- United States

- /

- Banks

- /

- NYSE:WBS

Does Webster Financial’s (WBS) Steady Dividend Approach Reveal Its Long-Term Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On October 29, 2025, Webster Financial Corporation announced that its Board of Directors declared a quarterly cash dividend of US$0.40 per common share, while also affirming quarterly preferred dividends for Series F and Series G shares with payment dates extending into early 2026.

- This continued commitment to returning capital to shareholders highlights Webster Financial's stable capital management and focus on rewarding both common and preferred investors.

- We'll explore how the recent dividend affirmation underscores management's approach to shareholder returns and its relevance for Webster Financial's outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Webster Financial Investment Narrative Recap

Being a shareholder in Webster Financial right now means having conviction in its ability to manage credit risk from commercial real estate exposure, maintain a strong, recurring income stream, and capitalize on growth catalysts like HSA Bank. The recent affirmation and payment schedule for both common and preferred dividends reflects consistent capital return, but does not materially change the biggest short-term catalyst, expanding fee and deposit growth, and the primary risk related to commercial real estate losses and margin compression.

The latest quarterly dividend announcement, maintaining a US$0.40 per share payout, is consistent with prior quarters and reinforces Webster’s ongoing focus on shareholder returns. Reliable dividend payments can provide confidence during periods of industry uncertainty, but challenges related to loan growth and deposit competition remain key to future performance.

Yet, investors should not overlook the possibility that commercial real estate headwinds could lead to higher provision expenses and pressure net income if...

Read the full narrative on Webster Financial (it's free!)

Webster Financial's narrative projects $3.4 billion revenue and $1.2 billion earnings by 2028. This requires 10.8% yearly revenue growth and a $369 million earnings increase from the current earnings of $830.6 million.

Uncover how Webster Financial's forecasts yield a $71.59 fair value, a 24% upside to its current price.

Exploring Other Perspectives

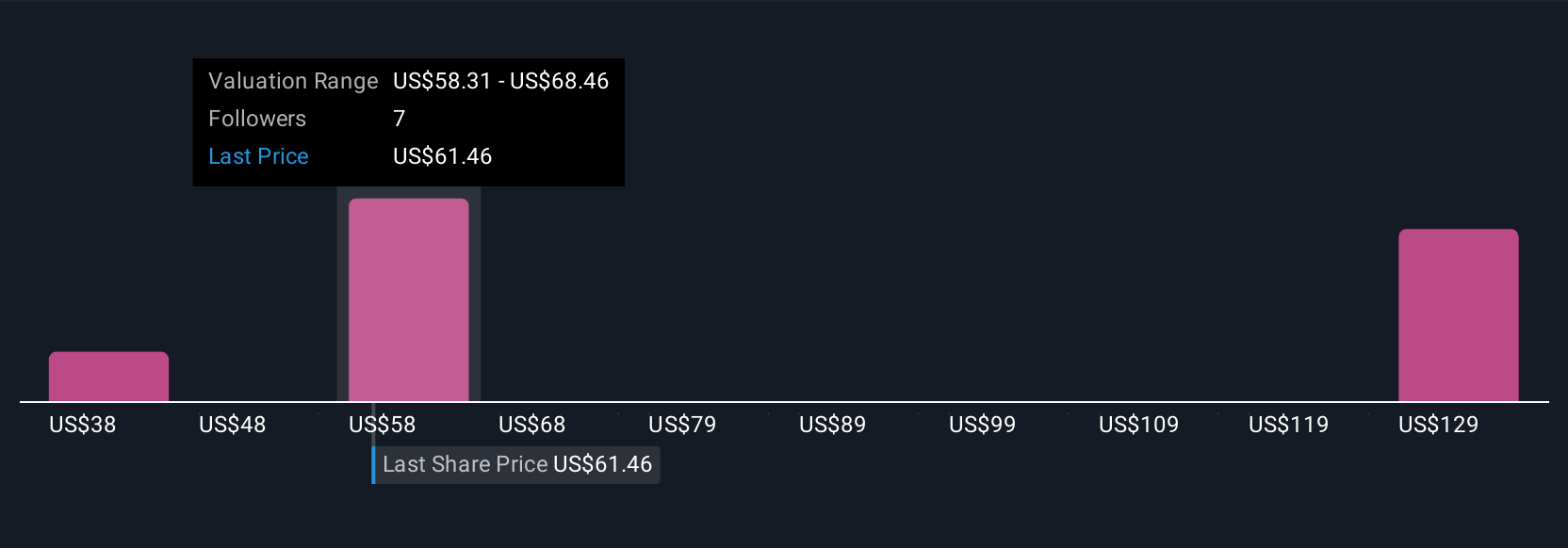

Simply Wall St Community members put fair value for Webster Financial stock in a wide range, from US$38 to US$129, across three different estimates. While major catalysts include HSA Bank's projected long-term deposit growth, you can see how views on the company’s future can vary, consider all the perspectives before making your own assessment.

Explore 3 other fair value estimates on Webster Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Webster Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Webster Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Webster Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Webster Financial's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives