- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM): A Fresh Look at Valuation After Recent Share Price Plateau

Reviewed by Simply Wall St

See our latest analysis for JPMorgan Chase.

JPMorgan Chase has steadily climbed in 2024, with a year-to-date share price return of 24.2% underscoring its strong momentum. Recent moves have been more muted as the market digests earlier gains and weighs ongoing macro headlines. The bank’s one-year total shareholder return of 21.6% reflects a robust long-term performance, reinforcing the confidence investors have placed in its ability to deliver even as the pace of gains has leveled off in recent weeks.

If you’re on the lookout for your next opportunity, now’s a perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

With shares hovering near recent highs and the stock trading at an 18% discount to its estimated intrinsic value, investors are left wondering whether this reflects a real buying opportunity or if markets have already priced in the bank’s future growth.

Most Popular Narrative: 9.2% Undervalued

Compared to JPMorgan Chase's last close at $298, the most widely followed narrative argues for a fair value closer to $328. This view reflects confidence in the company’s future resilience and growth, stemming from a broad set of business drivers.

Ongoing investment and active participation in tokenization, stablecoins, and payment innovations (as detailed in the deposit token discussion) positions JPMorgan to benefit competitively from the next wave of technology adoption in banking and payments. This is likely to support both future revenue resilience and margin improvement.

Want to know which industry shifts are factored into this above-market target? The secret sauce is a bold assumption about margin power and digital expansion. The narrative banks on breakthroughs most would not associate with an old-guard institution. Curious if these visionary calls can really deliver higher multiples and faster growth? See the projections that could put this stock in a different league.

Result: Fair Value of $328 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes and accelerating fintech competition remain key risks that could affect JPMorgan Chase’s growth and profit outlook.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: What Do Earnings Ratios Say?

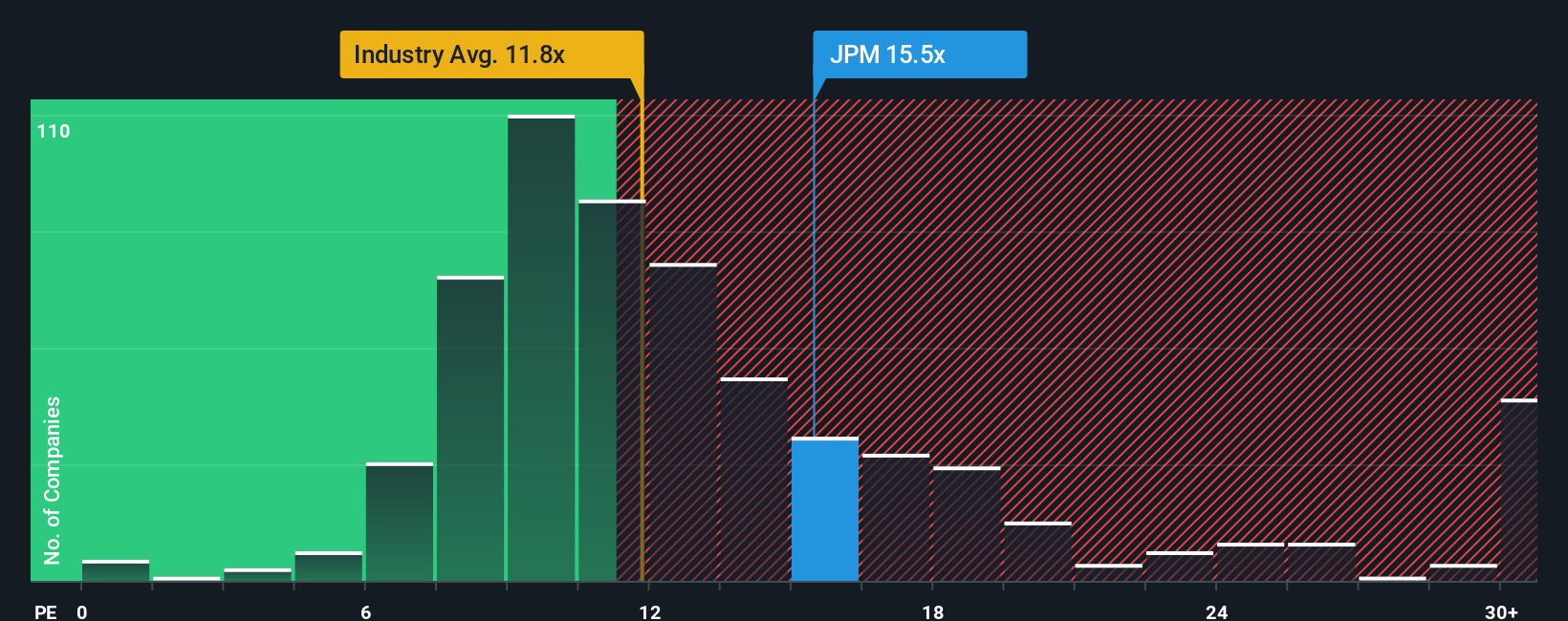

Looking at valuation through the lens of earnings multiples paints a more cautious picture. JPMorgan Chase currently trades at 14.3 times earnings, which is above both the US Banks industry average of 11.2 and the peer average of 12.7. Notably, this is also higher than the market’s fair ratio estimate of 13.9.

This premium means investors are paying more for each dollar of JPMorgan’s earnings compared to its industry. This raises questions about future value and how much upside is truly left. Could this multiple signal risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you'd rather dig into the numbers and come to your own conclusions, it's easy to dive in and create a personal outlook based on fresh data. Do it your way.

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count with screening tools that help you spot stocks breaking new ground, delivering value, or offering strong dividends before everyone else notices.

- Uncover rapid growth opportunities by targeting these 26 AI penny stocks, which are pushing the boundaries in artificial intelligence and transforming entire industries.

- Capture remarkable value plays among these 917 undervalued stocks based on cash flows, which boast compelling fundamentals at prices the market hasn’t fully appreciated yet.

- Secure potential income streams by focusing on these 14 dividend stocks with yields > 3%, which offer generous yields built to reward patient investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success