- United States

- /

- Banks

- /

- NYSE:KEY

Will KeyCorp's (KEY) Third Quarter Turnaround and Strategy Shift Alter Its Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 6, 2025, KeyCorp presented at The BancAnalysts Association of Boston Conference, where Chief Financial Officer Clark Harold Ibrahim Khayat and Head of Consumer Banking Victor B. Alexander discussed financial performance and strategy at The Langham Hotel in Boston.

- KeyCorp achieved a major financial turnaround in the third quarter of 2025, reporting revenues that more than doubled year-over-year and a return to profitability, outpacing analyst expectations even while facing sector-wide challenges.

- We'll explore how KeyCorp's rebound to profitability and rapid revenue growth could affect its investment outlook going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

KeyCorp Investment Narrative Recap

Investors in KeyCorp need to believe in the bank's ability to sustain its recent financial recovery and revenue expansion despite persistent sector headwinds, such as fintech competition and regulatory costs. While Q3 results signaled a strong turnaround and outperformance of analyst estimates, the most important short-term catalyst remains continued improvement in net interest income, with the greatest risk being deterioration in loan quality; the latest news does not materially change this risk profile or near-term outlook.

Among recent announcements, the October 2025 earnings report stands out, highlighting a swing to $489 million in net income and year-over-year growth in net interest income to $1,184 million. This performance, supported by lower charge-offs and improved noninterest income, strengthens KeyCorp’s position against pressures on net interest margins and tepid loan demand.

Yet behind the promising quarterly results, investors should still watch for signs of rising nonperforming loans and...

Read the full narrative on KeyCorp (it's free!)

KeyCorp's narrative projects $7.7 billion in revenue and $2.4 billion in earnings by 2027. This requires 10.5% yearly revenue growth and an increase of $1.7 billion in earnings from the current $716.0 million.

Uncover how KeyCorp's forecasts yield a $21.46 fair value, a 22% upside to its current price.

Exploring Other Perspectives

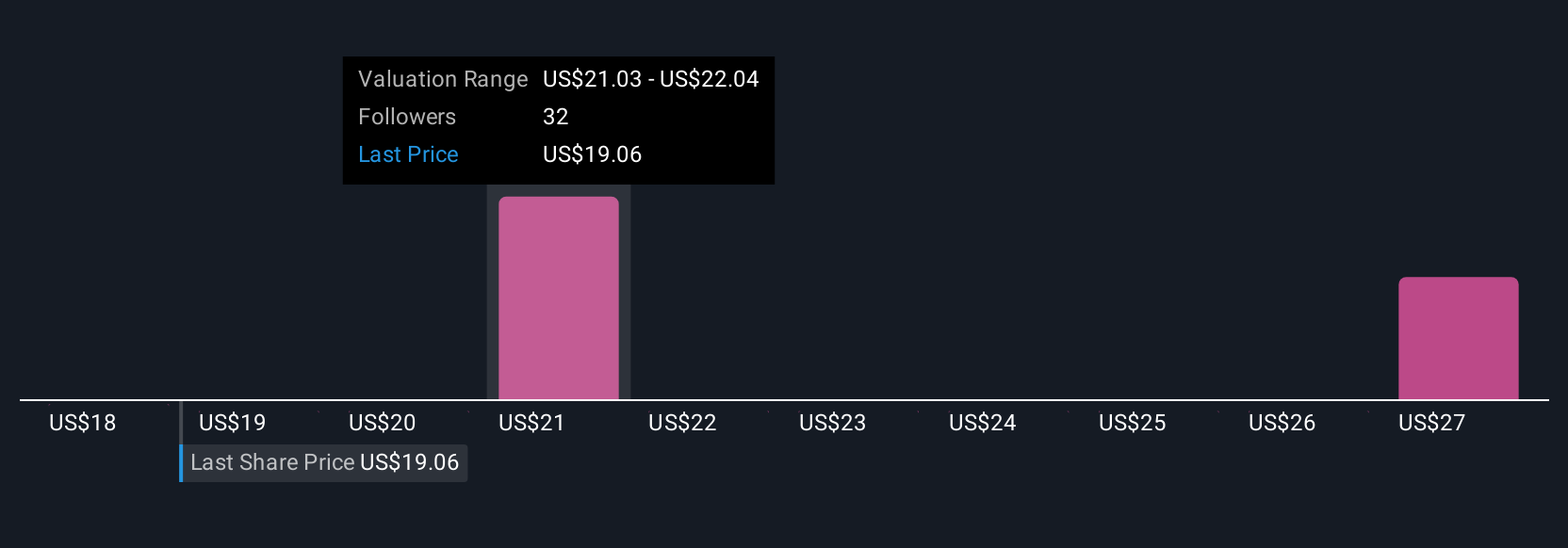

Three fair value estimates from the Simply Wall St Community place KeyCorp between US$21.46 and US$31.56 per share. With ongoing pressure from loan demand and credit risks, viewpoints among participants highlight how differently future prospects can be seen, consider how these factors might affect your outlook.

Explore 3 other fair value estimates on KeyCorp - why the stock might be worth as much as 79% more than the current price!

Build Your Own KeyCorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KeyCorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KeyCorp's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives