- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH): Assessing Fair Value and Growth Prospects After Recent Modest Share Gains

Reviewed by Simply Wall St

See our latest analysis for Bank of Hawaii.

While Bank of Hawaii’s share price has regained ground lately, climbing 5.8% over the past three months, total shareholder return over the past year remains slightly negative. The longer-term picture is more resilient, with five-year total shareholder return up a substantial 34%, indicating steady progress even as recent momentum has been mixed.

If you’re looking to broaden your investing radar, now is a perfect moment to see what’s happening among fast-growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership

With the stock trading just below analyst targets and boasting consistent growth, the key question now is whether Bank of Hawaii remains undervalued or if the market has already priced in all the anticipated upside.

Most Popular Narrative: 7.9% Undervalued

The prevailing narrative places Bank of Hawaii’s fair value at $70.50, a solid premium over the last close of $64.93. This suggests room for moderate upside if fundamentals play out as forecast. Investors are paying close attention since this viewpoint brings detailed future assumptions to the table rather than simply following market momentum.

Ongoing digital transformation and sustained investments in digital banking platforms are expected to enhance operational efficiency, improve customer acquisition and retention, and support controlled expense growth, boosting long-term net margins.

Curious what revenue and earnings forecasts are baked into this optimistic fair value? The secret is a specific set of future profit margins and growth assumptions that could surprise most traditional bank investors. Want to see which bold projections make this price target possible?

Result: Fair Value of $70.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Hawaiian real estate and flat deposit growth mean any shift in local property values or deposit costs could challenge this optimistic outlook.

Find out about the key risks to this Bank of Hawaii narrative.

Another View: What Do the Multiples Say?

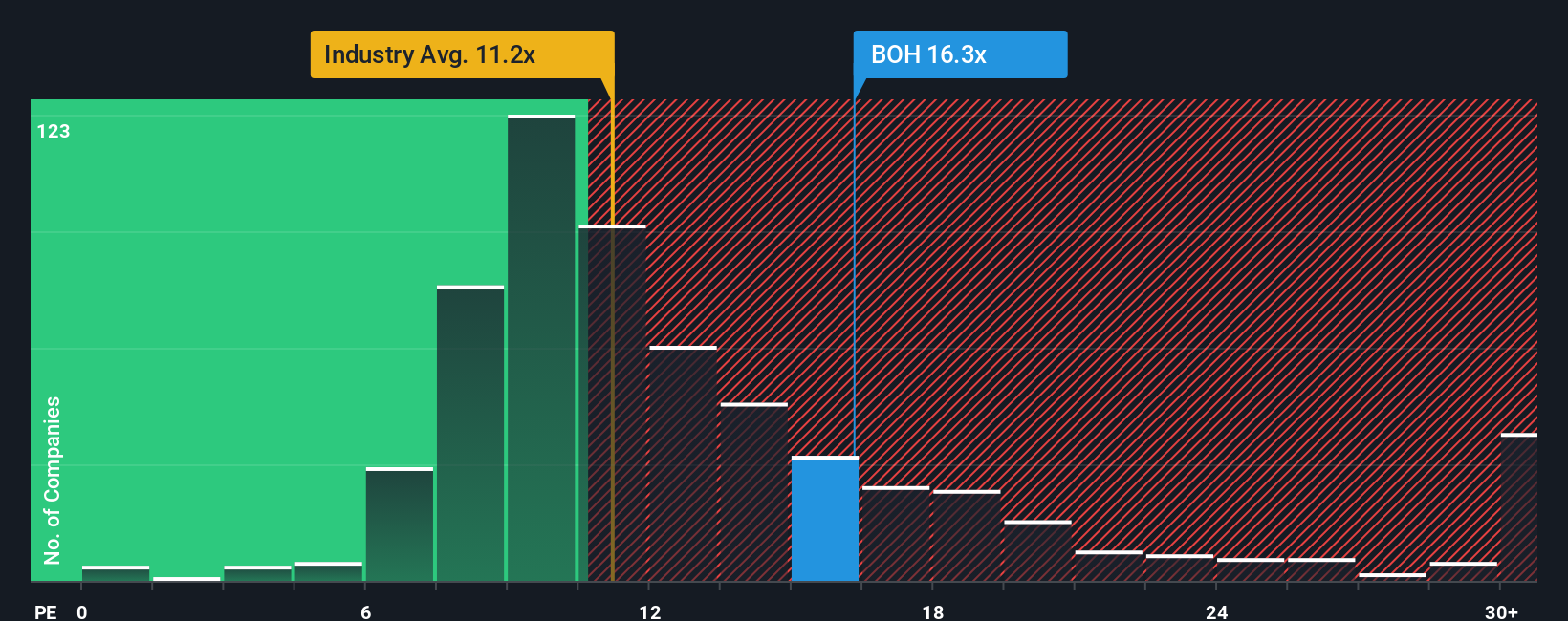

Looking at Bank of Hawaii through the lens of its price-to-earnings ratio, the story is less optimistic. The company trades at 15.8 times earnings, which is more expensive than both its peer group average of 12.6x and the broader US Banks industry average of 11.2x. Even compared to its own fair ratio of 13.7x, the shares look pricey, suggesting less margin for error if expectations are not met. How much of a premium is too much for a stable, consistent bank?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Hawaii Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build your own view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of Hawaii.

Looking for More Smart Investment Opportunities?

Don’t limit your financial potential. The market is full of stocks with fresh momentum and long-term promise. Expand your strategy and seize today’s unique openings.

- Unlock steady income streams by checking out these 22 dividend stocks with yields > 3% that deliver yields above 3% for income-focused investors.

- Spot under-the-radar gems ready to disrupt their industries with these 834 undervalued stocks based on cash flows offering strong growth at compelling prices.

- Tap into emerging trends at the intersection of healthcare and artificial intelligence with these 33 healthcare AI stocks transforming patient care and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives