- United States

- /

- Banks

- /

- NYSE:BANC

Is There More to Banc of California’s Value After Recent Business Realignment?

Reviewed by Bailey Pemberton

If you’re holding Banc of California stock and wondering what your next move should be, you’re definitely not alone. After all, the stock’s recent performance has turned a few heads, with a 3.1% gain both in the past week and over the last month. Look back a little further and the year-to-date return sits at a solid 12.8%, with the past year posting a comparable 11.5% climb. Whether you already own shares or are eyeing them now, it’s hard not to wonder if there’s another leg up or if the current valuation is stretched.

Much of this momentum can be traced back to news swirling around Banc of California’s business realignment, which has been shaking up the bank’s strategy in a changing market. Recent headlines have highlighted management’s moves to streamline operations and refocus on areas expected to drive long-term growth. As a result, investor perception of the bank’s risk profile appears to be improving, and more are betting on the potential for future upside as these initiatives play out.

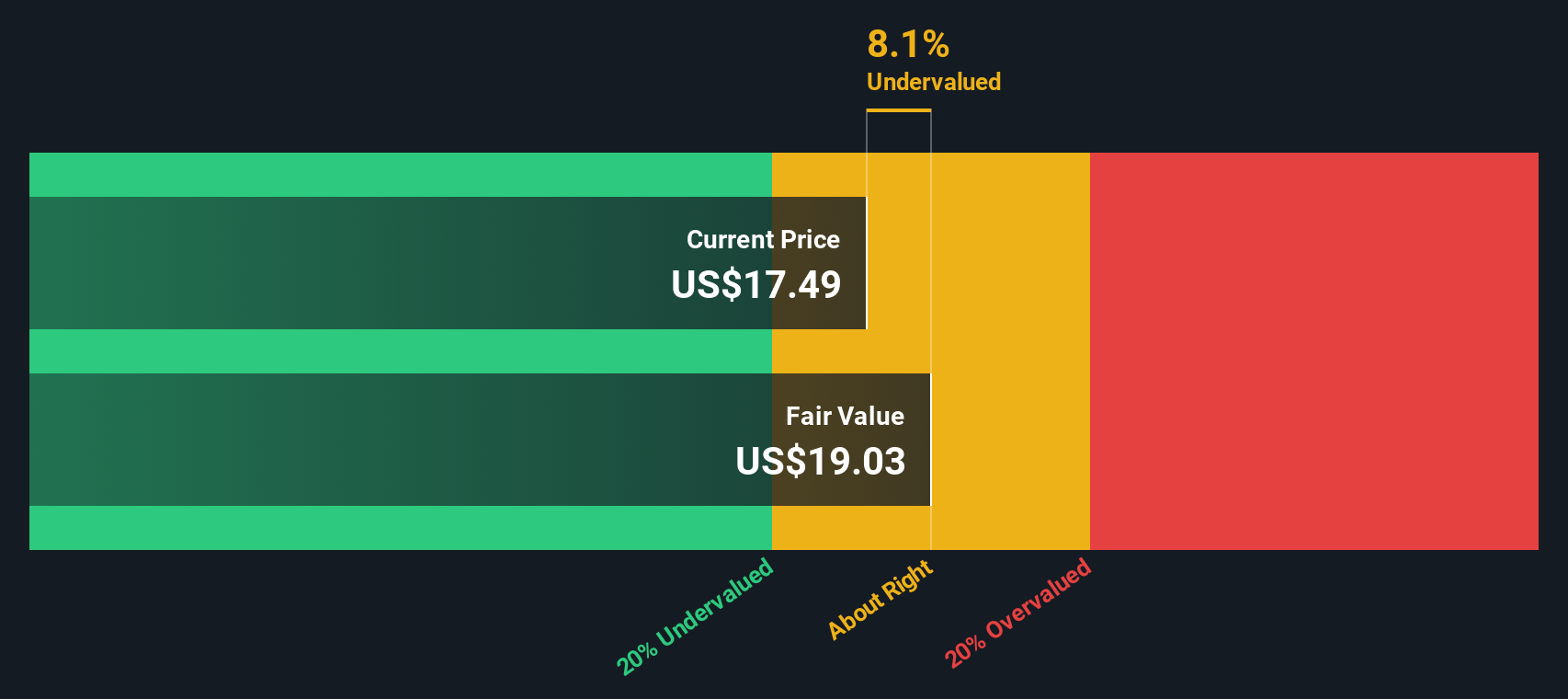

Of course, all this price action brings up the question of valuation. Based on common benchmarks, Banc of California currently scores a 3 out of 6 on the undervaluation checklist, which is a decent mark but not a slam dunk. So, how does the market’s enthusiasm line up with the fundamentals? Before making any decisions, let’s walk through the major ways investors determine whether a stock is truly undervalued (and stick around for what could be an even sharper lens on valuation toward the end of the article).

Why Banc of California is lagging behind its peers

Approach 1: Banc of California Excess Returns Analysis

The Excess Returns valuation model is focused on evaluating whether a company can generate returns above its cost of equity, which captures the true economic profit earned from shareholder capital. For Banc of California, this approach offers a more nuanced sense of value compared to simple ratios or broad industry comparisons.

Based on analyst projections and recent financial data, Banc of California reports a Book Value of $19.10 per share and a Stable EPS of $1.65 per share. These estimates are derived from the aggregated future return on equity assessments of eight analysts, providing a more reliable long-term perspective. The average Return on Equity is 7.75 percent, and the stable Book Value is expected to reach $21.24 per share in the future. However, the Cost of Equity is calculated at $1.66 per share, which brings the Excess Return down to negative $0.01 per share. This result essentially indicates that returns are almost exactly matching the required cost of capital.

Despite these modest excess returns, the Excess Returns model values the intrinsic share price at $21.03. This implies that Banc of California trades at an 18.2 percent discount compared to its fundamental worth, suggesting the market may be underestimating the value generated by the bank's investments in its core business.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banc of California is undervalued by 18.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

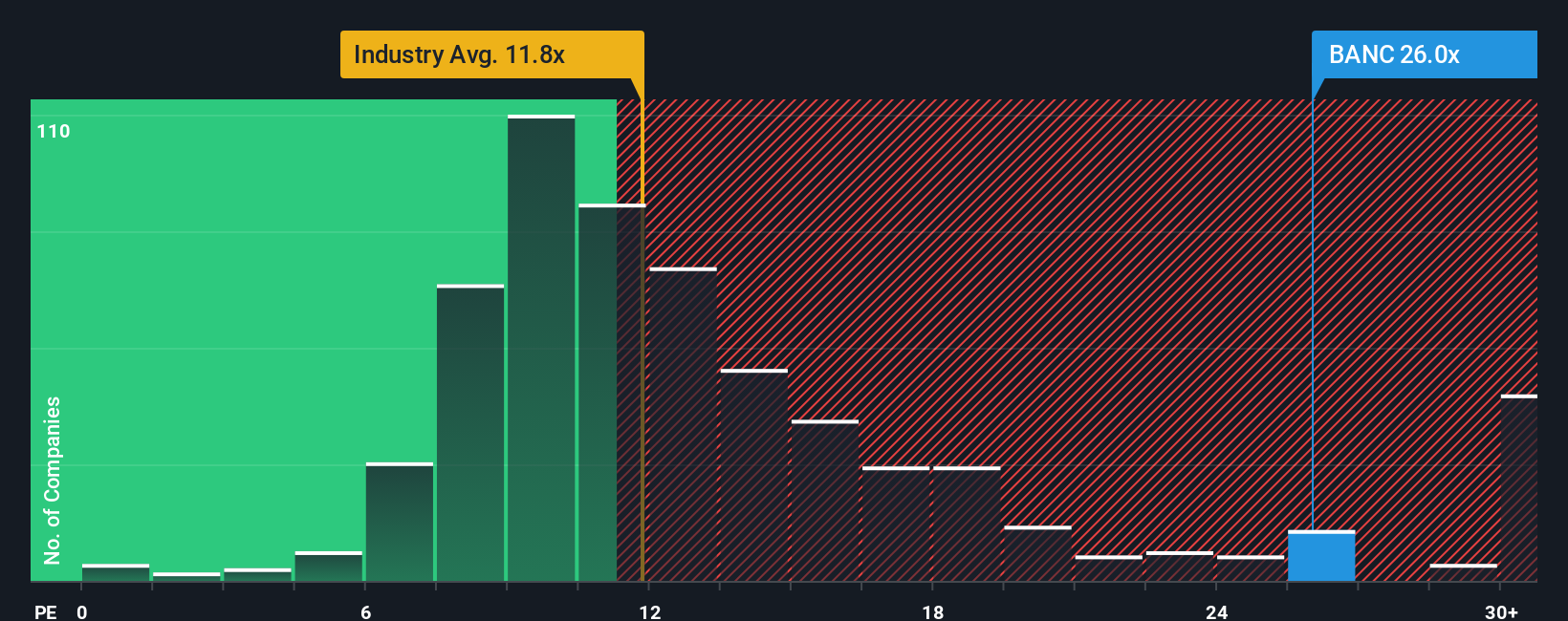

Approach 2: Banc of California Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a reliable valuation tool for profitable companies like Banc of California because it links a stock’s market price directly to its ability to generate net income. For investors, a reasonable PE ratio serves as a barometer of how much they are paying for every dollar of earnings, making it easier to assess if a stock is under or overvalued relative to its actual profit power.

Of course, what counts as a “normal” or “fair” PE is not one-size-fits-all. It is influenced by factors such as expected earnings growth and the level of risk. Companies with stable earnings and strong growth prospects usually command higher PE ratios, while those facing more uncertainty or weaker growth rates tend to trade closer to the market or industry average.

Currently, Banc of California trades at a PE ratio of 15.84x. This sits just below both the peer average of 17.27x and the Simply Wall St Fair Ratio of 16.26x, but significantly above the Banks industry average of 11.25x. The Fair Ratio, a proprietary metric developed by Simply Wall St, estimates the multiple that best reflects the company’s blend of earnings growth, risk, profit margin, market cap, and its unique position within the industry. Unlike a straight comparison to industry averages or selected peers, the Fair Ratio is tailored and adjusts for the nuances that can make a company stand out or lag behind. Looking at Banc of California’s current PE and its Fair Ratio, there is only a small gap between the two, indicating the market price is pretty much in line with what you would expect based on fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banc of California Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic approach to investing that goes beyond the traditional numbers.

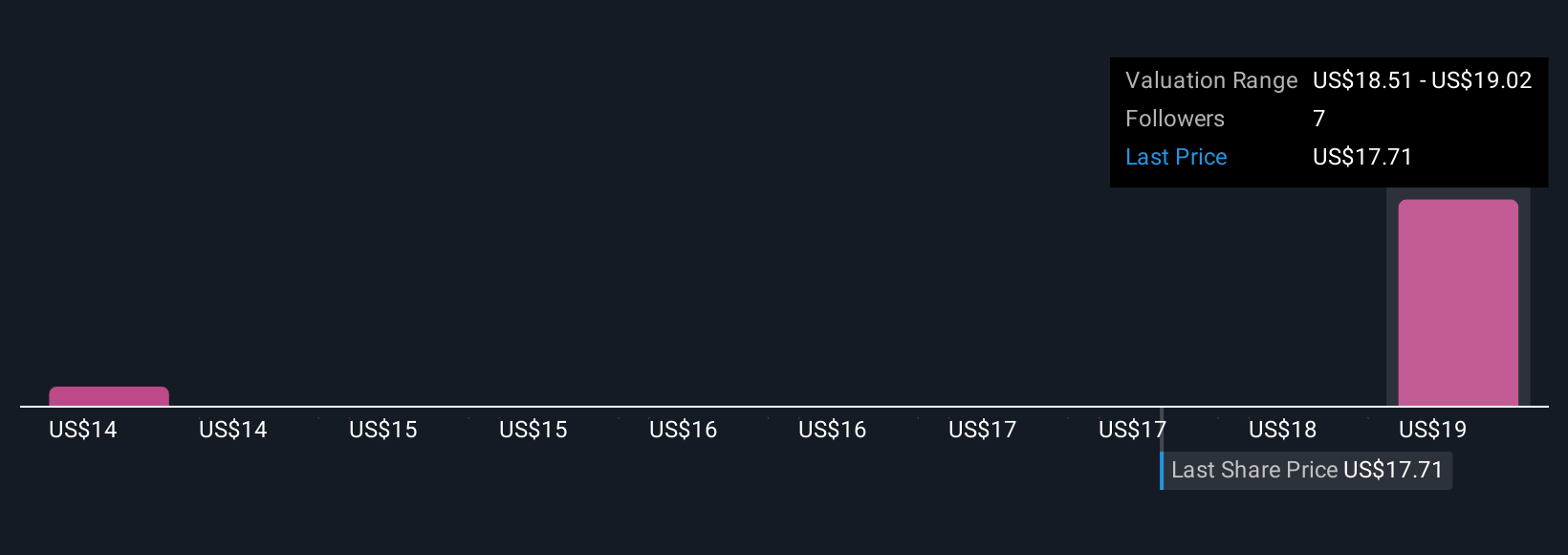

A Narrative is simply the story and perspective you build about a company: what you believe its future holds and why. It combines your view of the business, such as expected revenue, earnings, margins and key trends, with a financial forecast and a calculated fair value. This lets you see if your expectations mean the stock is under or overvalued at today’s price.

Millions of investors already use Narratives on Simply Wall St’s Community page, where it is easy and accessible to build or browse ideas about any stock, including Banc of California. Narratives empower you to make clearer decisions about whether to buy or sell by comparing each Narrative’s up-to-date fair value against the latest share price, helping you act confidently on your convictions.

What’s more, Narratives are updated automatically as new news or earnings are released, so your perspective can change as fast as the facts do. For instance, some Banc of California Narratives are more optimistic, projecting a fair value as high as $21 per share based on analyst optimism and ongoing digital transformation, while more cautious Narratives see fair value as low as $15 due to risks like reliance on regional commercial real estate or integration hurdles. That’s why Narratives offer a sharper lens on valuation. They connect your investment thesis directly to actionable numbers, always reflecting the latest scene in the company’s story.

Do you think there's more to the story for Banc of California? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion