- United States

- /

- Banks

- /

- NYSE:BBT

Beacon Financial (BBT): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Beacon Financial.

Beacon Financial’s latest share price return reflects a fading momentum, with a 7-day share price return of 3.7% but a broader YTD slide of 13.6%. Recent price movements suggest investors are taking a more cautious view following last year’s rapid gains.

If you’re curious about what else is changing hands in today’s market, consider broadening your search and discover fast growing stocks with high insider ownership

But with Beacon Financial’s recent pullback and signs of strong annual growth, is the market overlooking an undervalued opportunity, or are current prices already reflecting all the future upside?

Price-to-Earnings of 25.8x: Is it justified?

Beacon Financial currently trades at a price-to-earnings (P/E) ratio of 25.8x, placing it well above its industry peers and the broader sector average. With shares closing at $24.13, investors are paying a premium for its earnings compared to similar banks.

The P/E multiple measures how much investors are willing to pay for each dollar of the company's earnings. For banks, this ratio often signals market expectations about future growth and profitability. A higher P/E can indicate confidence in future performance, but it may also suggest the stock is overvalued in context.

While the premium might reflect Beacon Financial’s high-quality earnings and rapid revenue growth, it is important to note that its P/E ratio is significantly higher than both its peer average (16.6x) and the US Banks industry average (11.3x). However, when compared to its estimated fair price-to-earnings ratio of 51.6x, there may still be more room for upside if the company delivers on robust growth forecasts.

Explore the SWS fair ratio for Beacon Financial

Result: Price-to-Earnings of 25.8x (OVERVALUED)

However, rapid earnings growth may slow, or market volatility could increase. Both of these developments could prompt a swift shift in sentiment around Beacon Financial shares.

Find out about the key risks to this Beacon Financial narrative.

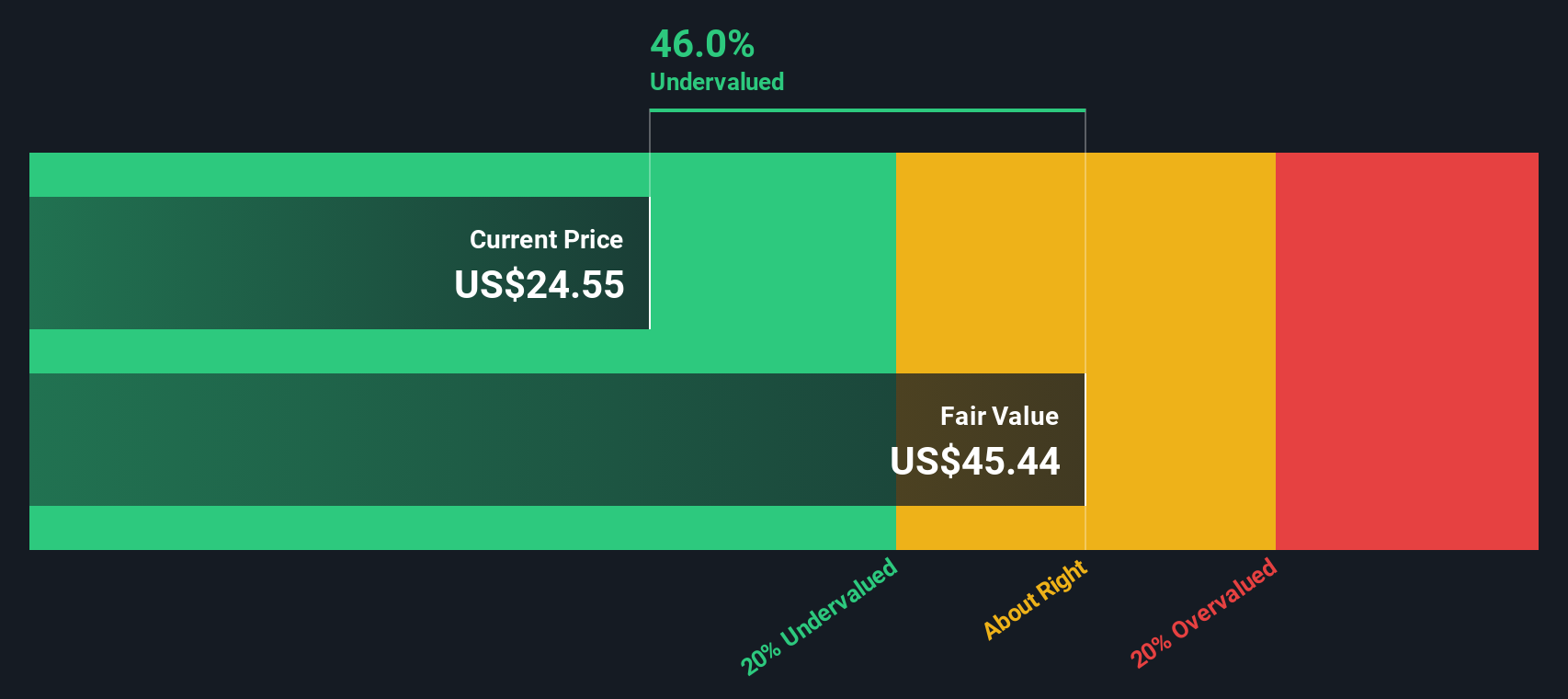

Another View: Undervalued per Our DCF Model?

While the current share price may look rich compared to earnings, our SWS DCF model suggests Beacon Financial is trading 47.5% below its estimated fair value of $45.96. This provides a very different perspective and suggests there could be untapped value the market is missing. Should investors trust the numbers or the mood?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Beacon Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Beacon Financial Narrative

If you have a different perspective or enjoy drawing your own conclusions from the numbers, you can piece together your own story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Beacon Financial.

Looking for More Investment Ideas?

Don’t sit on the sidelines while other investors capture tomorrow’s big stories. Use these handpicked ideas to spot fresh opportunities and keep your portfolio energized.

- Tap into the power of consistent income by searching for market leaders with yields over 3% using these 17 dividend stocks with yields > 3%.

- Unlock high-upside opportunities by finding companies the market might be overlooking with these 875 undervalued stocks based on cash flows.

- Stay ahead of tomorrow’s technology boom by checking out cutting-edge innovators through these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beacon Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBT

Beacon Financial

Operates as the bank holding company for Beacon Bank & Trust that provides various banking solutions in New England and New York, the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives