- United States

- /

- Banks

- /

- NYSE:SBSI

Southside Bancshares (SBSI): Net Margin Holds Strong, Defying Market's Modest Growth Narrative

Reviewed by Simply Wall St

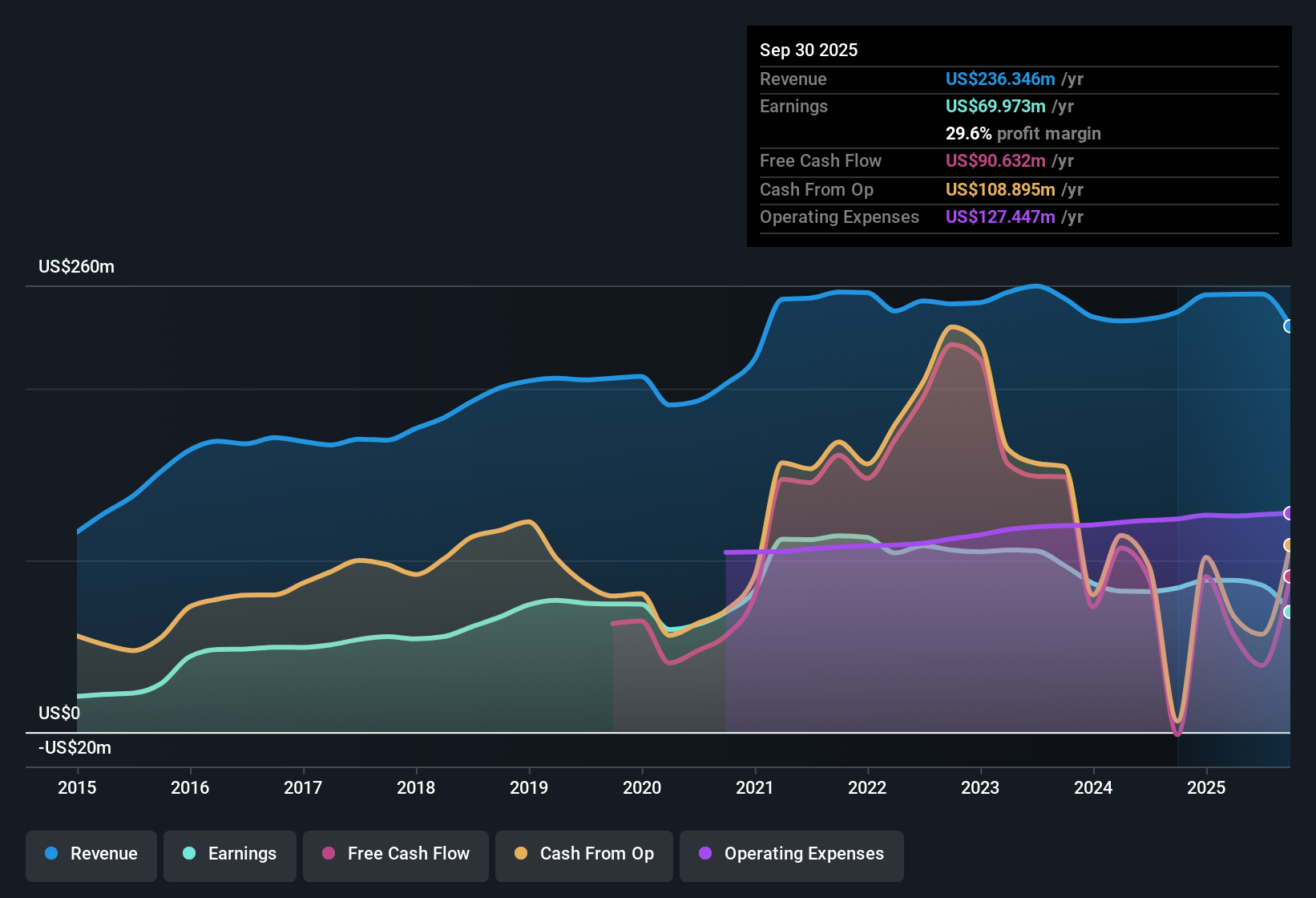

Southside Bancshares (SBSI) reported a net profit margin of 33.6%, dipping slightly from 34.1% a year earlier, while earnings growth over the last year came in at 4.5% after years of averaging a 3.5% annual decline. Looking forward, analysts project the company's earnings will grow at 3.99% per year with revenue expected to rise 5.6% annually, both trailing the broader US market's averages. Despite these modest growth forecasts, the stock is trading at a discounted 9.7x Price-To-Earnings ratio, well below its peer group and estimated fair value. This may highlight the perceived stability and quality of its results.

See our full analysis for Southside Bancshares.Next up, we'll see how these latest figures compare with the prevailing narratives among investors and analysts, where expectations match up and where the real story may surprise.

See what the community is saying about Southside Bancshares

Share Price Discounted Against DCF Fair Value

- With a current share price of $27.48, Southside Bancshares is trading at a steep discount to its DCF fair value of $53.73, and below the analyst price target of $32.67. This suggests the market continues to undervalue its long-term earnings potential.

- Analysts' consensus view points out that:

- The gap between the share price and both fair value and price target reflects a divergence between the company’s high-quality, stable margins and the market’s tepid outlook for growth. Consensus expects revenue to climb just 5.6% per year, while maintaining an above-industry profit margin of 33.6%.

- The company’s Price-To-Earnings ratio of 9.7x is well below the US Banks industry median of 11.2x and peers at 19.6x, further strengthening the narrative that Southside’s relative value and earnings quality may not be fully recognized by investors.

- For a full dive into the consensus narrative behind these valuation signals, including why analysts' fair value and price targets remain above the current share price, see the breakdown in the official consensus report. 📊 Read the full Southside Bancshares Consensus Narrative.

Profit Margin Slide Still Tops Industry

- Despite a modest contraction, the company’s net profit margin of 33.6% remains robust versus industry peers, outstripping the US market average and supporting a 4.5% earnings lift this year after several years of average declines.

- Analysts' consensus narrative highlights two trends:

- Even as profit margins are forecast to compress to 28.5% in three years, management’s focus on efficiency ratios and tech-driven cost reduction aims to maintain an edge in net margin and mitigate the drag of sub-market revenue growth.

- Consistent credit quality and the ability to hold margins well above average US banks heavily supports the bullish case that Southside’s profitability foundation remains intact, even with slower top-line expansion on the horizon.

Texas Growth Outpaces Loan Pressures

- Management’s expansion of commercial and industrial lending in high-growth Texas markets is expected to help diversify the portfolio and partially offset the uncertainties posed by heavy exposure to commercial real estate and unpredictable loan payoffs.

- According to the analysts' consensus, these moves contribute to a key tension:

- While bulls highlight strong loan production and digital investments as drivers for fee income and resilience, bears point to sector risks like rising unrealized security losses (up to $60.4 million from $51.2 million last quarter) and heightened competition from non-bank lenders as ongoing drags on growth and asset quality.

- This tension between local market strength and sector headwinds is central to how future earnings stability and revenue growth will play out in analyst models.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Southside Bancshares on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from your own angle? Share your insights and shape your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Southside Bancshares.

See What Else Is Out There

While Southside Bancshares is valued below peers, its slower projected earnings growth and revenue outlook may limit long-term upside compared to the broader market.

If consistent growth is your priority, see how stable growth stocks screener (2099 results) could reveal companies delivering steady expansion when others face headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBSI

Southside Bancshares

Operates as the bank holding company for Southside Bank that provides various financial services to individuals, businesses, municipal entities, and nonprofit organizations.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives