- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU): Assessing Valuation After U.S. Bank Charter Application and Amazon Brazil Partnership

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) has been grabbing attention following several big moves, including its application for a U.S. national bank charter and a new payment partnership with Amazon Brazil. Investors are watching closely as the company eyes further growth and improved results.

See our latest analysis for Nu Holdings.

After notching an all-time high of $16.49 in September and rolling out several headline-grabbing initiatives, Nu Holdings’ 49% year-to-date share price return stands out against the sector. While momentum has cooled slightly in the very short term, the company's three-year total shareholder return of over 250% underscores the impressive longer-term value creation driven by expansion and profitability gains.

If Nu Holdings’ bold expansion has you curious about other fast-moving opportunities, it is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock hovering near its highs and more growth initiatives on the horizon, investors face a key question: Is Nu Holdings still undervalued, or has the market already priced in the next phase of expansion?

Most Popular Narrative: 9% Undervalued

With a last close price of $15.87 and a narrative fair value of $17.46, analysts see some headroom for Nu Holdings. The market has responded to major announcements, but the key question is exactly which trends are driving this valuation projection.

The rapid growth of Latin America's digitally native population, combined with expanding smartphone and internet adoption, is creating a sustained surge in demand for Nu's app-based financial services. This is fueling long-term customer acquisition, higher engagement, and driving topline revenue growth.

Want to see what powers this bullish outlook? A record-setting growth assumption, bold margin projections, and a rare premium multiple drive this price target. Uncover which forecasts and which risks are moving the needle for Nu’s fair value.

Result: Fair Value of $17.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and regulatory uncertainty in new markets could challenge Nu Holdings’ growth trajectory and put pressure on its projected profitability in the coming years.

Find out about the key risks to this Nu Holdings narrative.

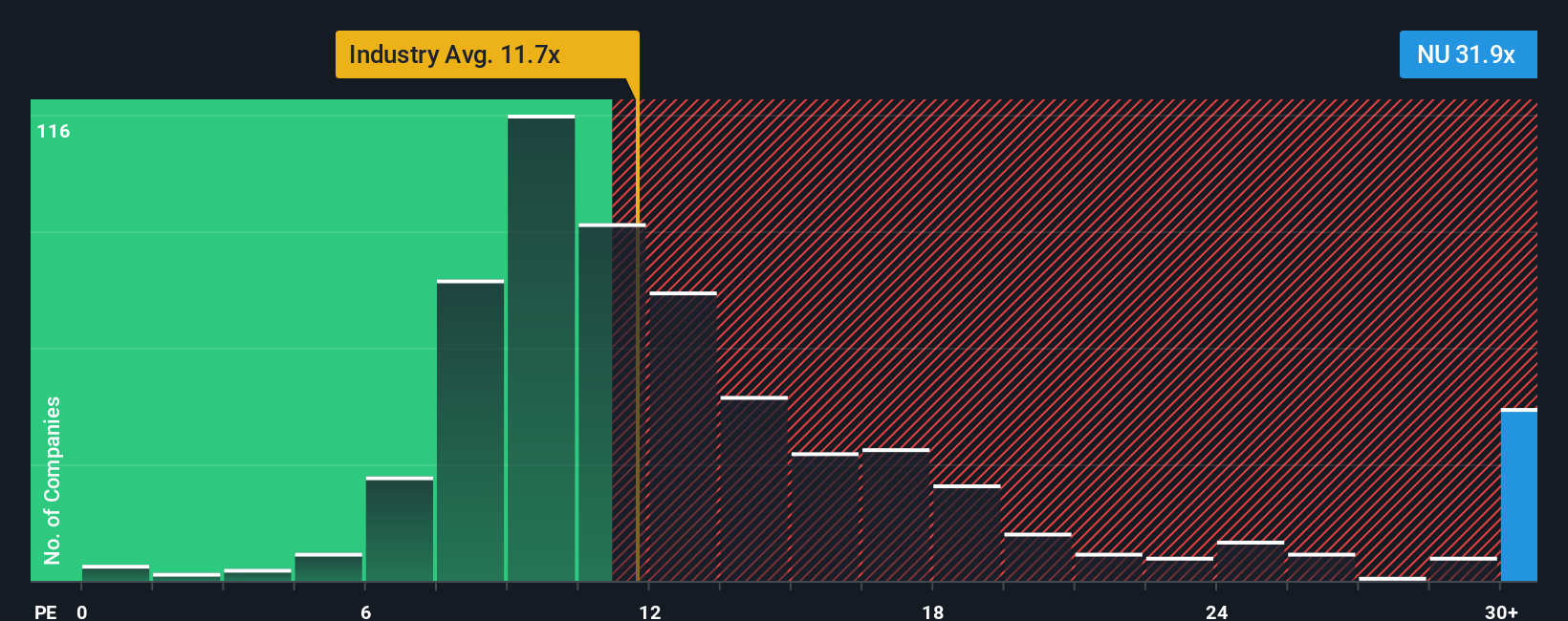

Another View: Valuation Using Market Multiples

Looking through the lens of market multiples, Nu Holdings trades at a price-to-earnings ratio of 33.3x. This is significantly higher than both the US Banks industry average of 11.1x and its peers' 11.5x. This premium suggests investors are betting on future outperformance. However, if growth slows or expectations reset, downside risk could increase. Will the market continue to justify this high multiple, or is a reality check on the way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see things differently or want a deeper dive, it only takes a few minutes to analyze the numbers and develop your own perspective. Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Uncover unique stocks that match your ambitions and stay ahead of market trends with the help of the Simply Wall Street Screener.

- Spot companies with strong cash flows and potential for upward price moves by getting hands-on with these 874 undervalued stocks based on cash flows.

- Tap into advancements in healthcare and artificial intelligence by checking out these 32 healthcare AI stocks, where innovation meets real-world impact.

- Catalyze your search for passive income and see which companies are rewarding shareholders through regular payouts with these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives