- United States

- /

- Banks

- /

- NYSE:CMA

How HoldCo’s Unusual Shareholder Presentation Could Shape Comerica’s (CMA) Strategic Future

Reviewed by Sasha Jovanovic

- On November 17, 2025, HoldCo Asset Management publicly released a presentation addressed to Comerica's Independent Directors, disclosing its ownership of Comerica common stock and making the presentation accessible online.

- This unusual move highlights rising shareholder engagement and may signal potential calls for changes in governance or business strategy at Comerica.

- We'll examine how HoldCo's shareholder presentation and active engagement could influence Comerica's investment narrative and future direction.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Comerica Investment Narrative Recap

To be a Comerica shareholder today, you need confidence in the bank's ability to unlock value from its established Sunbelt presence, its merger with Fifth Third, and its ongoing efforts to boost operational efficiency, all while containing costs and expanding fee-based business lines. While HoldCo Asset Management's public campaign is grabbing headlines and raises the stakes for management and board oversight, its immediate effect on the most important catalyst, successful integration of the Fifth Third merger, does not appear material at this stage. The key short-term risk remains Comerica's historically high expense base, which could limit margin improvement regardless of activist pressure.

Of recent company actions, the impending merger with Fifth Third Bancorp stands out as most relevant, given HoldCo’s push for greater shareholder value and scrutiny of Comerica’s direction. While dividends and activist attention draw interest, the merger’s outcome is likely to determine whether Comerica’s scale advantage and access to high-growth markets can be fully realized in the coming quarters.

But for investors, the real contrast lies in the challenge of controlling costs across legacy operations, a factor that continues to...

Read the full narrative on Comerica (it's free!)

Comerica's outlook anticipates $3.5 billion in revenue and $702.1 million in earnings by 2028. This is based on a projected 3.1% annual revenue growth rate and a modest $10.1 million increase in earnings from the current $692.0 million level.

Uncover how Comerica's forecasts yield a $81.28 fair value, a 7% upside to its current price.

Exploring Other Perspectives

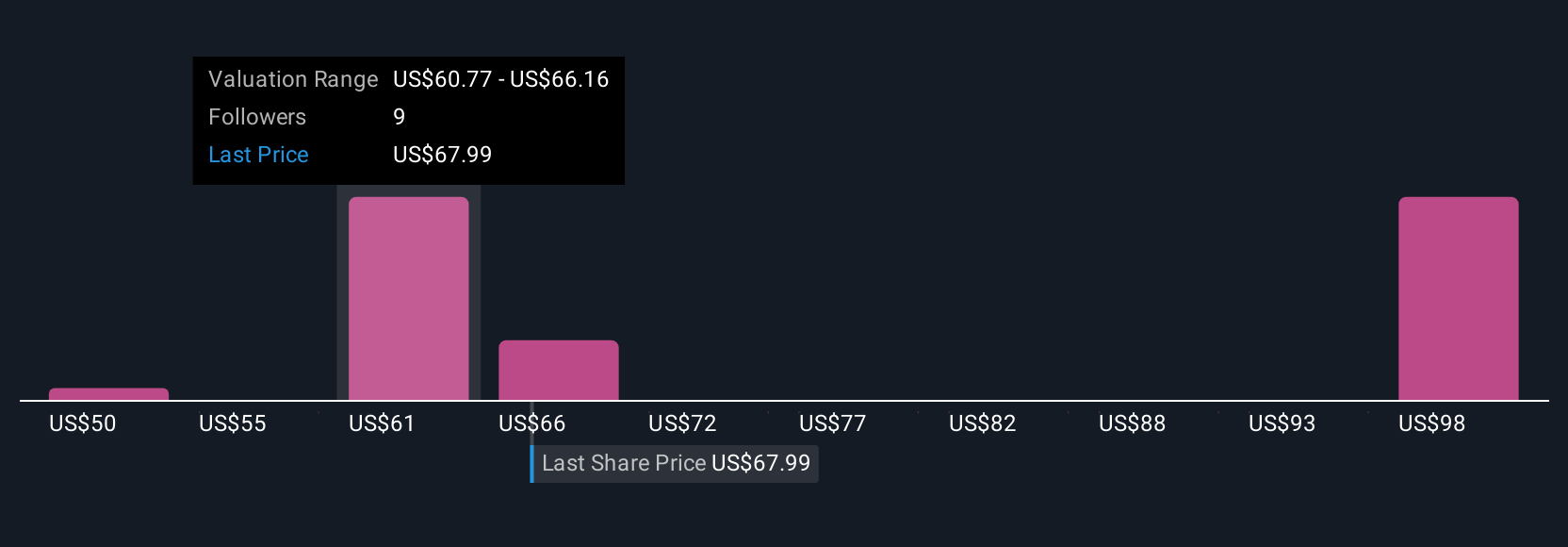

Six members of the Simply Wall St Community placed fair value estimates for Comerica spanning from US$50 to an eye-catching US$77,058.81. And with ongoing expense pressures possibly weighing on margins, these sharply differing outlooks invite you to consider multiple angles before making any decision.

Explore 6 other fair value estimates on Comerica - why the stock might be a potential multi-bagger!

Build Your Own Comerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comerica research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Comerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comerica's overall financial health at a glance.

No Opportunity In Comerica?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives