- United States

- /

- Banks

- /

- NYSE:FFWM

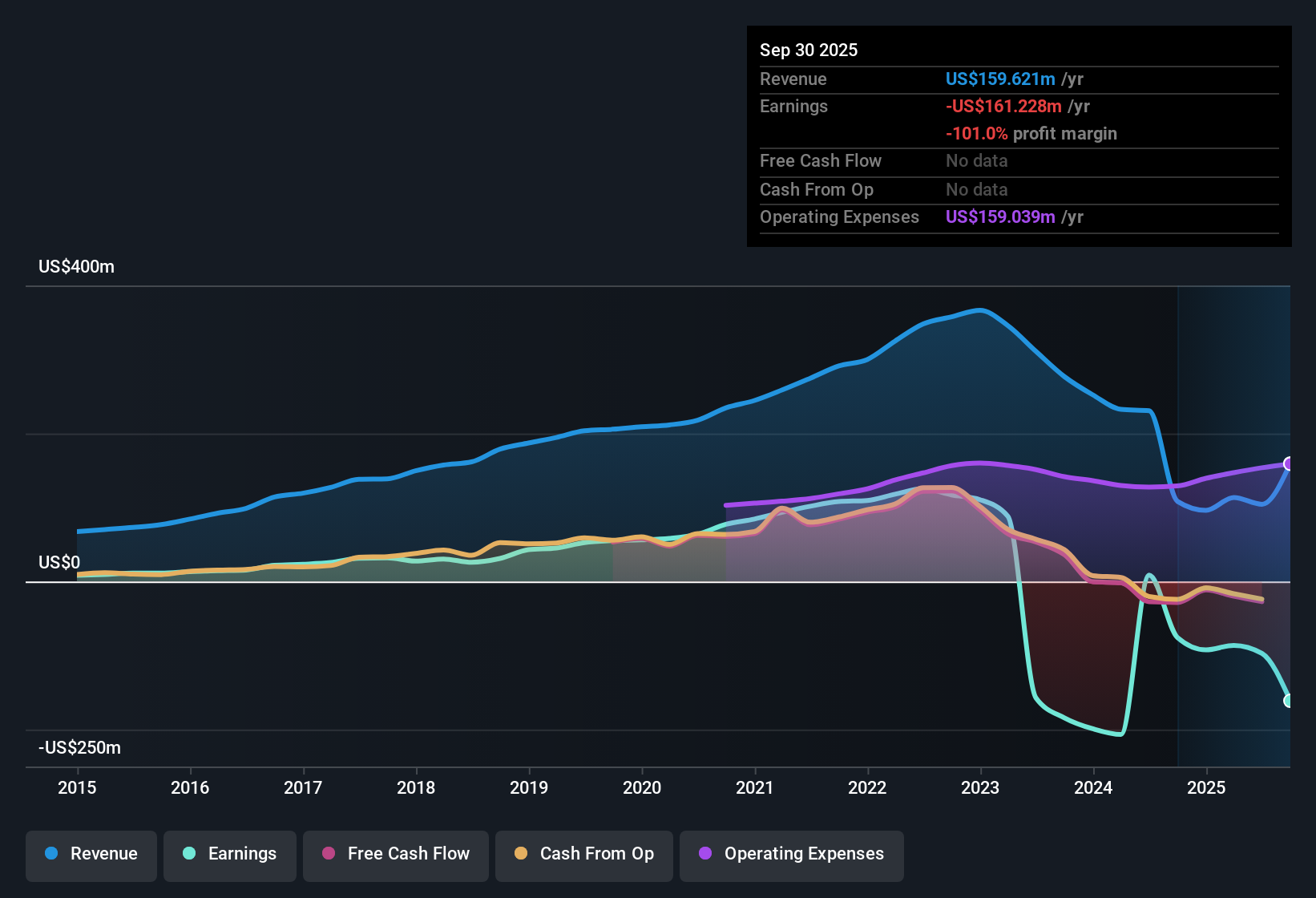

First Foundation (FFWM) Price-to-Book Discount Reinforces Ongoing Losses and Profitability Concerns

Reviewed by Simply Wall St

First Foundation (FFWM) is currently unprofitable, and its losses have worsened at an annual rate of 53.3% over the past five years. With revenue and earnings growth trends both unestablished, and no improvement in net profit margin, the company remains under significant financial pressure. The lack of profit growth means the main takeaway for investors is that risks remain high, with little in the way of established rewards right now.

See our full analysis for First Foundation.Next, we will see how these numbers measure up when set against the broader market and community narratives, and whether they reinforce or challenge the story so far.

See what the community is saying about First Foundation

Analyst Target Suggests Only Modest Upside

- With First Foundation’s share price at $5.30 and the analysts’ consensus price target set at $6.00, the implied upside is a limited 13% from today’s levels, underscoring only a slim margin above current valuations.

- Analysts’ consensus view sees some positive momentum for longer-term recovery but underscores that the upside is tempered by steep ongoing losses and the requirement for significant improvement in profit margins and asset mix.

- The consensus price target assumes profit margins will rise sharply from 3.7% now to 34.8% in three years, but that turnaround from deep losses remains unproven and the current valuation already reflects much of this optimism.

- Consensus also expects a dramatic revenue swing: analysts are forecasting annual revenue growth of 21.1% over the next three years, but these improvements have yet to show up in the financials.

Price-to-Book Stands Out as Deep Discount

- First Foundation trades at a price-to-book ratio of just 0.5x, marking a more pronounced discount than the US Banks industry at 1x and direct peers at 0.8x. This signals the company is valued at half the worth of its tangible assets.

- Consensus narrative highlights that this atypically cheap valuation makes FFWM appear attractive on paper, but also mirrors the serious risks tied to ongoing losses and questions about whether the business can reverse its downward trajectory.

- While the price-to-book discount might catch the eye of value investors, the consensus cautions that discounted stocks often reflect serious operational or balance sheet concerns. Analysts expect the share count to surge more than 30% per year through 2027.

- The low multiple alone is not a buy signal. Analysts note that without a clear shift in profitability, FFWM may simply be “cheap for a reason.”

Balance Sheet Strategy Faces Multiple Hurdles

- The consensus narrative points out that First Foundation’s $228 million capital raise is intended to support expansion into new markets and to reposition its mix of earning assets for improved margins, but also brings new layers of risk related to execution.

- Analysts believe this strategy could improve recurring revenue and income diversification, yet they warn that reliance on wholesale funding, interest rate risk from fixed lending, and the challenge of expanding commercial and industrial lending could all limit the benefits.

- The capital injection creates room for more lending and better balance sheet management, but consensus notes that if execution falters or market conditions shift, these moves may not translate into meaningful profit gains.

- Potential for higher provisions for loan losses and uncertainty around asset quality mean that even with the new capital, there is no guarantee of achieving the margin and revenue growth targets underpinning analyst forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Foundation on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells another story? In just a few minutes, you can put your own narrative together and share your viewpoint. Do it your way

A great starting point for your First Foundation research is our analysis highlighting 1 important warning sign that could impact your investment decision.

See What Else Is Out There

First Foundation’s uncertain profits, steep ongoing losses, and balance sheet challenges highlight significant risk and a lack of reliable financial stability.

If you want companies with stronger foundations and healthier financials, check out solid balance sheet and fundamentals stocks screener (1985 results) that are built to withstand volatility and avoid similar pitfalls.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FFWM

First Foundation

Provides banking services, investment advisory, wealth management, and trust services to individuals, businesses, and other organizations in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives