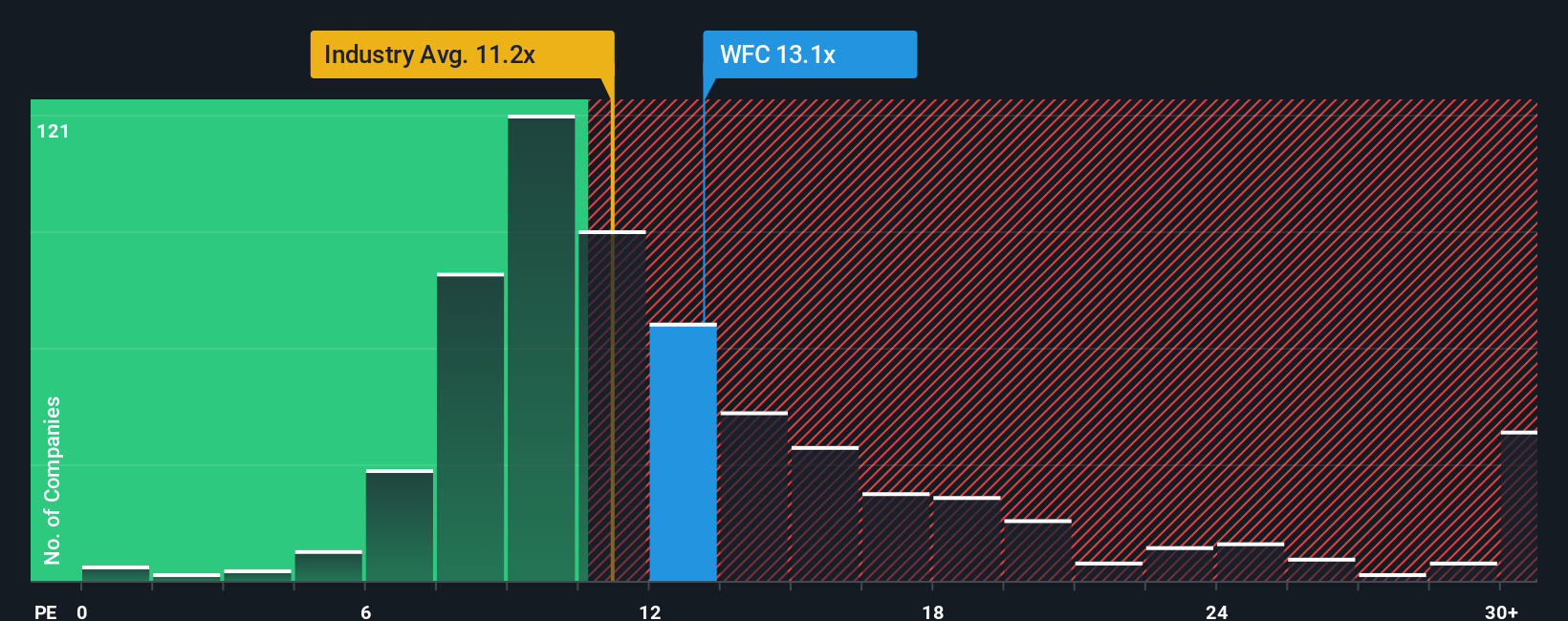

Approach 2: Wells Fargo Price vs Earnings

The price-to-earnings (PE) ratio is a commonly used valuation metric for profitable companies, as it shows how much investors are willing to pay for each dollar of a company’s earnings. It is particularly useful for established firms like Wells Fargo with consistent profitability, as earnings often provide a clearer picture of underlying business health.

While looking at the PE ratio can be helpful, it is important to remember that expectations for future growth and perceived risks will influence what is seen as a "typical" or "fair" PE multiple. Higher growth companies tend to trade at higher PE ratios, while greater risk or lower profitability can reduce what the market is willing to pay.

Right now, Wells Fargo trades at a PE ratio of 13.6x. This is slightly above the average for its banking peers, which sits at 13.3x, and is materially higher than the broader industry average of 11.2x. However, the proprietary "Fair Ratio" calculated by Simply Wall St for Wells Fargo, based on factors like the company's earnings growth, risk profile, profit margin, industry, and market cap, is 15.5x. The Fair Ratio offers a more tailored benchmark than peer or industry comparisons because it adjusts for the specific strengths and risks of the business rather than treating all banks as equal.

Comparing Wells Fargo’s actual PE to the Fair Ratio, the stock currently trades below what could reasonably be considered “fair value.” This suggests that, accounting for its unique characteristics, Wells Fargo may be undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wells Fargo Narrative

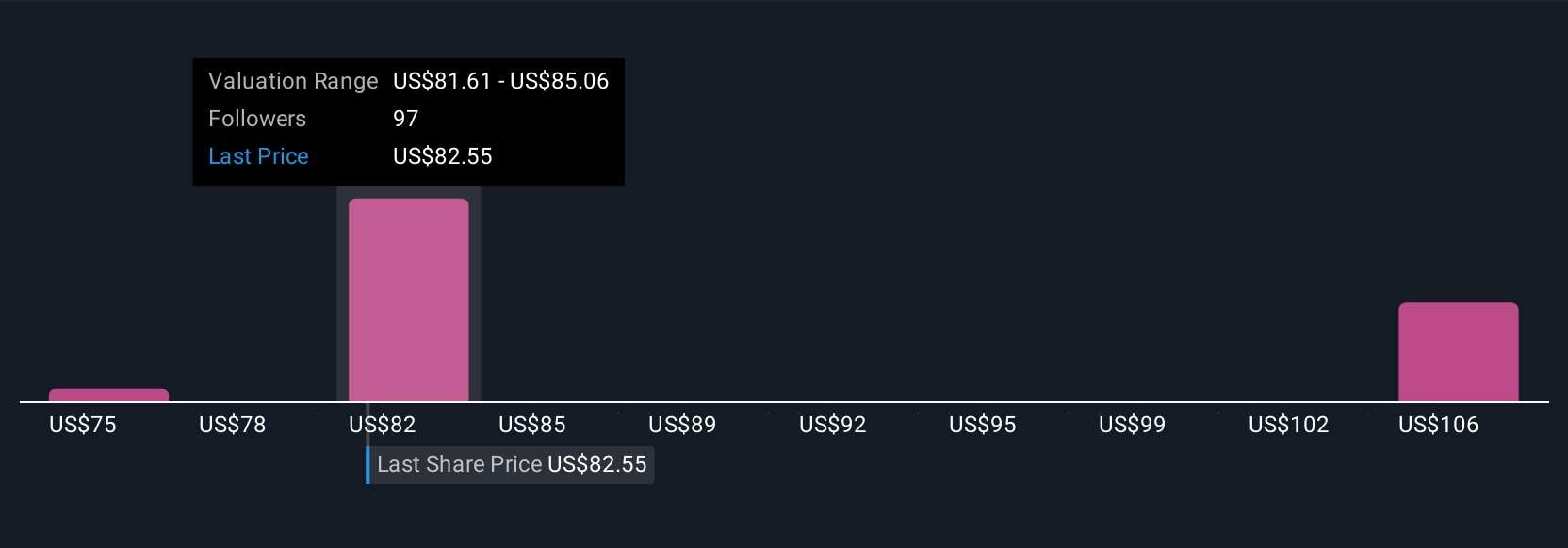

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, powerful way to link the story you believe about a company, such as Wells Fargo’s future growth, risks, and business changes, to your financial forecasts and fair value estimates, adding your own perspective behind the numbers.

Narratives connect your investment thesis (the "why" behind what you expect) to a forward-looking forecast of revenue, earnings, and margins, then translate all of that into a personal fair value. On Simply Wall St's Community page, millions of investors use Narratives as an easy, accessible tool to compare their own view of a company against the crowd, helping you decide whether to buy or sell based on how your Fair Value stacks up against the current Price.

Narratives dynamically update as new news or earnings come in, so your investment case always stays in sync with reality. For example, one investor might think Wells Fargo could be worth $74.70 per share if they expect only moderate growth and margin pressure, while another sees $91.44 as fair value thanks to expectations of rapid digital expansion and improved profitability. Narratives help you understand what is really driving those estimates and which story you believe most.

For Wells Fargo, we will make it really easy for you with previews of two leading Wells Fargo Narratives:

Fair Value: $91.44

Currently 5.5% undervalued (based on last close price vs. narrative fair value)

Expected Revenue Growth: 6.51%

- Regulatory restrictions have been lifted, unlocking balance sheet and business expansion, especially via digital banking and wealth management initiatives.

- Strategic investments in technology, expense control, and scalable platforms aim to boost long-term margins and competitiveness. Analysts forecast steady earnings growth and ongoing share buybacks.

- Risks remain from digital competition, evolving consumer behavior, and persistent compliance requirements. Analysts on average see the stock as close to fairly valued with upside from successful digital transformation.

Fair Value: $74.70

Currently 15.7% overvalued (based on last close price vs. narrative fair value)

Expected Revenue Growth: 3.0%

- While Wells Fargo’s forward P/E is below market and fundamentals remain solid, recent sector headwinds and slow growth in key segments keep some analysts cautious.

- Near-term revenue and earnings forecasts are positive but modest, and regulatory changes, though potentially beneficial, are not expected to fuel rapid gains.

- Despite undervaluation signals, tough competition and macroeconomic uncertainty could limit share price appreciation. Select analysts assign a more conservative fair value.

Do you think there's more to the story for Wells Fargo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives