- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial’s Valuation in Focus Following Expanded Technology Partnership with Logistics Leader NFI

Reviewed by Simply Wall St

Triumph Financial has just announced an expanded collaboration with NFI, a major player in logistics. NFI is adopting Triumph’s Payment, Audit, and Intelligence solutions to further digitize and automate payments across its carrier operations.

See our latest analysis for Triumph Financial.

Triumph Financial’s expanded partnership with logistics giant NFI comes on the heels of a new $40 million shelf registration and its recent presentation at a high-profile investment conference. This is occurring amid real momentum shifts. While operational growth is evident, the market has remained cautious, with the share price returning -43.03% year-to-date and the total shareholder return dropping nearly 49% over the past year. In the long term, though, Triumph still posts a modest positive total return over five years, hinting at underlying resilience even as near-term sentiment stays muted.

If you’re curious what other companies are gaining traction in today’s market, it could be a smart move to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 23 percent below analyst price targets despite solid revenue growth and a major new client, the question is whether Triumph Financial is now undervalued or if the market is already pricing in all future gains.

Most Popular Narrative: 16.4% Undervalued

Triumph Financial’s fair value, based on the most widely followed narrative, stands significantly above the last close. This raises questions about what is supporting the higher price target in the face of recent share declines. Analysts appear to agree on the potential for substantial upside as they weigh several financial catalysts and key strategic moves in their projections.

Integration of Greenscreens into Triumph's platform, with its $40B in proprietary audit and payment data, is significantly improving product accuracy and penetration within the top freight brokers. This is accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment, supporting higher fee-based revenue and improved earnings growth.

Earnings are set to leap, network effects are gaining ground, and a business model pivot few see coming may be underway. What is the secret equation fueling this bullish view? The narrative’s calculation is not just about growth, it hinges on a crucial shift in how Triumph makes money from technology and recurring revenues. The full story behind these bold projections might surprise you.

Result: Fair Value of $60.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy exposure to freight and logistics, along with competition from fintech challengers, could weigh on margins and challenge Triumph’s longer-term bullish outlook.

Find out about the key risks to this Triumph Financial narrative.

Another View: A Closer Look at Valuation Multiples

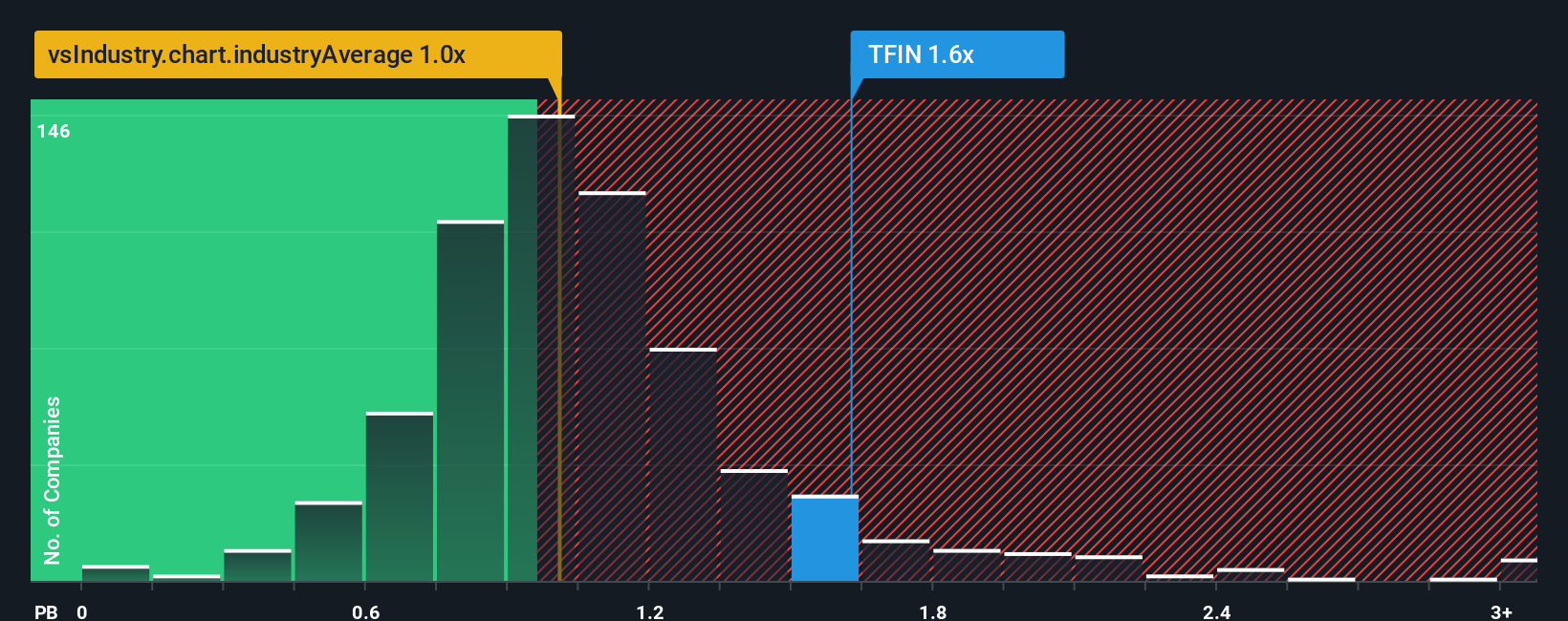

While some see Triumph Financial trading below analyst targets, banks are often assessed by their price-to-book ratio. Triumph’s current multiple of 1.4x stands notably above the industry and peer average of 1x. This raises the stakes for upside. Will this premium persist, or does it point to valuation risk if fundamentals disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Triumph Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Triumph Financial Narrative

Keep in mind, if you want to dig into the numbers or shape your own view, it only takes a few minutes to build your personal take on Triumph Financial. Do it your way

A great starting point for your Triumph Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Smart investors know opportunities do not wait. Unlock tomorrow’s leaders and stay ahead of market shifts by using these targeted screeners. Your next great investment could be just one click away.

- Capitalize on untapped value by seeking out opportunities with strong upside through these 908 undervalued stocks based on cash flows that are primed for long-term growth based on real cash flow analysis.

- Target wealth-building potential with these 15 dividend stocks with yields > 3% focused on delivering reliable income and attractive yields for your portfolio.

- Get ahead of the technological curve by identifying companies shaping breakthroughs in artificial intelligence using these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives