- United States

- /

- Banks

- /

- NYSE:MCB

Metropolitan Bank Holding (MCB) Net Profit Margin Rises, Reinforcing Bullish Narratives on Growth Momentum

Reviewed by Simply Wall St

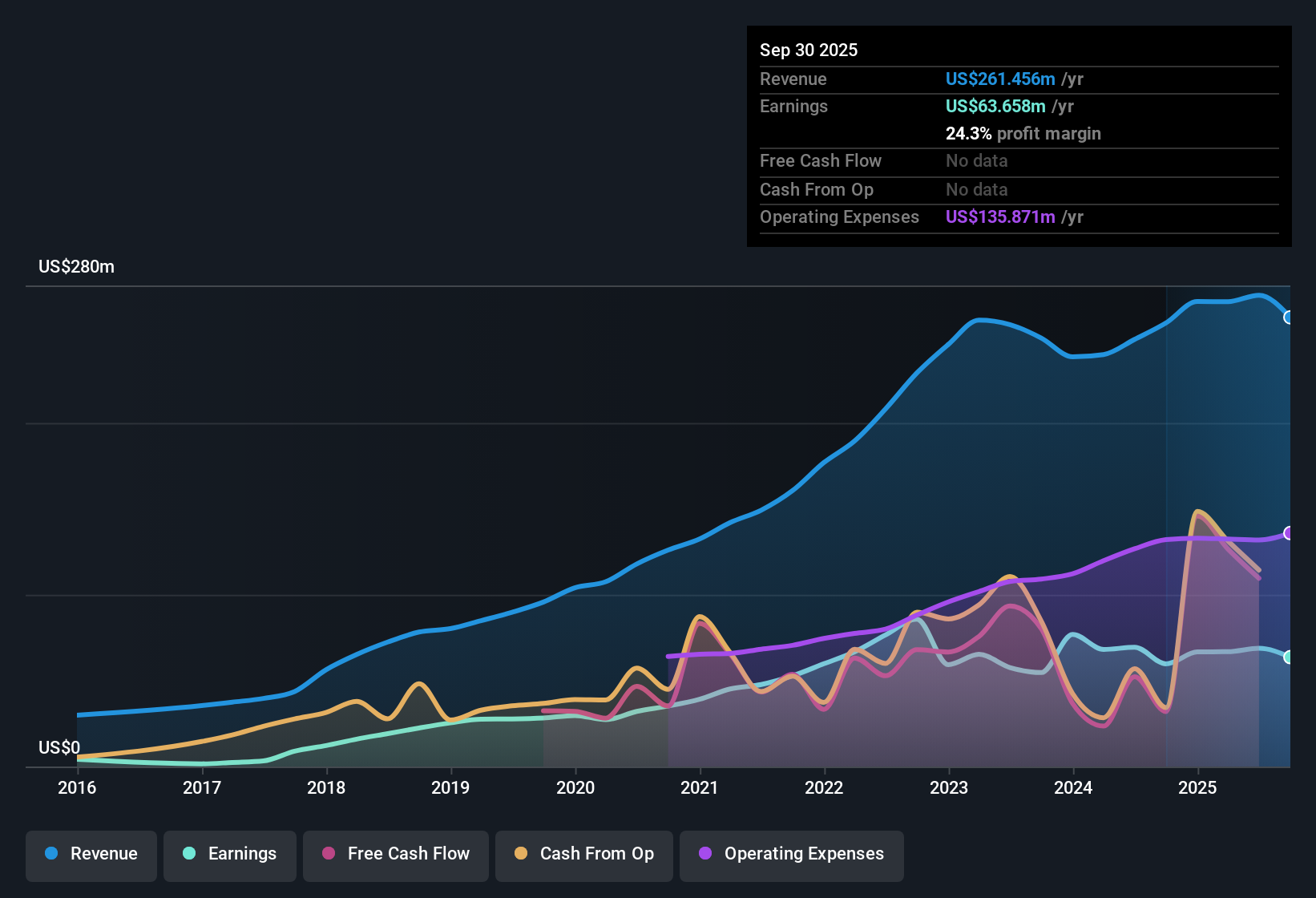

Metropolitan Bank Holding (MCB) delivered net profit margins of 24.3%, up from 23.1% a year ago, with annual revenue growth projected at 18.4% and earnings expected to rise 28.7% per year. Both figures are well ahead of the broader US market. Shares are trading at $70.9, which is below the estimated fair value of $151.56 and at a Price-To-Earnings ratio of 11.6x versus the peer average of 17.9x. Investors may interpret these results as signs of strong ongoing momentum, with value and growth drivers supporting a positive market view and only minor risks identified.

See our full analysis for Metropolitan Bank Holding.Next up, we’ll see how these headline numbers compare with the most widely followed market narratives, highlighting where the new results may reinforce or challenge existing views.

See what the community is saying about Metropolitan Bank Holding

Tech Investments Aim for Margin Gains

- Management projects profit margins to rise from 25.1% today to 32.6% in three years. This reflects a strategy to boost efficiency through new technology upgrades.

- Analysts' consensus view is that continued spending on digital platforms is likely to accelerate noninterest income. Core deposit and loan growth are seen as supporting margin expansion even as larger banks advance rapidly.

- The bank’s integration of real-time payment platforms positions it to attract fintech partnerships and higher-margin fee income.

- Consensus narrative notes that delays in executing these upgrades may cause operational inefficiencies and set MCB behind faster-moving competitors.

- To see how analysts balance these opportunities and risks, check the full consensus narrative for Metropolitan Bank Holding. 📊 Read the full Metropolitan Bank Holding Consensus Narrative.

Loan Book Leans Into CRE Sector

- Advanced loan growth remains heavily concentrated in commercial real estate, which raises exposure to property cycles that could directly reduce earnings if sector conditions turn.

- Bears highlight that while prudent credit risk management has kept asset quality high, overexposure to CRE loans is a critical risk. Any downturn in the sector could increase credit losses and reduce return on equity.

- Cautious observers point out that even with diversified exposure, rising commercial property stress in key urban markets could lead to outsized impacts on provisions and profitability.

- Bears are also concerned that regulatory scrutiny might further constrain growth in these higher-risk loan segments.

Valuation Discount to Fair Value

- Shares trade at $70.90, which is a 53% discount to the DCF fair value of $151.56 and 20% below the consensus analyst target of $89.00. This highlights a perceived opportunity versus expectations for future earnings and margin growth.

- Analysts' consensus view argues that sustained profit and revenue momentum, along with stable risk trends, justifies MCB’s status as a value pick. However, the current price implies skepticism toward whether projected growth and efficiency gains will fully materialize in a competitive banking landscape.

- Market participants may be waiting for evidence that technology upgrades and core deposit growth actually translate into the higher margins and earnings forecast by analysts.

- Valuation suggests any inflection in digital execution or loan performance could quickly rerate the stock to close the gap with both fair value and target price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Metropolitan Bank Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your perspective and quickly shape your own view on Metropolitan Bank Holding. Do it your way.

A great starting point for your Metropolitan Bank Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Metropolitan Bank Holding’s heavy exposure to commercial real estate and uncertainty in delivering digital upgrades create earnings volatility, these risks may impact consistent performance.

If you value more predictable growth and fewer sector-specific headwinds, consider companies showing steadier results through cycles by using stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCB

Metropolitan Bank Holding

Operates as the bank holding company for Metropolitan Commercial Bank that provides a range of business, commercial, and retail banking products and services.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives