- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY): A Fresh Look at Valuation After Recent Volatility

Reviewed by Simply Wall St

See our latest analysis for KeyCorp.

This year, KeyCorp’s share price has managed a modest rise, even as some recent volatility has tested investor patience. While the bank’s solid one-year total shareholder return of 7.23% outpaces the day-to-day price drift, momentum appears to be taking a breather after early-year gains.

If you’re looking for uncovering what’s moving beyond the big banks, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With KeyCorp trading below both analyst price targets and estimated intrinsic value, the question stands out: is this today’s overlooked bargain, or has the market already accounted for all its future growth prospects?

Most Popular Narrative: 18.8% Undervalued

KeyCorp’s current share price of $17.59 is well below the most popular narrative’s fair value estimate of $21.65, setting up a notable value gap that has caught the market’s attention.

Expansion in the wealth management and commercial payments sectors, marked by record production volumes and significant client growth, is poised to drive noninterest income upwards and influence both revenue and net margins positively. Strong growth in the national third-party commercial loan servicing business provides a counter-cyclical revenue stream and insights into the commercial real estate market. This could bolster diversified revenue streams and enhance earnings stability.

Curious about the key levers behind this optimistic value target? The most important narrative assumptions include unusually aggressive growth in earnings, a jump in future margins, and a profit multiple more often seen in faster-growth sectors. Want to know which crucial figures underpin this bullish stance? Uncover the drivers that separate this narrative’s bold outlook from the consensus.

Result: Fair Value of $21.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent declines in earnings per share and rising nonperforming loans could challenge confidence in KeyCorp’s current growth outlook.

Find out about the key risks to this KeyCorp narrative.

Another View: Valuing Through Earnings Ratios

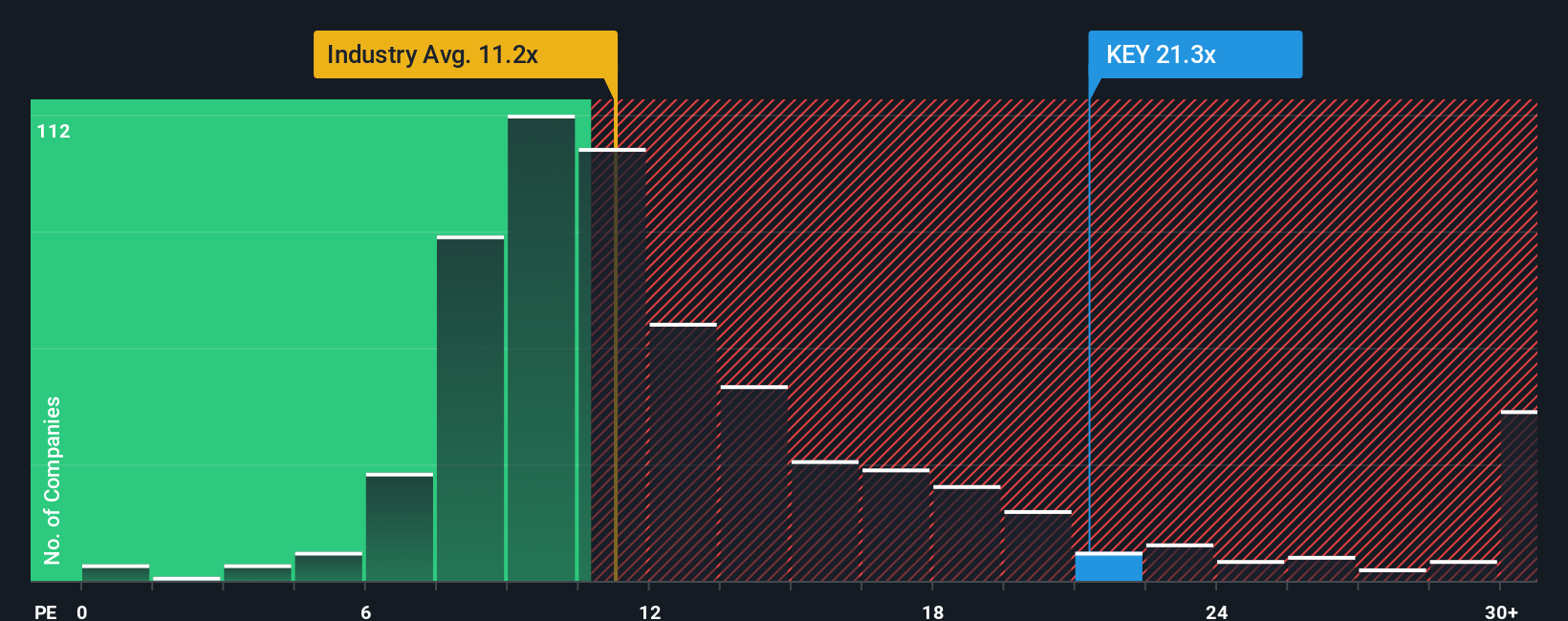

Looking at valuation from a different angle, KeyCorp trades at a price-to-earnings ratio of 21x, which is significantly higher than the industry average of 11.2x and the peer average of 11.9x. Even compared to its own fair ratio of 18.5x, shares look expensive. This premium suggests the market has high expectations built in. The key question is whether there is enough upside left to justify paying more than peers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If you see the story differently or want to dive deeper into the numbers, you can quickly shape your own narrative in just minutes. Do it your way.

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't sit on the sidelines while huge opportunities unfold in today's fast-moving market. Make the most of your research time with these powerful stock ideas:

- Unlock income potential and spot consistent winners by reviewing these 22 dividend stocks with yields > 3%, which offers attractive yields and strong financial health.

- Seize the future with these 26 AI penny stocks, which are driving innovation in artificial intelligence, automation, and data-driven industries.

- Catch overlooked bargains before the crowd by examining these 832 undervalued stocks based on cash flows, identified as trading below their fair value based on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives