- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM): Evaluating Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

JPMorgan Chase (JPM) shares have seen some movement recently, capturing the attention of investors looking for stability in large U.S. banks. With its broad reach and steady earnings growth, JPMorgan Chase continues to anchor many diversified portfolios.

See our latest analysis for JPMorgan Chase.

JPMorgan Chase has logged a robust run this year, with its share price climbing nearly 29% year-to-date and a total shareholder return of almost 29% over the past year. Despite a brief dip of just over 1% in the last day, the longer-term numbers suggest momentum is still in the company's favor. This builds on steady earnings and investor confidence that has delivered a powerful 153% total shareholder return over the past three years.

If you're keen to spot other dynamic movers with serious growth prospects, this is your chance to discover fast growing stocks with high insider ownership.

With shares close to their recent highs and a modest premium to analyst targets, investors may be wondering whether JPMorgan Chase remains undervalued, or if its strong performance means future growth is already factored in. Could there still be a buying opportunity?

Most Popular Narrative: 5.8% Undervalued

JPMorgan Chase's latest closing price remains below the most popular narrative's fair value estimate, which suggests potential upside. This perspective is based on optimistic forecasts for the bank and provides an opportunity to further examine the key factors influencing this valuation.

Ongoing investment and active participation in tokenization, stablecoins, and payment innovations (as detailed in the deposit token discussion) position JPMorgan to benefit competitively from the next wave of technology adoption in banking and payments. This is expected to support both revenue resilience and margin improvement in the future.

Want to understand which high-impact assumptions are driving this premium? The future price target relies on confident projections for profits, revenue, and a shrinking share count. Interested in what specifically shapes the narrative's fair value estimate? Explore further to learn more.

Result: Fair Value of $328.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising expenses and potential softening in net interest margins could limit JPMorgan Chase's earnings upside, which may challenge the current bullish narrative.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: Multiples Send a Different Signal

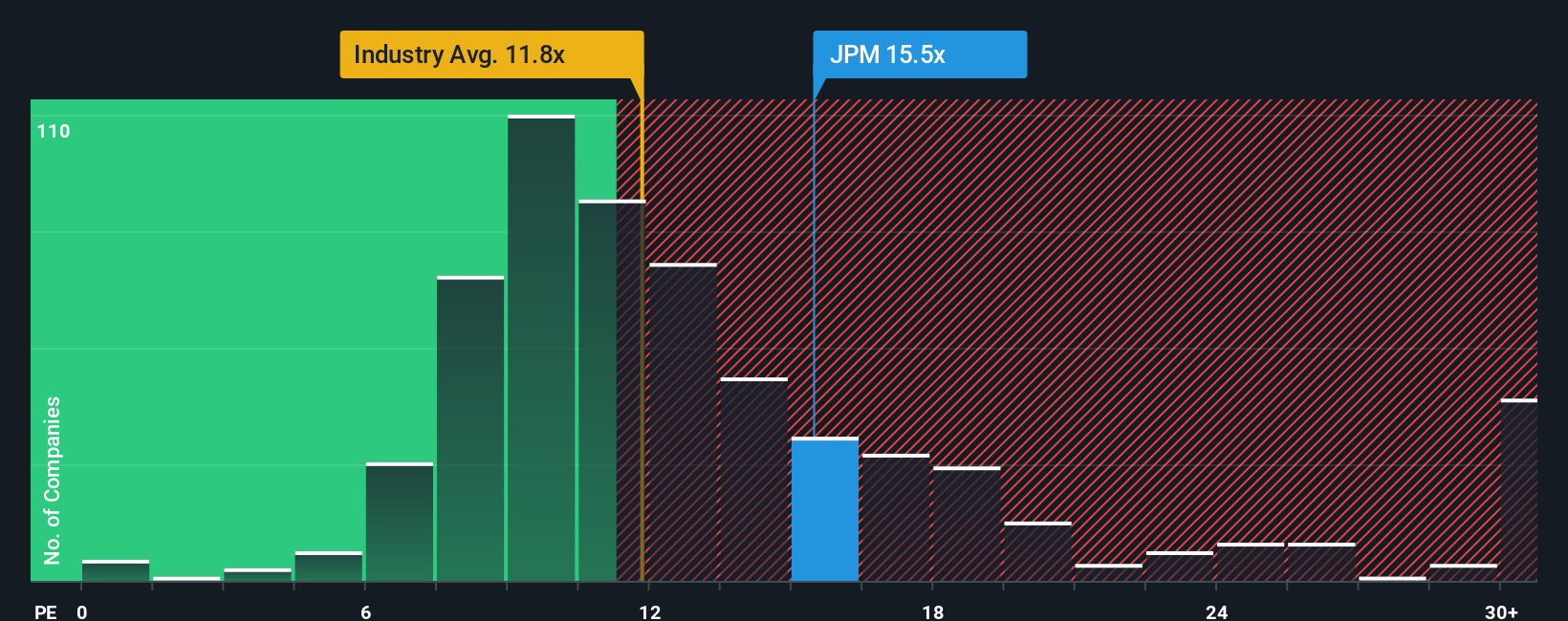

While the narrative-driven valuation points to JPMorgan Chase being undervalued, a look at one key market metric tells a different story. The company's price-to-earnings ratio stands at 14.8x, higher than both the US banks industry average (11.5x) and its peer average (13x), but just below the fair ratio of 15.5x. This suggests JPMorgan may be trading with a valuation premium. Is the market awarding quality, or could expectations be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you'd rather chart your own course or have different insights on JPMorgan Chase, you can put together a personalized view in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding JPMorgan Chase.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. See how top investors spot the next winners with the Simply Wall Street Screener and power your portfolio with fresh ideas.

- Boost your long-term returns by tapping into these 930 undervalued stocks based on cash flows featuring stocks trading below their intrinsic value but showing strong financial momentum.

- Capture high-yield potential by targeting these 14 dividend stocks with yields > 3% that are delivering attractive payouts well above the market average.

- Ride the wave of technology innovation by accessing these 27 quantum computing stocks at the frontier of computational breakthroughs and quantum-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026