- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank's (NYSE:CADE) Shareholders Will Receive A Bigger Dividend Than Last Year

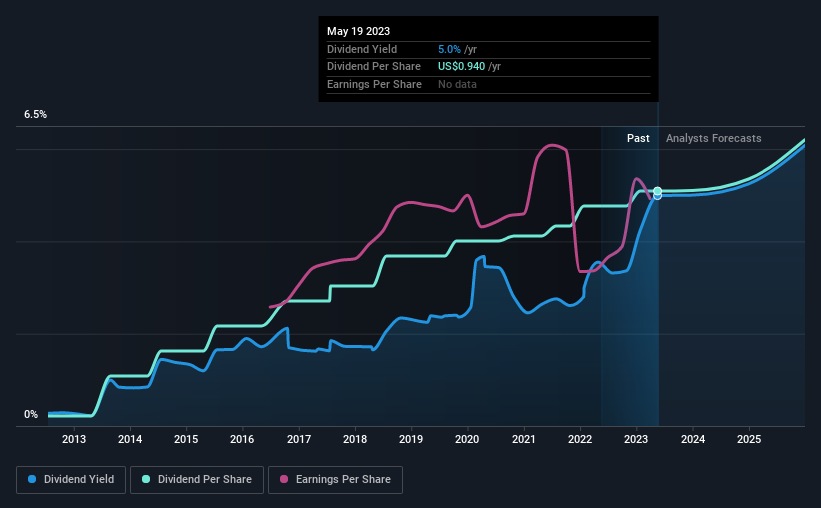

Cadence Bank (NYSE:CADE) has announced that it will be increasing its dividend from last year's comparable payment on the 3rd of July to $0.235. This will take the dividend yield to an attractive 5.0%, providing a nice boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Cadence Bank's stock price has reduced by 31% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Check out our latest analysis for Cadence Bank

Cadence Bank's Payment Expected To Have Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

Cadence Bank has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 39%, which means that Cadence Bank would be able to pay its last dividend without pressure on the balance sheet.

Looking forward, EPS is forecast to rise by 21.9% over the next 3 years. Analysts forecast the future payout ratio could be 37% over the same time horizon, which is a number we think the company can maintain.

Cadence Bank Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.04 in 2013, and the most recent fiscal year payment was $0.94. This means that it has been growing its distributions at 37% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 4.6% a year for the past five years, which isn't massive but still better than seeing them shrink. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

We Really Like Cadence Bank's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 10 analysts we track are forecasting for Cadence Bank for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CADE

Flawless balance sheet with reasonable growth potential and pays a dividend.