- United States

- /

- Banks

- /

- NYSE:GBCI

Did Glacier Bancorp's (GBCI) New Shelf Registration Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Glacier Bancorp, Inc. recently filed a shelf registration, allowing it to issue various securities such as common and preferred stock, depositary shares, debt securities, warrants, rights, and units in the future.

- This new shelf registration offers the company increased flexibility to strengthen its capital base as it pursues further growth and manages industry uncertainties.

- We’ll examine how this expanded funding capability could influence Glacier Bancorp’s investment narrative and future growth plans.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Glacier Bancorp Investment Narrative Recap

To be a Glacier Bancorp shareholder, you need to believe in the company’s ability to unlock long-term value through acquisitions in growing regional markets while maintaining operational efficiency, strong asset quality, and sound risk controls. The recent shelf registration increases financial flexibility but does not immediately affect the primary catalyst, continued successful integration of acquisitions, nor is it likely to materially shift the most significant risk, which remains around cost discipline and integration of new businesses.

Among recent announcements, the latest quarterly earnings report stands out, with Glacier Bancorp highlighting year-over-year growth in net income and net interest income amid a larger operational footprint following the BOID acquisition. The shelf registration aligns with this trajectory, providing capacity for further growth, but the real test will be if margin expansion continues as new businesses are folded in and costs remain controlled.

By contrast, investors should pay close attention to how the costs of integrating new acquisitions are trending, as persistently rising noninterest expenses could...

Read the full narrative on Glacier Bancorp (it's free!)

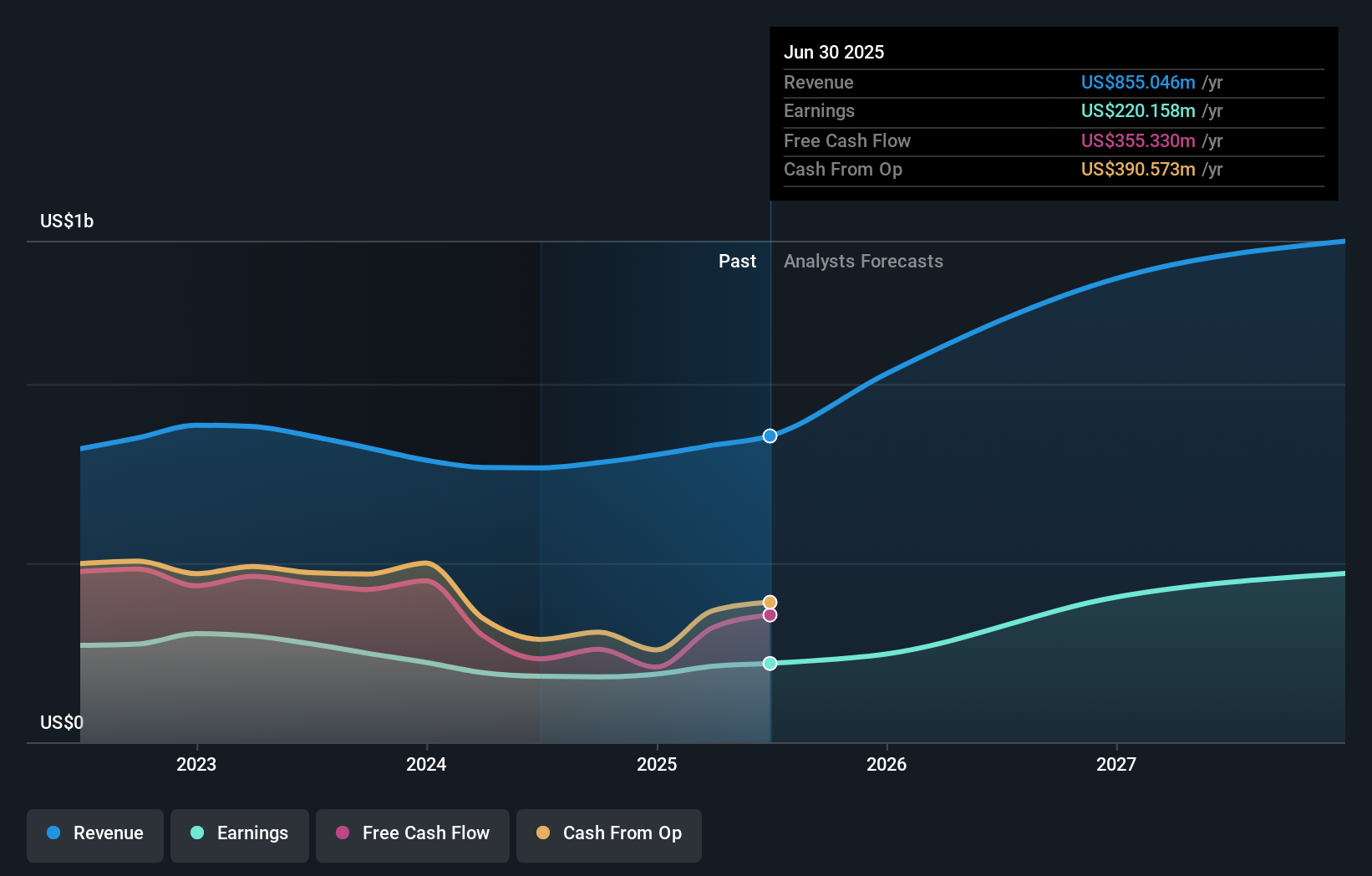

Glacier Bancorp's outlook anticipates $1.6 billion in revenue and $581.0 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 23.5% and an earnings increase of $360.8 million from current earnings of $220.2 million.

Uncover how Glacier Bancorp's forecasts yield a $53.83 fair value, a 32% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member tagged fair value at US$53.83 per share, showing a single, concentrated view. With ongoing concerns about operational efficiency as the company scales, it’s worth exploring several different perspectives before making any decisions.

Explore another fair value estimate on Glacier Bancorp - why the stock might be worth as much as 32% more than the current price!

Build Your Own Glacier Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glacier Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Glacier Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glacier Bancorp's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives