- United States

- /

- Banks

- /

- NYSE:JPM

Will JPMorgan Chase's (JPM) Risk Controls Define Its Edge as Scrutiny Intensifies?

Reviewed by Sasha Jovanovic

- In recent days, the House Committee on Oversight and Government Reform issued subpoenas to JPMorgan Chase seeking financial records related to Jeffrey Epstein's accounts, prompting the bank to launch an internal investigation that identified thousands of suspicious transactions.

- This development highlights the significant legal and reputational risks large financial institutions can face when government scrutiny intensifies over historical client activities.

- We'll examine what the Congressional investigation and internal review signal for JPMorgan Chase's risk profile and long-term sector leadership.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

JPMorgan Chase Investment Narrative Recap

To believe in JPMorgan Chase as a long-term investment, you typically need confidence in its ability to leverage global scale, diversified revenue streams, and steady digital expansion to drive resilient earnings. While the Congressional subpoenas into legacy client activity add a new layer of regulatory and legal risk, this event does not appear to materially change the main near-term catalysts, such as ongoing growth in asset management, or the most significant risk, which remains heightened regulatory scrutiny across the industry.

Among recent announcements, JPMorgan’s ongoing business expansion stands out. Its plan to open four new J.P. Morgan Financial Centers in California, with more in the pipeline, aligns closely with the ongoing catalyst of capturing growth in wealth management and personalized banking, segments central to its long-term revenue goals and margin stability. This move also underscores management’s continuing commitment to deepening relationships with affluent clients despite external pressures.

But in contrast to the headlines, investors should not overlook the compounding effect of stricter oversight and...

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's outlook anticipates $186.7 billion in revenue and $55.5 billion in earnings by 2028. This is based on an annual revenue growth rate of 4.5% and an earnings increase of just $0.3 billion from current earnings of $55.2 billion.

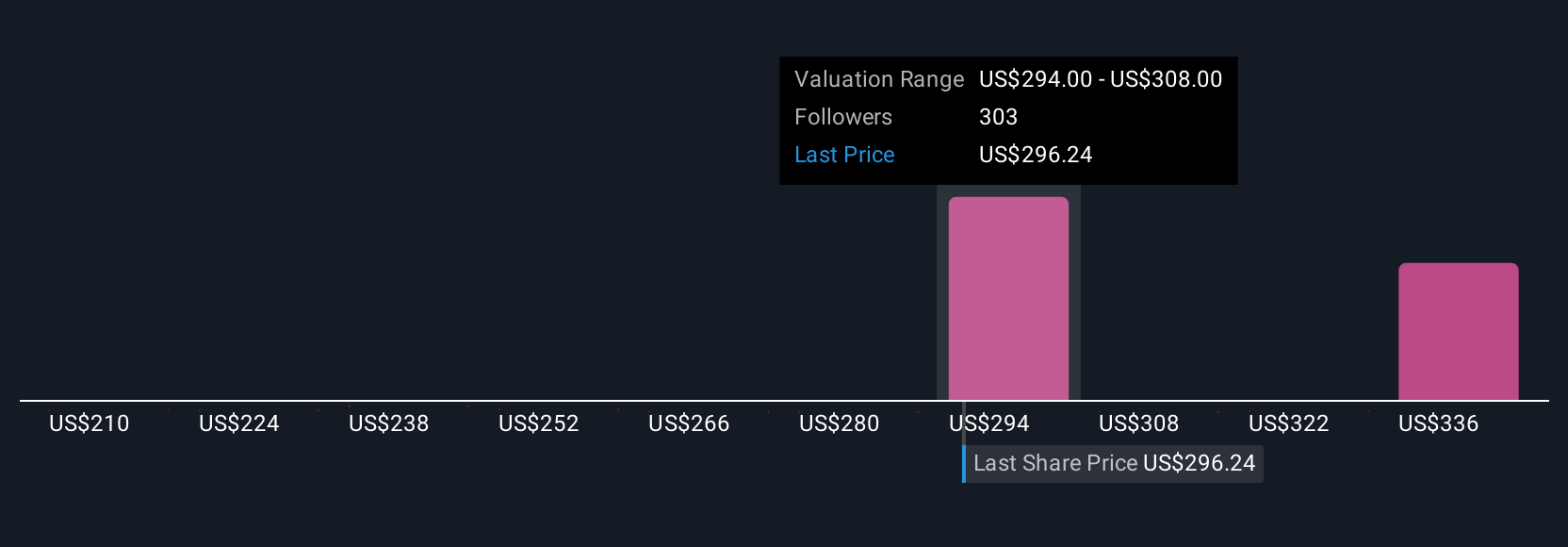

Uncover how JPMorgan Chase's forecasts yield a $327.70 fair value, a 8% upside to its current price.

Exploring Other Perspectives

While the recent subpoenas highlight regulatory pressures, the most optimistic analysts were forecasting JPMorgan Chase revenue could hit US$194,800,000,000 by 2028, betting on acceleration in wealth and global payments. It’s important to remember views on growth and risk can be far apart, and fresh news like this may shift expectations. Consider several viewpoints as you weigh the full story for yourself.

Explore 23 other fair value estimates on JPMorgan Chase - why the stock might be worth as much as 21% more than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives