- United States

- /

- Banks

- /

- NYSE:PNC

Has PNC’s Strong 2025 Rally Outrun Its Fundamentals After Digital Banking Expansion?

Reviewed by Bailey Pemberton

- If you have been wondering whether PNC Financial Services Group is still a buy after its strong run, you are not alone. This is exactly the kind of stock where a closer look at valuation can really change the narrative.

- The share price has climbed to around $212.9, with gains of 1.0% over the last week, 13.9% over the last month, and a solid 74.0% over five years, which hints at both embedded optimism and rising expectations.

- Recent headlines have focused on PNC expanding its digital banking capabilities and sharpening its cost controls, moves that investors often read as signals of improving efficiency and long term competitiveness. At the same time, regulatory and interest rate chatter has kept large regional banks in the spotlight, adding a layer of macro driven risk perception to every price move.

- On our checks, PNC scores a 4/6 valuation score, suggesting it looks undervalued on several key metrics even after the recent rally. Next we will walk through those traditional valuation approaches, before finishing with a more nuanced framework that can help you judge whether the current price really reflects the long term story.

Approach 1: PNC Financial Services Group Excess Returns Analysis

The Excess Returns model looks at how much value PNC Financial Services Group can create above the return that shareholders require. Instead of focusing on raw earnings, it measures how effectively management turns each dollar of equity into profits after covering the cost of that equity.

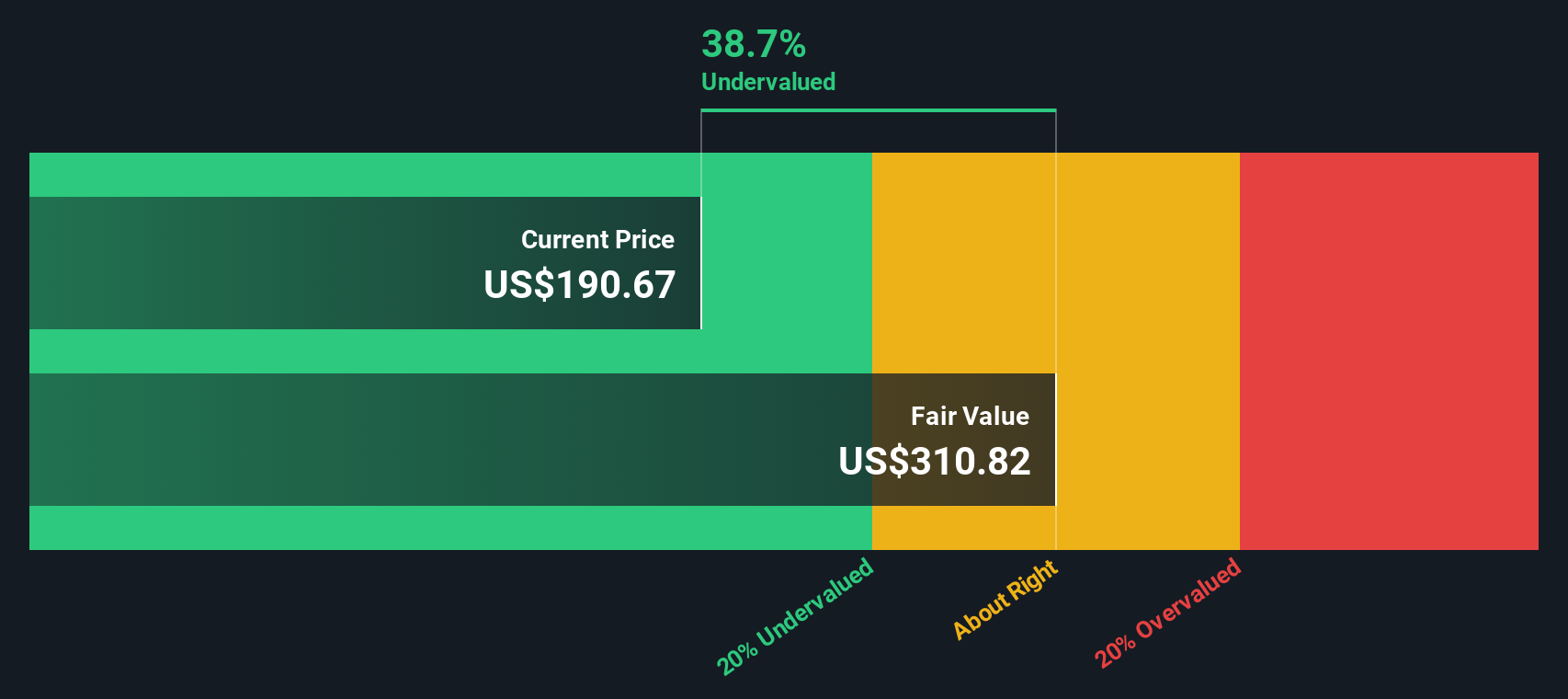

For PNC, the starting Book Value is $135.67 per share, with a Stable Book Value projected at $148.72 per share, based on weighted future estimates from 12 analysts. On that equity base, analysts expect Stable EPS of $18.38 per share, drawn from future return on equity estimates from 13 analysts. With an Average Return on Equity of 12.36% and a Cost of Equity of $11.11 per share, the model calculates an Excess Return of $7.26 per share. This indicates PNC is forecast to earn more than its required hurdle rate.

When these excess returns are projected and capitalized, the Excess Returns valuation implies an intrinsic value of about $321.07 per share, roughly 33.7% above the current price of about $212.90. On this framework, the stock appears materially undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests PNC Financial Services Group is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: PNC Financial Services Group Price vs Earnings

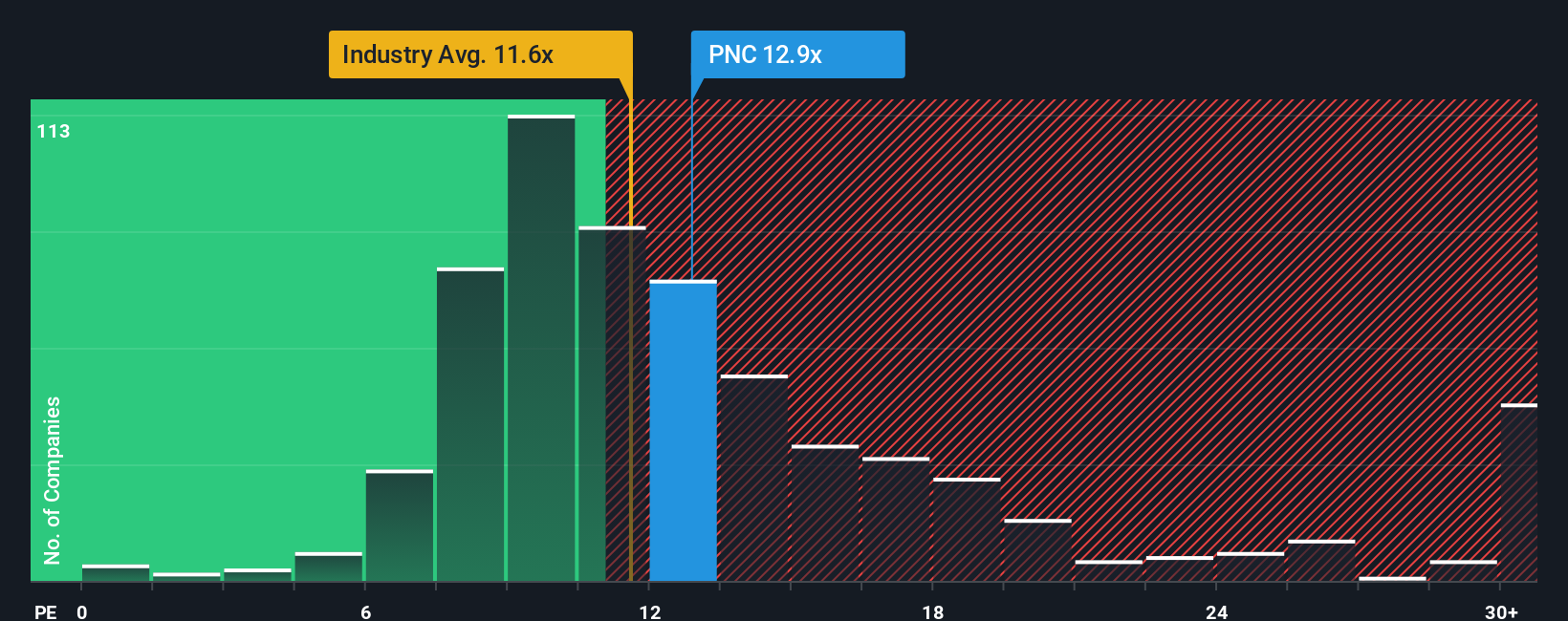

For profitable banks like PNC Financial Services Group, the price to earnings ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current profits. It neatly captures the trade off between today’s earnings power and expectations for future growth.

In general, faster growing and lower risk companies tend to trade at a higher PE multiple, while slower growth or riskier names tend to trade at a discount. PNC currently trades at about 13.56x earnings, which is above the broader Banks industry average of roughly 11.91x but below the 18.55x average of its closest peers. Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable PE should be, given PNC’s earnings growth outlook, profitability, size and risk profile. On this basis, PNC’s Fair Ratio comes out at around 14.19x, indicating that investors might reasonably pay a slightly higher multiple than the current market is assigning.

Because the Fair Ratio is tailored to PNC’s specific fundamentals rather than broad group averages, it offers a more nuanced anchor for valuation. With the stock trading modestly below this Fair Ratio, the multiple-based view points to mild undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PNC Financial Services Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, which are simple stories you create about a company that connect your view of its strategy and operating environment to a set of numbers, such as future revenue, earnings, margins and ultimately a fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to turn their qualitative beliefs into quantitative forecasts, linking a company’s story to a financial model and then to a Fair Value that can be compared directly to today’s share price to decide whether it is a buy, hold or sell.

Because Narratives are updated dynamically as new information like earnings results, regulatory news or strategic moves come in, they stay current and can quickly reflect shifts in risk or opportunity that might otherwise take you weeks of research to incorporate into your thinking.

For PNC Financial Services Group, for instance, a more bullish investor might lean toward the higher analyst price target near $238, assuming stronger revenue growth, firmer margins and a higher future PE multiple. In contrast, a more cautious investor might anchor closer to the $186 target, reflecting slower growth, margin pressure and a lower justified multiple.

Do you think there's more to the story for PNC Financial Services Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion