- United States

- /

- Banks

- /

- NYSE:GBCI

Does Glacier Bancorp's 163rd Dividend Signal Enduring Stability Amid Rate Uncertainty for GBCI?

Reviewed by Sasha Jovanovic

- On November 12, 2025, Glacier Bancorp’s Board of Directors declared a US$0.33 quarterly dividend, making this the company’s 163rd consecutive dividend and marking 49 increases to date, with payment scheduled for December 18 to shareholders of record on December 9.

- This long-term commitment to steadily raising dividends highlights Glacier Bancorp’s focus on consistent shareholder returns and operational stability even amid a changing interest rate environment.

- With the Board’s steady dividend signal as context, we’ll assess how expectations for interest rate cuts may influence Glacier Bancorp’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Glacier Bancorp Investment Narrative Recap

To be a Glacier Bancorp shareholder, one likely believes in the ongoing stability of regional banking, the value of recurring dividends, and the role of disciplined management in supporting returns through various interest rate cycles. The recent dividend announcement supports this consistency, but expectations for imminent interest rate cuts could emerge as the most important short-term catalyst, while the risk of elevated noninterest expenses remains material. On balance, this latest news does not appear to fundamentally change these factors in the near term.

Among recent announcements, Glacier Bancorp’s strong third-quarter earnings stand out, with net interest income rising to US$225.38 million and net income increasing to US$67.9 million. This performance suggests the company continues to generate solid results ahead of potential rate policy shifts, reinforcing the short-term catalyst of interest rate changes while also spotlighting the ongoing pressure from acquisition-driven costs.

In contrast, investors should be aware of persistent cost risks, especially if integration delays from past acquisitions begin to affect...

Read the full narrative on Glacier Bancorp (it's free!)

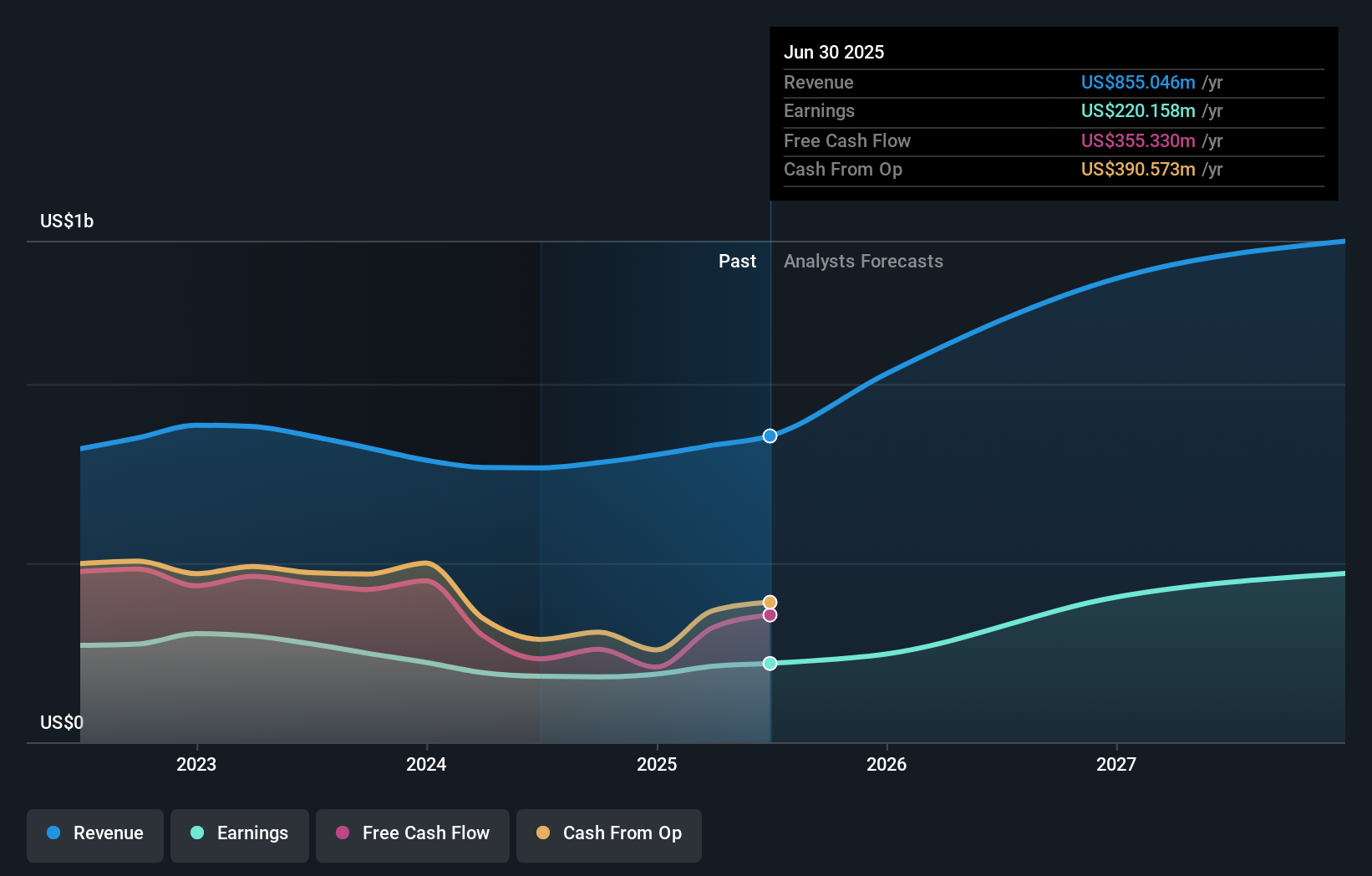

Glacier Bancorp's narrative projects $1.6 billion revenue and $581.0 million earnings by 2028. This requires 23.5% yearly revenue growth and a $360.8 million earnings increase from $220.2 million currently.

Uncover how Glacier Bancorp's forecasts yield a $53.83 fair value, a 29% upside to its current price.

Exploring Other Perspectives

All 10 fair value estimates from the Simply Wall St Community converge at US$53.83, with no range of opinion. Interest rate shifts remain a primary focus, potentially affecting future margins and returns for Glacier Bancorp.

Explore another fair value estimate on Glacier Bancorp - why the stock might be worth as much as 29% more than the current price!

Build Your Own Glacier Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glacier Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Glacier Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glacier Bancorp's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success