- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank's (NYSE:CADE) Upcoming Dividend Will Be Larger Than Last Year's

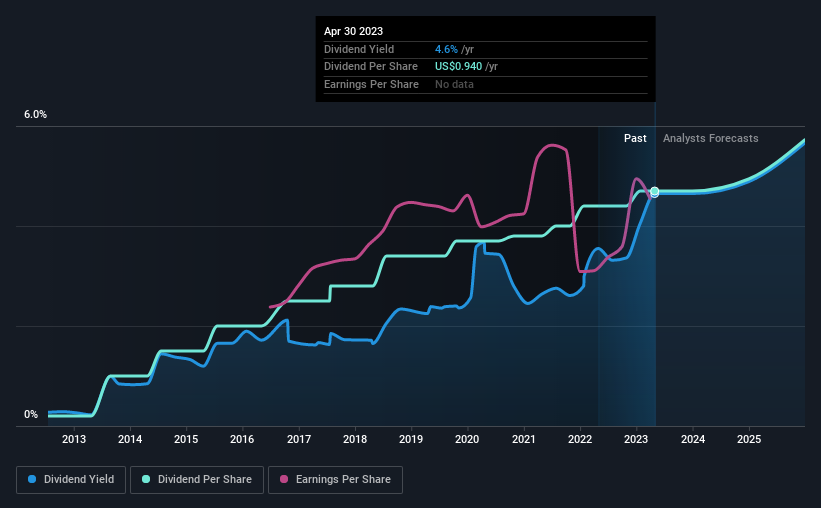

Cadence Bank's (NYSE:CADE) dividend will be increasing from last year's payment of the same period to $0.235 on 3rd of July. This takes the dividend yield to 4.6%, which shareholders will be pleased with.

Check out our latest analysis for Cadence Bank

Cadence Bank's Earnings Will Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

Having distributed dividends for at least 10 years, Cadence Bank has a long history of paying out a part of its earnings to shareholders. Based on Cadence Bank's last earnings report, the payout ratio is at a decent 39%, meaning that the company is able to pay out its dividend with a bit of room to spare.

Looking forward, EPS is forecast to rise by 21.9% over the next 3 years. Analysts forecast the future payout ratio could be 37% over the same time horizon, which is a number we think the company can maintain.

Cadence Bank Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2013, the dividend has gone from $0.04 total annually to $0.94. This means that it has been growing its distributions at 37% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Earnings has been rising at 4.6% per annum over the last five years, which admittedly is a bit slow. While EPS growth is quite low, Cadence Bank has the option to increase the payout ratio to return more cash to shareholders.

Cadence Bank Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Cadence Bank is a strong income stock thanks to its track record and growing earnings. Earnings are easily covering distributions, and the company is generating plenty of cash. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 9 analysts we track are forecasting for Cadence Bank for free with public analyst estimates for the company. Is Cadence Bank not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CADE

Flawless balance sheet with reasonable growth potential and pays a dividend.