- United States

- /

- Banks

- /

- NYSE:JPM

How JPMorgan Chase's (JPM) $500 Billion Sustainable Investment Plan Is Shaping Its Long-Term Story

Reviewed by Sasha Jovanovic

- JPMorgan Chase recently reported robust financial results and announced plans to invest US$500 billion in sustainable industries and up to US$10 billion in US companies, while continuing to address legal and regulatory challenges.

- This active capital deployment highlights the bank's efforts to reinforce its leadership in sustainable finance and innovation, even as it manages ongoing compliance and reputational risks.

- We'll examine how JPMorgan's strong earnings and high-profile investment commitments shape its long-term value proposition and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

JPMorgan Chase Investment Narrative Recap

To be a long-term shareholder of JPMorgan Chase, you need to believe in the bank’s ability to leverage its breadth and scale to capture steady fee income growth from wealth management and payments, all while effectively managing mounting regulatory challenges. Recent news around robust earnings, investment commitments, and heightened legal scrutiny does not substantially alter the key short-term catalyst: strong client asset inflows, or the biggest risk, which remains regulatory complexity driving higher compliance and operational costs.

Among the latest developments, JPMorgan’s announcement of a US$500 billion investment in sustainable industries stands out, aligning with the core catalyst of expanding global investment asset pools. This underscores management’s focus on capturing demand for sophisticated financial services, though regulatory risks and margin pressures remain part of the equation.

But, despite these gains, investors should not overlook the risk that greater regulatory scrutiny could…

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase is expected to reach $186.7 billion in revenue and $55.5 billion in earnings by 2028. This projection assumes 4.5% annual revenue growth and a modest $0.3 billion increase in earnings from the current $55.2 billion.

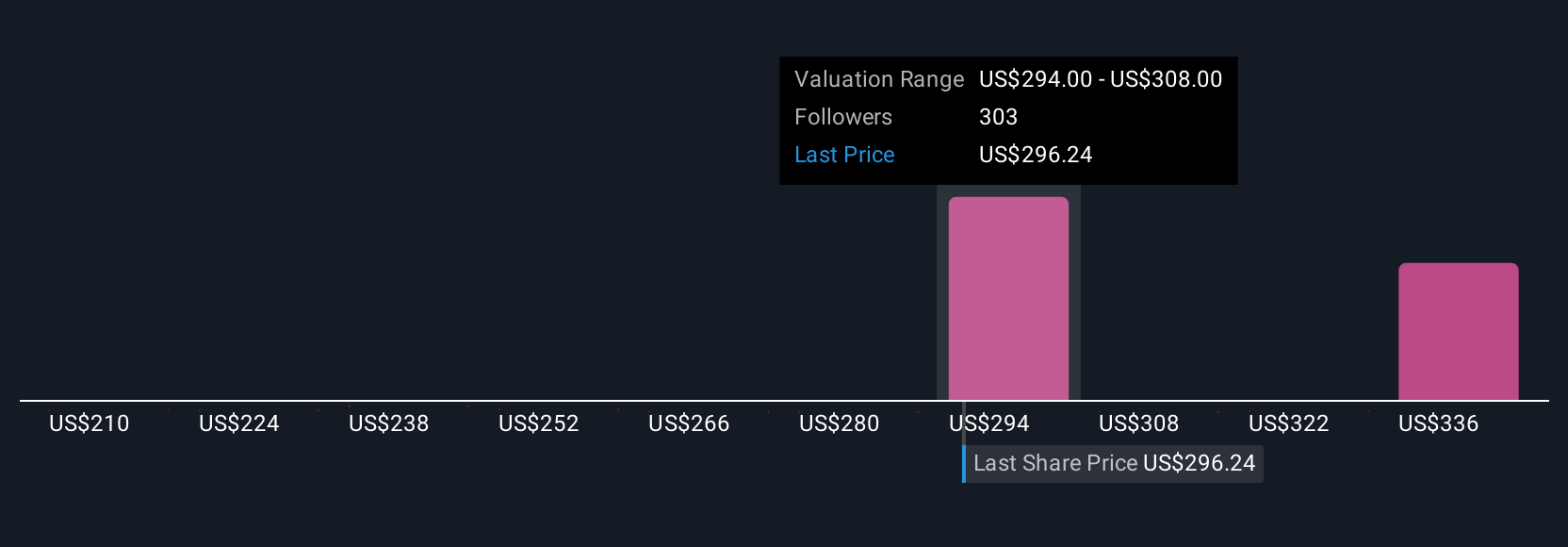

Uncover how JPMorgan Chase's forecasts yield a $326.43 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts saw JPMorgan heading for revenue of nearly US$194.8 billion with earnings at US$59.0 billion. They focus on massive digital banking and fee income opportunities, yet they also see risk if disruptive fintech competition accelerates. Opinions vary widely, so take some time to compare how these different views might shift as new developments unfold.

Explore 23 other fair value estimates on JPMorgan Chase - why the stock might be worth 21% less than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives