- United States

- /

- Banks

- /

- NYSE:HOMB

A Look at Home Bancshares (HOMB) Valuation Following Dividend Increase and Management’s Confidence Signal

Reviewed by Simply Wall St

Home Bancshares announced its Board of Directors has approved a 5% rise in the company’s regular quarterly cash dividend, increasing it to $0.21 per share. This higher payout reflects management’s commitment to rewarding shareholders and shows confidence in the company’s financial health.

See our latest analysis for Home Bancshares (Conway AR).

Shares of Home Bancshares (Conway AR) have seen modest declines in recent weeks, but with a steady 1-year total shareholder return of 3.05% and an impressive 66.65% total return over five years, the company is showing resilience and long-term value. This latest dividend hike suggests momentum is building around management’s commitment to rewarding investors and underscores confidence in the bank’s outlook.

If you’re looking for more opportunities in the financial sector, now is a good moment to see what’s happening across the industry by checking out fast growing stocks with high insider ownership.

But with Home Bancshares trading at a noticeable discount to analyst targets and strong dividend growth, is the market overlooking real upside? Or is all the future growth already reflected in today’s share price?

Most Popular Narrative: 18% Undervalued

With Home Bancshares closing at $27.04, the latest widely followed narrative values the stock at $33.13 per share. This gap stems from distinct forecasts for profits and growth, framing a highly debated case for further upside.

*Management is actively seeking bank acquisition targets in its core footprint, leveraging its historical track record of disciplined, accretive M&A to drive asset growth and EPS expansion. Any successful deals would be directly additive to earnings and tangible book value.*

How bold are the underlying financial projections driving this price target? The narrative hints at a game-changing expansion strategy and ambitious earnings progression. Curious how shifting growth, margins, and future multiples may justify today’s fair value? See the assumptions that put this stock on analysts’ radar.

Result: Fair Value of $33.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower loan growth in key markets and challenges integrating new acquisitions could disrupt forecasts and test management’s ability to sustain recent performance.

Find out about the key risks to this Home Bancshares (Conway AR) narrative.

Another View: Is the Market Price Too High?

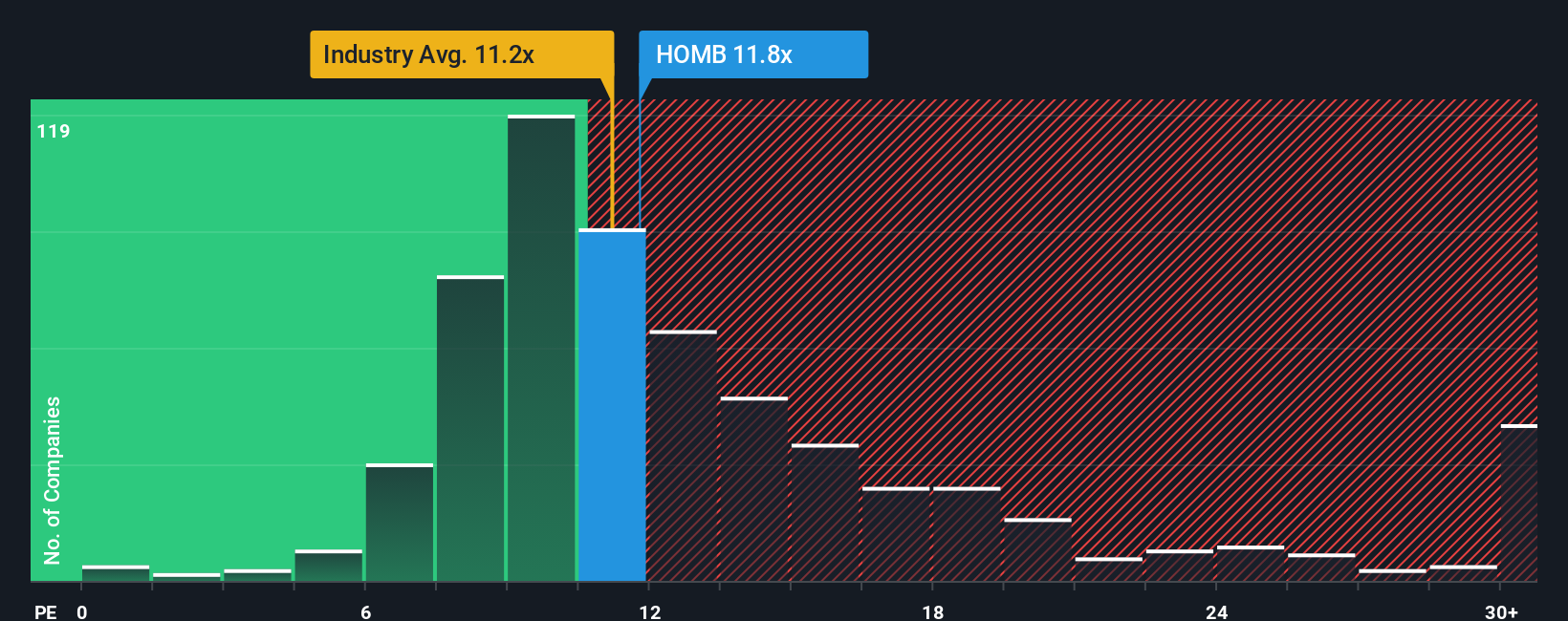

Looking at valuation from an earnings multiple perspective, Home Bancshares trades at 11.6 times earnings. That's higher than both the US Banks industry average (11x) and its peer group (10.6x), and well above the fair ratio of 10.6x, which the market could move toward. Such a premium suggests investors may be paying up for growth and stability, but it also raises questions. Is the market overestimating future performance, or is there still hidden value to be found?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Bancshares (Conway AR) Narrative

If you think there’s more to the story or want to test your own assumptions, you can dig into the numbers and build your own narrative in just a few minutes. Do it your way.

A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Smarter Investment Moves?

Why settle for just one opportunity when there’s a whole world of high-potential stocks waiting? Don’t let smarter ideas pass you by.

- Spot opportunities for long-term gains by checking out these 840 undervalued stocks based on cash flows that might be flying under Wall Street’s radar.

- Expand your watchlist with these 27 AI penny stocks as they harness artificial intelligence to reshape the future of business and innovation.

- Collect reliable income streams by evaluating these 18 dividend stocks with yields > 3%, which features generous yields and steady financials for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives