- United States

- /

- Banks

- /

- NYSE:PB

Prosperity Bancshares (PB): Assessing Valuation After Share Buyback Launch and Net Interest Margin Initiatives

Reviewed by Simply Wall St

Prosperity Bancshares (PB) is drawing attention after its recent focus on expanding net interest margins and launching a share buyback program. Even as loan growth remains limited, investors are watching how these moves may impact returns.

See our latest analysis for Prosperity Bancshares.

After a steady stream of updates, including a positive earnings call and the recent share buyback launch, Prosperity Bancshares continues to navigate a challenging environment for balance sheet growth. The past year’s 17.17% total shareholder return decline shows momentum has faded for now. The share price is at $66.02 and still facing near-term pressure.

If you’re weighing what’s next and want to uncover compelling opportunities beyond traditional banking, it’s a great time to expand your search and discover fast growing stocks with high insider ownership

With the stock currently trailing its recent highs and new strategies underway, the key question for investors is whether Prosperity Bancshares is trading at a discount or if the market has already accounted for future growth potential.

Most Popular Narrative: 15.9% Undervalued

With Prosperity Bancshares closing at $66.02 versus a fair value narrative of $78.47, the market price lags the most widely-followed analysts' projection. This gap raises eyebrows and invites a closer look at what may be driving long-term value.

Repricing of a sizable bond portfolio and rollover of existing loans at higher yields, combined with a disciplined deposit pricing strategy and low-cost core deposit base, are set to meaningfully increase net interest margin and net interest income through 2026.

What is the real secret to this premium narrative? Analysts are betting on a sustained boost to core profitability. There is a bold growth forecast hidden beneath the surface that underpins the projected valuation. Curious to see what specific growth drivers and margin assumptions could propel future gains? Unlock the details and find out what sets this forecast apart.

Result: Fair Value of $78.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising nonperforming assets and continued declines in loans and deposits could quickly challenge the optimism around Prosperity Bancshares' growth story.

Find out about the key risks to this Prosperity Bancshares narrative.

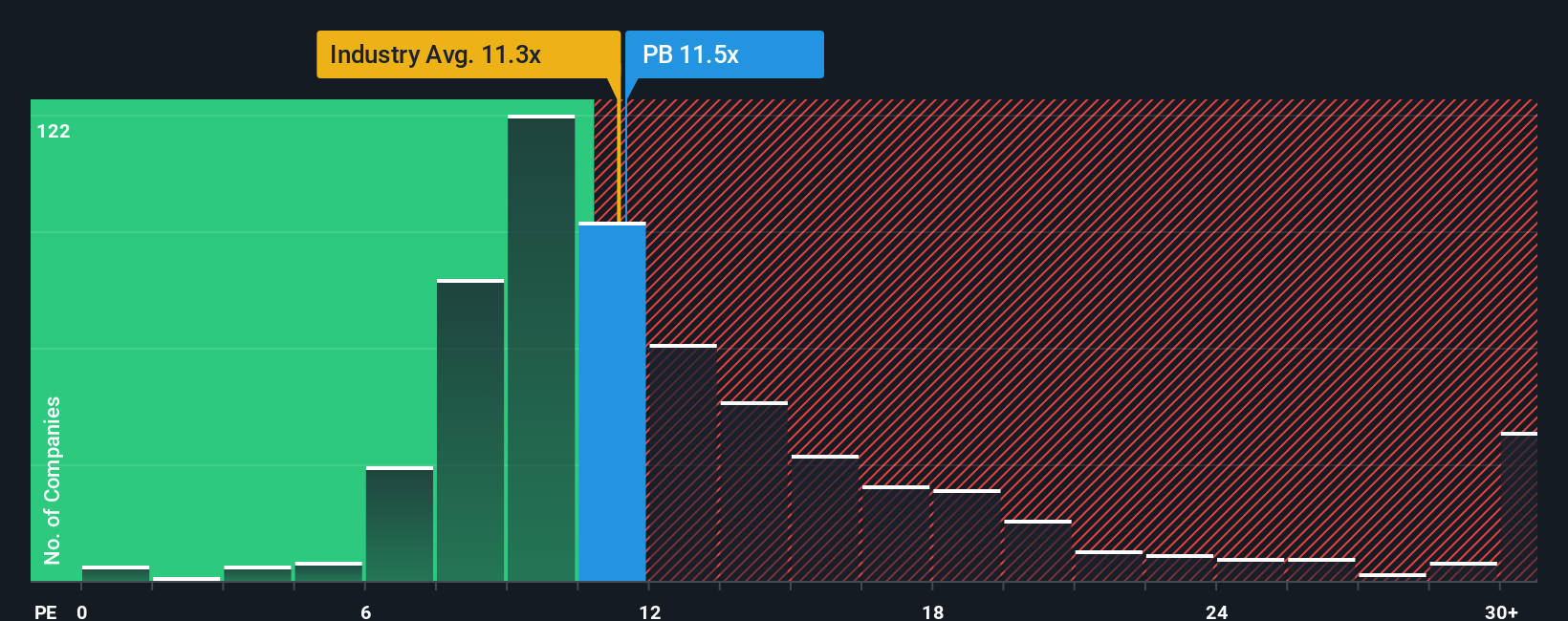

Another View: Market Multiples Send Mixed Signals

Looking at Prosperity Bancshares through the lens of price-to-earnings, the shares trade at 11.8x, slightly higher than the US Banks industry average of 11.1x and above their peer average of 11.4x. The fair ratio stands at 12x, hinting they are not a screaming bargain. When a stock is priced above industry and peer levels, it can mean investors see less upside based on current fundamentals, and there is less room for error if growth falters. Is the market too optimistic, or is there hidden value justifying this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosperity Bancshares Narrative

If this perspective does not align with your own or you are eager to dig deeper into the details, you can quickly shape your own view and build a personalized take by using Do it your way.

A great starting point for your Prosperity Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not wait on the sidelines while fresh opportunities pass by. Find your next winning stock idea with these powerful screening tools from Simply Wall Street. They are designed to help you invest with confidence and stay ahead of the crowd.

- Capture high potential by checking out these 915 undervalued stocks based on cash flows. These may be trading well below their intrinsic worth and could offer room for strong future gains.

- Maximize passive income by reviewing these 16 dividend stocks with yields > 3%. This features companies with yields greater than 3 percent and stable payout track records.

- Capitalize on tech disruption by browsing these 26 AI penny stocks. These highlight companies reshaping industries with powerful artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PB

Prosperity Bancshares

Operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives