- United States

- /

- Banks

- /

- NYSE:HOMB

What Home BancShares (HOMB)'s Dividend Increase Signals About Its Capital Allocation Approach

Reviewed by Sasha Jovanovic

- Home BancShares, Inc. recently announced that its Board of Directors approved a quarterly cash dividend increase to US$0.21 per share, payable December 3, 2025, to shareholders of record as of November 12, 2025, marking a 5% rise over the previous quarter's dividend.

- This dividend growth highlights management's emphasis on consistent shareholder returns and a steady approach to capital allocation, even as the company pursues expansion efforts.

- We will explore how this increased dividend signals confidence in Home BancShares’ long-term earnings and fits into its broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Home Bancshares (Conway AR) Investment Narrative Recap

To be a shareholder in Home BancShares is to believe in the strength of its regional banking focus, steady earnings, and management's commitment to shareholder returns through dividends and prudent capital allocation. The recent 5% dividend hike reflects ongoing confidence in earnings stability, but does not materially impact the most immediate catalyst: M&A-driven asset growth in core Sun Belt markets, nor does it ease the key risk from reliance on acquisition to meet growth targets.

Among recent announcements, the third-quarter 2025 earnings report stands out, with net interest income and net income both increasing year-over-year. This robust earnings performance supports the dividend increase and aligns with management's pattern of linking payout growth to profitability, reinforcing shareholder income but still leaving acquisitive growth as a primary lever for expanding returns.

On the flip side, investors should be aware that continued dependence on finding suitable acquisitions to drive future growth may bring...

Read the full narrative on Home Bancshares (Conway AR) (it's free!)

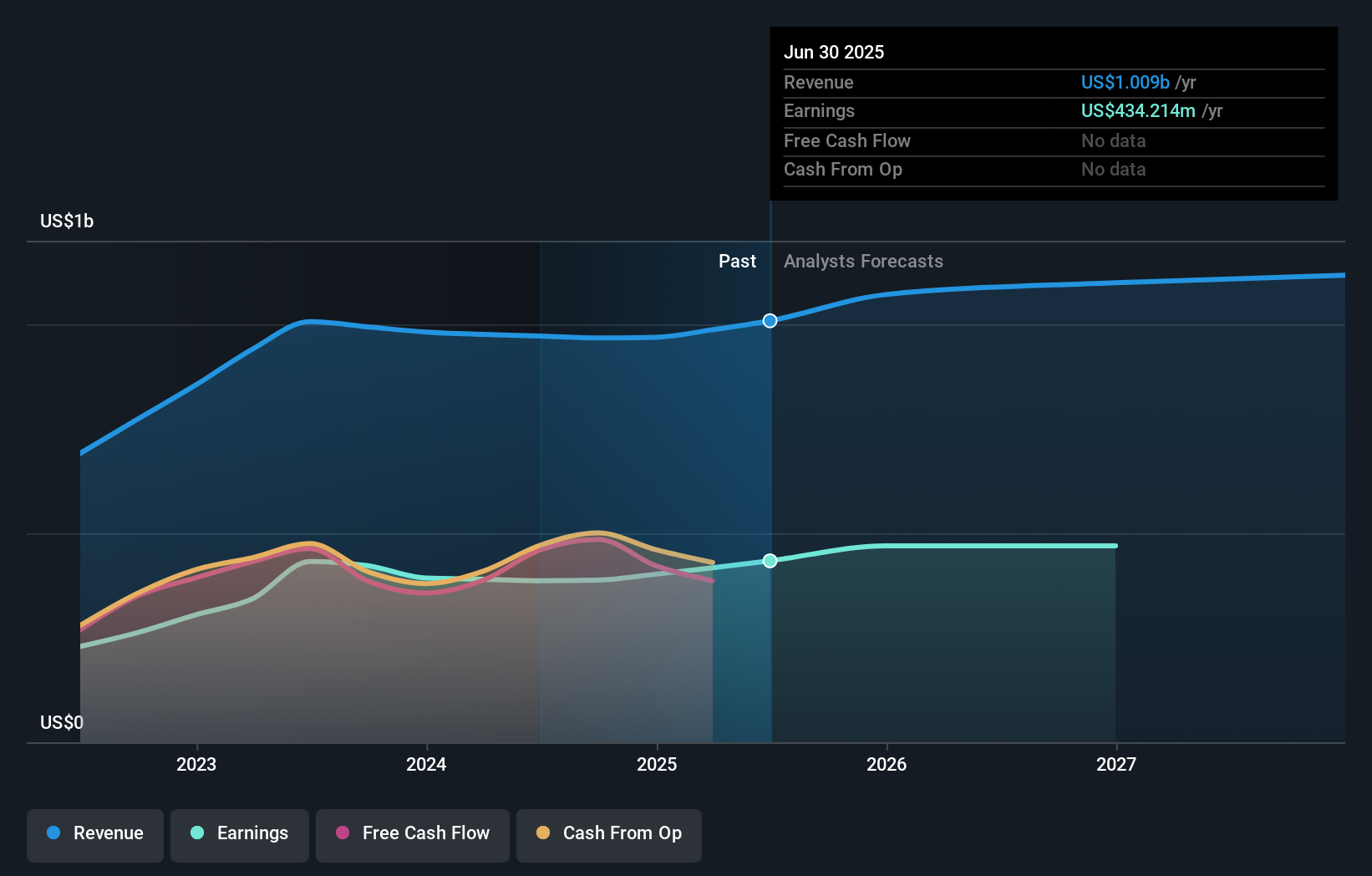

Home Bancshares (Conway AR)'s narrative projects $1.2 billion revenue and $512.9 million earnings by 2028. This requires 4.8% yearly revenue growth and a $78.7 million earnings increase from $434.2 million currently.

Uncover how Home Bancshares (Conway AR)'s forecasts yield a $33.12 fair value, a 23% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offers two independent fair value estimates for Home BancShares, ranging from US$33.13 to US$49.02 per share. While some participants see significant upside, the business’s consistent need for new acquisitions to fuel earnings remains a central theme for anyone considering other views on its growth prospects.

Explore 2 other fair value estimates on Home Bancshares (Conway AR) - why the stock might be worth just $33.12!

Build Your Own Home Bancshares (Conway AR) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Home Bancshares (Conway AR) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Bancshares (Conway AR)'s overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives