- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (NYSE:UWMC) Is Due To Pay A Dividend Of $0.10

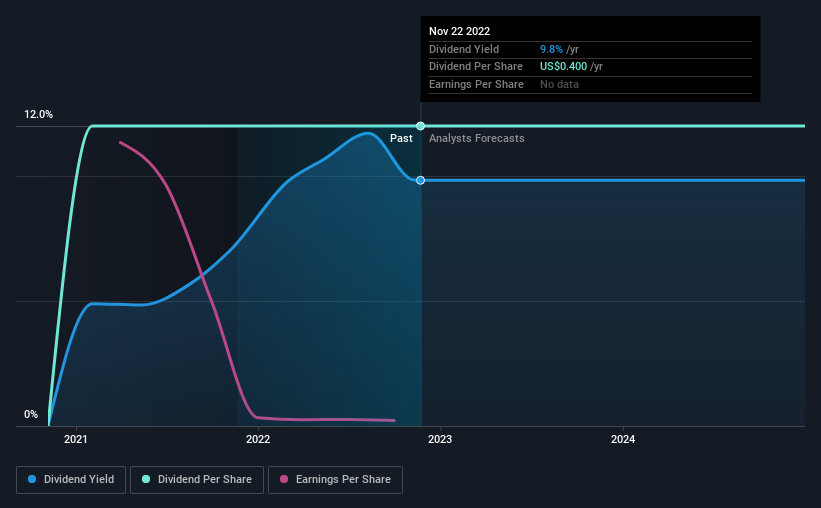

UWM Holdings Corporation's (NYSE:UWMC) investors are due to receive a payment of $0.10 per share on 10th of January. This means the annual payment is 9.8% of the current stock price, which is above the average for the industry.

View our latest analysis for UWM Holdings

UWM Holdings Not Expected To Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

Having paid out dividends for only 2 years, UWM Holdings does not have much of a history being a dividend paying company. Diving into the company's earnings report, the payout ratio is set at 63%, which is a decent ratio of dividend payout to earnings, and may sustain future dividends if the company stays at its current trend.

Looking forward, earnings per share is forecast to fall by 26.7% over the next 3 years. And estimates from analysts put the future payout ratio at 100% over the same time horizon, which is definitely a bit high to be sustainable going forward.

UWM Holdings Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. There hasn't been much of a change in the dividend over the last 2 years. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. EPS has fallen over the last year, with this year's number 96% below last year. Reduced dividend payments are a common consequence of declining earnings. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Our Thoughts On UWM Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for UWM Holdings you should be aware of, and 1 of them is significant. Is UWM Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UWMC

UWM Holdings

Engages in the residential mortgage lending business in the United States.

High growth potential and fair value.