- United States

- /

- Banks

- /

- NYSE:BKU

Is Jefferies’ Upgrade and Acquisition Interest Shifting the Investment Case for BankUnited (BKU)?

Reviewed by Sasha Jovanovic

- Jefferies recently upgraded BankUnited from Hold to Buy, citing the company’s appeal as a potential acquisition candidate and improvements in its underlying fundamentals.

- This shift highlights BankUnited’s discounted valuation and growing significance amid increased merger activity and changing dynamics in the regional banking sector.

- Now, we’ll consider how BankUnited’s potential acquisition interest could influence perspectives on its long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

BankUnited Investment Narrative Recap

To be a shareholder in BankUnited, you need conviction in the company’s ability to manage sector concentration risk and realize value through disciplined growth, especially in commercial real estate, while balancing short-term catalysts like potential M&A activity. The recent Jefferies upgrade amplifies attention on acquisition interest, but it does not materially change the most immediate risk: continued credit quality concerns in the office property segment, where nonperforming loans remain elevated and subject to ongoing scrutiny.

Among the latest announcements, BankUnited’s Q3 results stand out, with year-over-year gains in net interest income and net income providing a factual basis for Jefferies’ optimism regarding underlying fundamentals. While this performance offers support for improved sentiment, it must be considered alongside the catalyst of sustained deposit and balance sheet growth as the company expands in targeted high-growth regions.

By contrast, what investors should be aware of is the risk that underlying nonperforming office loans could...

Read the full narrative on BankUnited (it's free!)

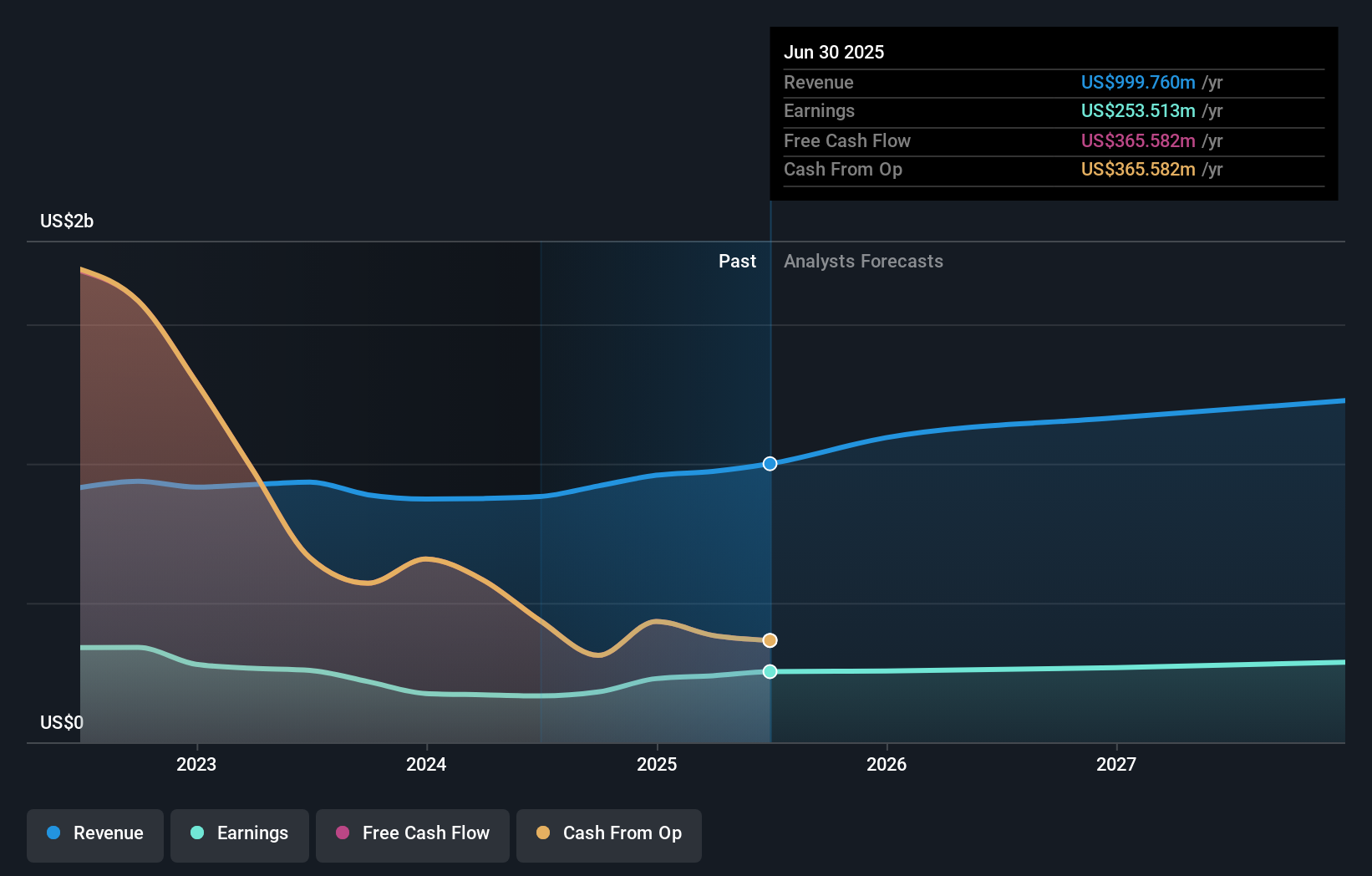

BankUnited's outlook anticipates $1.3 billion in revenue and $291.8 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 8.9% and a $38.3 million earnings increase from the current level of $253.5 million.

Uncover how BankUnited's forecasts yield a $42.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Every one of the 1 fair value estimates submitted by the Simply Wall St Community pegs BankUnited at exactly US$42 per share. Yet, risks tied to rising nonperforming office loans may prompt you to seek a range of opinions before forming your outlook.

Explore another fair value estimate on BankUnited - why the stock might be worth just $42.00!

Build Your Own BankUnited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BankUnited research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BankUnited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BankUnited's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankUnited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKU

BankUnited

Operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026