- United States

- /

- Banks

- /

- NYSE:JPM

Is JPMorgan Still Attractively Priced After 42% Surge and Fed Rate Pause?

Reviewed by Bailey Pemberton

- Curious if JPMorgan Chase is a bargain or simply priced for perfection? You're not alone. Even seasoned investors are eager to see what the numbers really say.

- The stock has surged 42.5% over the past year and is up an impressive 29.6% year-to-date. With a recent 3.6% jump in just the last week, this hints at renewed momentum and shifting risk appetites.

- This strong performance has been shaped by recent headlines, including the Fed’s pause on interest rate hikes and JPMorgan’s expansion into digital banking. Moves such as acquiring fintech assets and ramping up tech investment have also drawn investor attention, fueling both optimism and debate about future upside.

- With a value score of 2 out of 6 on our core checks, there is more to the valuation story than meets the eye. Up next, we will break down where JPMorgan stands according to traditional valuation models, then go a step further with a smarter way to judge value most investors miss.

JPMorgan Chase scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

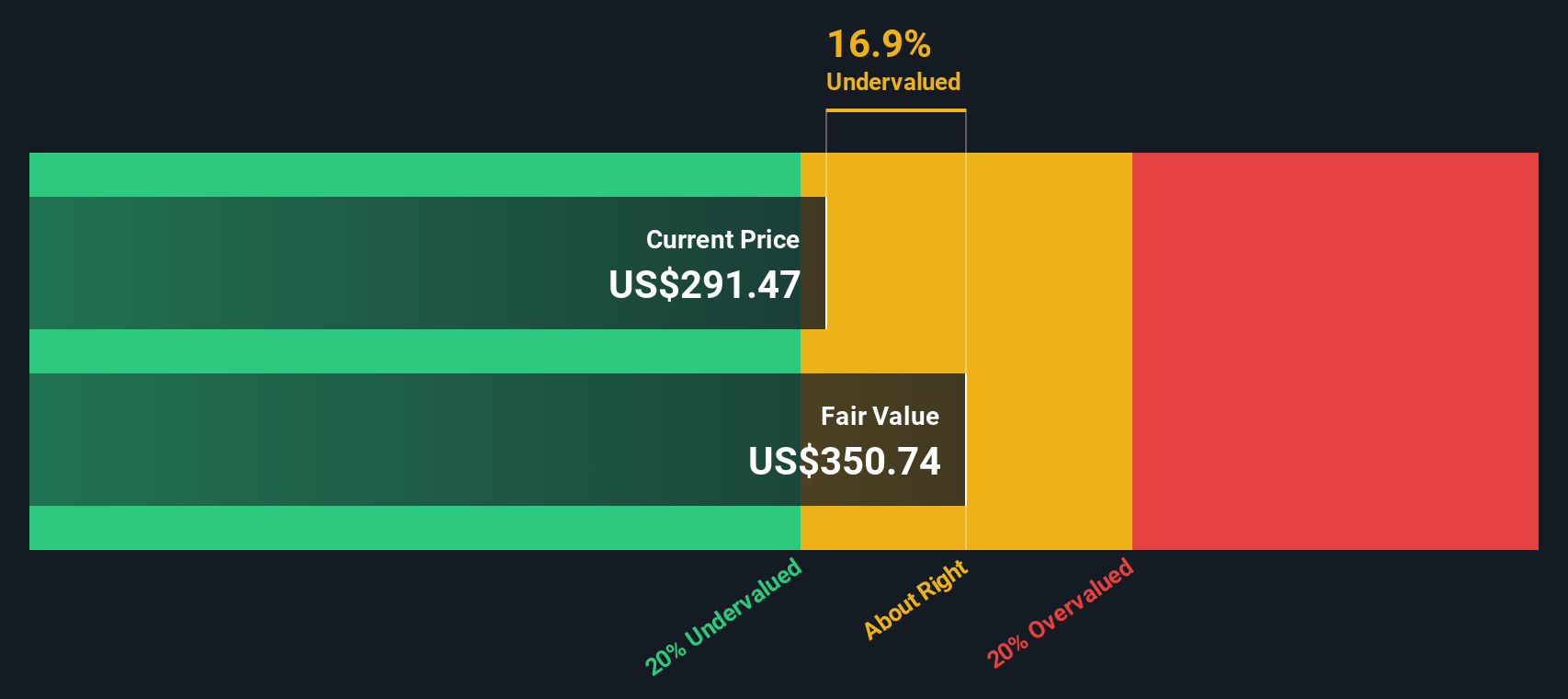

The Excess Returns model estimates a company's fair value by assessing how effectively it generates returns on its equity relative to its cost of capital. Put simply, it measures the extra profits JPMorgan Chase delivers above what investors require, focusing on efficient capital deployment and growth projections.

For JPMorgan Chase, recent estimates suggest a Book Value of $124.96 per share and a Stable EPS (Earnings Per Share) of $22.42, based on the weighted future Return on Equity projections from 13 analysts. The Cost of Equity stands at $11.10 per share, which means the Excess Return, or the additional value created, is $11.31 per share. Over the long run, analysts expect an average Return on Equity of 16.60%. Furthermore, the Stable Book Value is projected to reach $135.04 per share, drawing on analysts' forward-looking estimates.

Based on these calculations, the Excess Returns method yields an estimated intrinsic value for JPMorgan Chase stock that is 12.4% higher than the current price, implying it is undervalued by this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests JPMorgan Chase is undervalued by 12.4%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: JPMorgan Chase Price vs Earnings

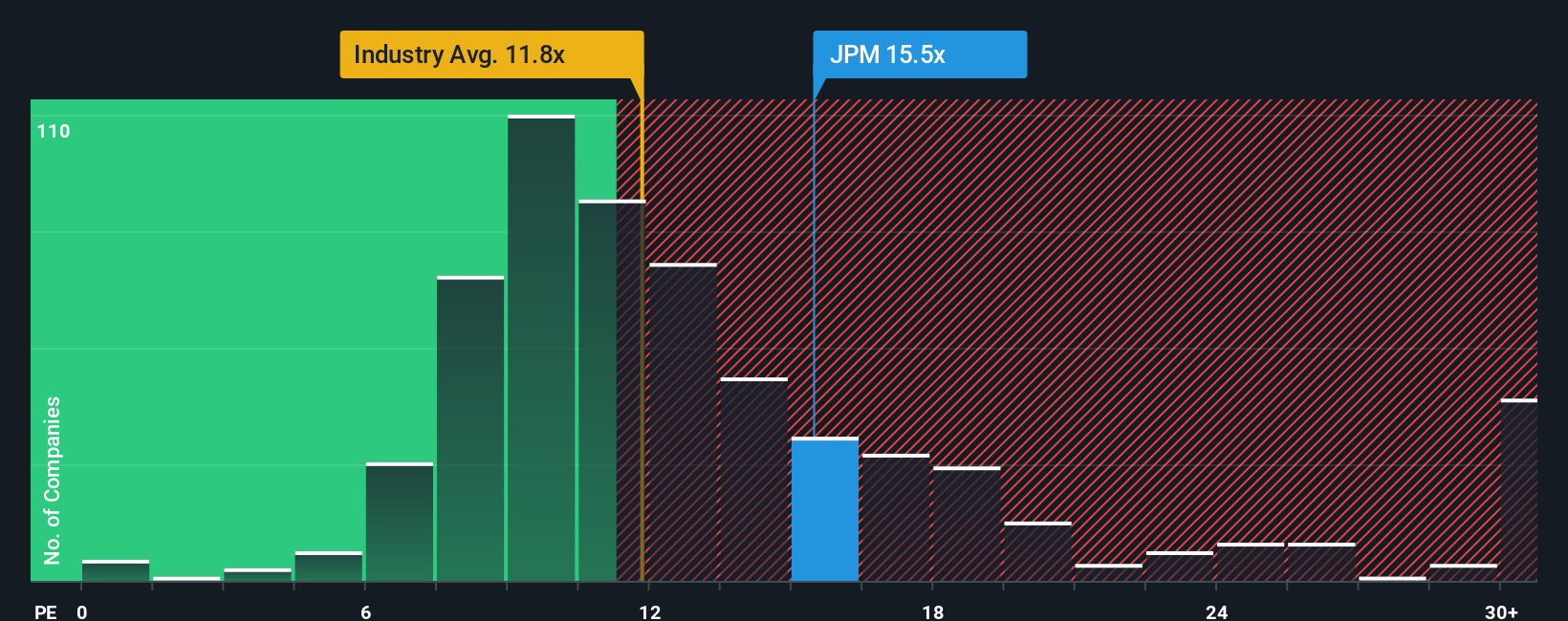

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like JPMorgan Chase, as it directly relates the company’s share price to its earnings per share. For established banks, PE gives a quick sense of how much investors are willing to pay for each dollar of earnings, making it a practical tool for comparing relative value in the sector.

Growth expectations and perceived risk play a big role in determining what a “normal” or “fair” PE ratio should be. Companies expected to grow faster or seen as less risky typically command higher PE ratios, while slower growth or higher risk can lead to lower multiples.

Currently, JPMorgan Chase trades on a PE ratio of 14.95x. This is higher than the industry average of 11.07x and also above the peer average of 12.93x, reflecting its market leadership and robust profitability. However, Simply Wall St's proprietary “Fair Ratio” for JPMorgan Chase is 15.59x. Unlike broad industry or peer averages, this Fair Ratio factors in the company’s unique earnings growth, profitability, industry profile, risk, and market capitalization. This offers a more tailored perspective on value.

Comparing the Fair Ratio and the company’s actual PE reveals that JPMorgan Chase is trading very close to what would be considered fair, meaning its current share price is largely justified by fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

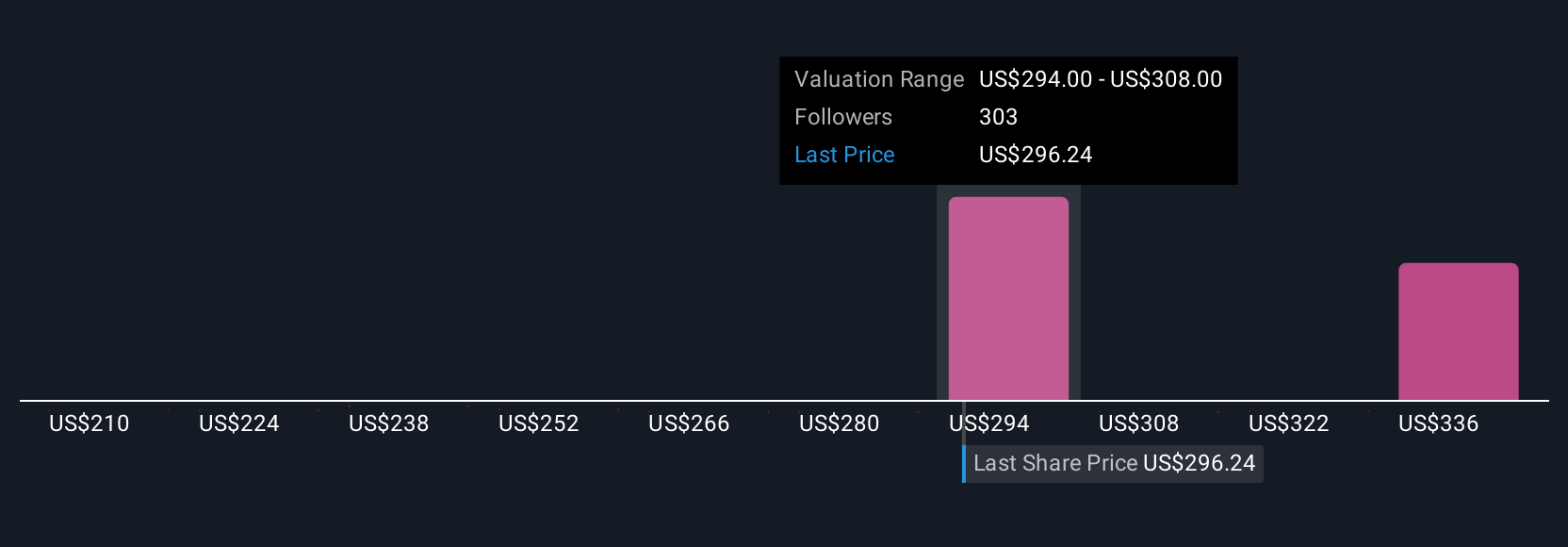

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a smarter and more dynamic way to make investment decisions. A Narrative is a simple, approachable tool that lets you bring your own story and perspective, such as your estimates for future revenue, profit margins, and what you consider fair value, into a financial forecast. This approach ties the company’s business realities directly to actionable valuations. Narratives bridge the gap between a company's story and the numbers, empowering you to test out your thesis and see where it leads.

On Simply Wall St’s Community page, millions of investors use Narratives to compare fair value with the market price and ultimately decide when to buy, hold, or sell. What makes Narratives uniquely valuable is that they update automatically as new information, earnings, or news emerges, keeping your investment thesis relevant and timely.

For example, one investor might have a bullish Narrative on JPMorgan Chase, highlighting its global backbone in digital banking and wealth management, and arrive at a fair value of $350. Another investor might take a more cautious view, focusing on rising competition and costs, setting their fair value closer to $247. Narratives allow you to explore, challenge, and refine your own outlook with complete transparency.

For JPMorgan Chase, we’ll make it really easy for you with previews of two leading JPMorgan Chase Narratives:

Fair Value: $326.43

Undervalued by approximately 4.7%

Projected Revenue Growth Rate: 6.02%

- Diversified growth in wealth management, payments, and digital banking is projected to deliver higher fee revenue, stronger customer acquisition, and margin improvement.

- Strategic investment in new technologies and business lines positions the company for resilience and sustained competitive gains. This supports stable or growing earnings even as market conditions shift.

- Catalysts include healthy inflows into managed assets, digital expansion driving reduced costs and improved margins, and management confidence in both organic and inorganic growth for long-term value creation.

Fair Value: $247.02

Overvalued by approximately 25.9%

Projected Revenue Growth Rate: 4.08%

- Rising credit loss allowances and higher expenses are expected to pressure net and operating margins, impacting future profitability even with ongoing business growth.

- Forecasted rate cuts and a cautious investment banking outlook could reduce net interest income and advisory revenue. This could potentially create future headwinds for earnings.

- Bullish news, such as strong results in asset management and technology investment, is seen as potentially insufficient to offset margin compression and is outweighed by elevated expenses and credit risks.

Do you think there's more to the story for JPMorgan Chase? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives