- United States

- /

- Banks

- /

- NYSE:BKU

Should BankUnited's (BKU) CFO Transition Prompt a Rethink of Its Financial Leadership Narrative?

Reviewed by Sasha Jovanovic

- BankUnited, Inc. recently named James G. Mackey as its new chief financial officer, effective November 10, 2025, with former CFO Leslie N. Lunak moving into an advisory role through January 2026.

- This leadership shift brings fresh financial oversight at a time when the bank has reported a Non-GAAP EPS of US$0.95 for the recent quarter, exceeding expectations.

- We'll examine how this executive transition may influence BankUnited's investment narrative, particularly as new financial leadership takes the helm.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

BankUnited Investment Narrative Recap

At the core of the BankUnited investment case is a belief in the company’s ongoing expansion into high-growth markets and margin management, supported recently by above-expectation earnings. The appointment of James G. Mackey as CFO introduces new financial leadership but does not appear to materially shift the near term catalysts or the substantial risk of credit quality pressure from the bank’s heavy commercial real estate exposure, especially in the office segment. The most relevant recent announcement alongside the CFO transition is BankUnited’s Q3 financial update, which reported a Non-GAAP EPS of US$0.95, surpassing market expectations. This strengthens confidence in the bank’s operational execution, but does not directly address exposures that could challenge results if office-related nonperforming loans continue to rise. However, investors should also be aware that, while the leadership refresh may bring operational improvements, persistent inflows into nonperforming office assets remain a material concern if...

Read the full narrative on BankUnited (it's free!)

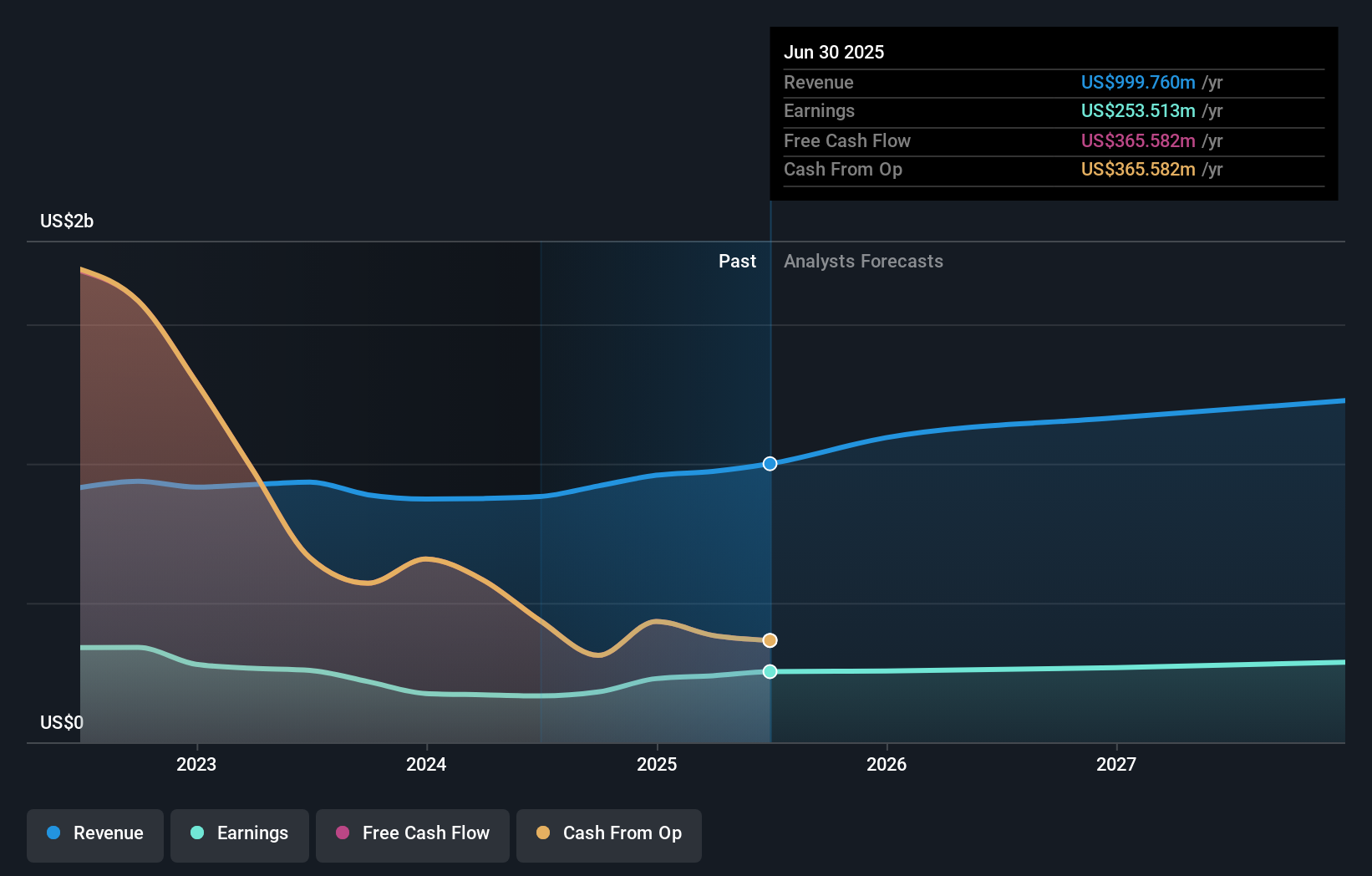

BankUnited's narrative projects $1.3 billion revenue and $291.8 million earnings by 2028. This requires 8.9% yearly revenue growth and a $38.3 million earnings increase from $253.5 million.

Uncover how BankUnited's forecasts yield a $42.02 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided a single fair value estimate for BankUnited at US$42.02, indicating little divergence in retail investor opinion. While financial results have recently beaten expectations, risks from commercial real estate exposure highlight why your outlook might differ from consensus.

Explore another fair value estimate on BankUnited - why the stock might be worth as much as 5% more than the current price!

Build Your Own BankUnited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BankUnited research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BankUnited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BankUnited's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankUnited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKU

BankUnited

Operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives