- United States

- /

- Banks

- /

- NYSE:PB

Prosperity Bancshares (PB): Evaluating Valuation After Net Income Growth and Dividend Increase

Reviewed by Simply Wall St

Prosperity Bancshares (PB) just reported higher net interest income and net income for the third quarter and year to date, along with a dividend increase. These updates signal strength in the bank’s ongoing performance and outlook.

See our latest analysis for Prosperity Bancshares.

It has been a busy stretch for Prosperity Bancshares, with earnings growth, a dividend hike, and a recent share buyback all drawing notice. Even so, the stock has seen some choppiness, with a year-to-date share price return of -10.9%. Still, the longer-term story is more resilient, shown by a total shareholder return of 25.8% over five years. Momentum seems mixed, but the fundamentals remain supportive.

If events like dividend hikes have you watching banks more closely, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With solid profits, steady dividend growth, and the stock now trading about 18% below consensus price targets, is this the setup for an attractive entry point, or is the market already factoring in future gains?

Most Popular Narrative: 15.8% Undervalued

Prosperity Bancshares is currently trading below what the most popular valuation narrative sees as its fair value, marking a potential disconnect between market price and projected financial momentum.

Expansion into high-growth Texas markets via the American Bank acquisition broadens Prosperity's footprint in rapidly growing regions such as San Antonio and Corpus Christi. This move supports above-peer core loan and deposit growth and directly boosts revenue and net interest income over the coming years.

Curious how this bold expansion feeds the bank’s valuation? The narrative leans heavily on Prosperity’s future growth playbook, one that could leave many forecasters stunned. Only by digging into the key drivers behind these expectations will you discover what truly justifies a higher price. Ready to see which bold assumptions are setting this valuation apart?

Result: Fair Value of $79.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as a recent rise in nonperforming assets and continued declines in loans and deposits could quickly challenge the bullish growth assumptions.

Find out about the key risks to this Prosperity Bancshares narrative.

Another View: Is the Market Right on the Numbers?

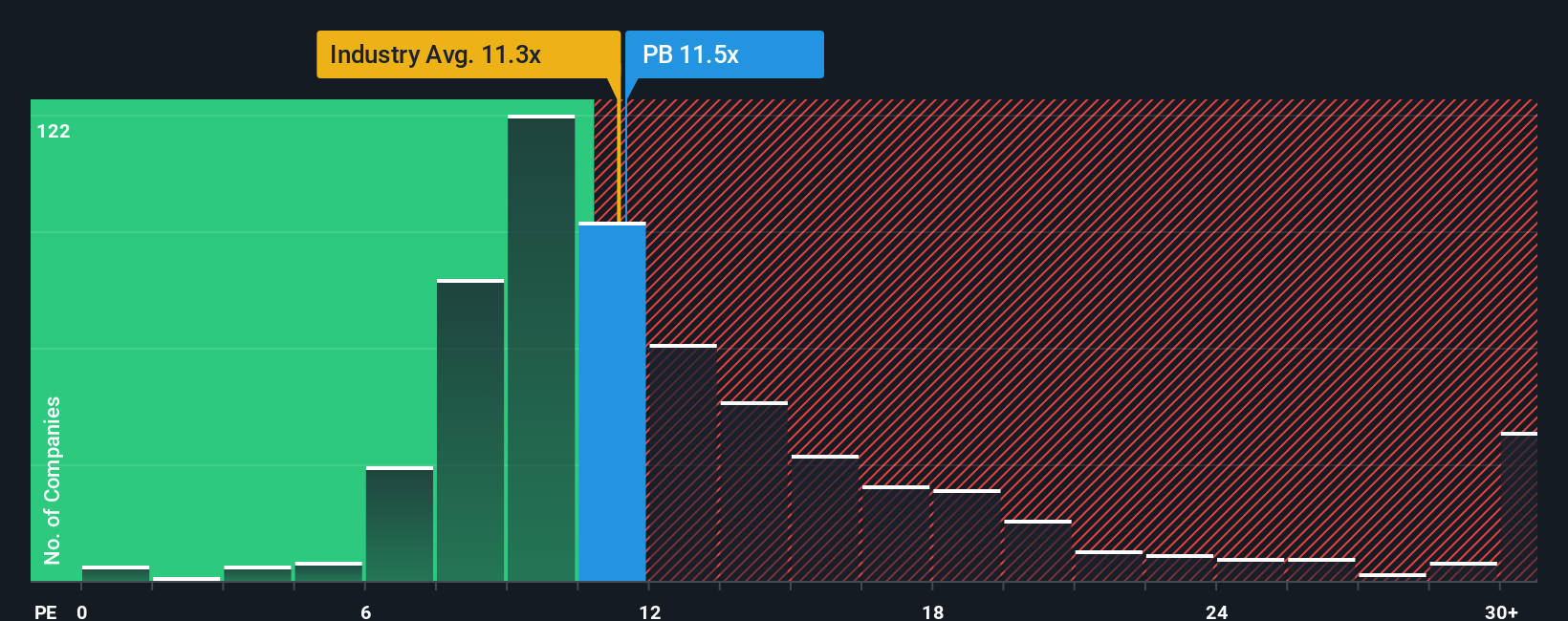

When we weigh Prosperity Bancshares against typical valuation ratios, the stock trades at about 11.9 times earnings, slightly pricier than both direct peers (11.3x) and the wider US Banks industry (11x). While this is near its fair ratio of 12.2x, it suggests the market is baking in optimism. This raises the question of whether there is much room for upside, or if there is possible risk if expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosperity Bancshares Narrative

If this perspective does not fit your outlook, you can dive into the financials and build your own story in just a few minutes, with Do it your way

A great starting point for your Prosperity Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself apart from the crowd by actively searching for high-potential stocks. Opportunities abound, and the right screeners can point you straight to tomorrow’s winners.

- Uncover strong cash flow potential by reviewing these 843 undervalued stocks based on cash flows, which is packed with companies the market may be overlooking right now.

- Capitalize on the AI trend and see which innovators are making real waves in the tech sector. Start with these 26 AI penny stocks.

- Boost your future income with these 18 dividend stocks with yields > 3%, where you’ll find stocks offering attractive yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PB

Prosperity Bancshares

Operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives