- United States

- /

- Banks

- /

- NYSE:BANC

Banc of California (BANC) Swings to Profit, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

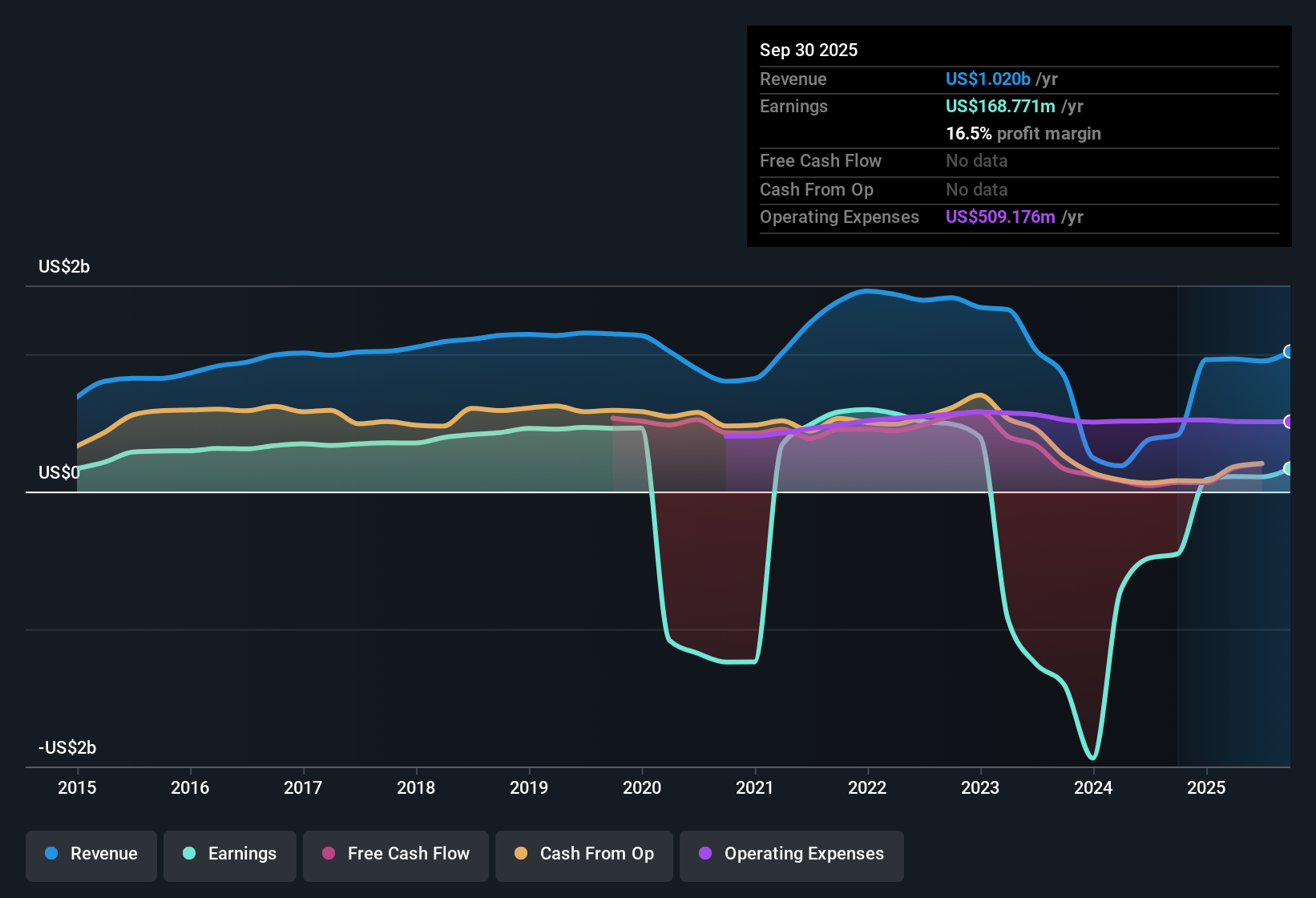

Banc of California (BANC) has turned profitable over the past year, flipping to high-quality earnings just as forecasts call for a robust 30.4% annual EPS growth, well ahead of the broader US market’s 15.5% pace. Revenue is expected to climb 11.7% per year, beating out the 10% advance seen across the US market. Shares are currently trading at $16.54, below some models’ fair value estimate of $19.17. Investors are weighing the strong outlook and accelerating margins against a relatively low price-to-earnings multiple and minor insider selling, as the risk/reward profile shifts decisively into positive territory this earnings season.

See our full analysis for Banc of California.Next, we’ll see how Banc of California’s latest results compare with the narratives that drive investor sentiment. Some long-standing stories may be confirmed, while others could be upended.

See what the community is saying about Banc of California

Margins Set for Steep Expansion

- Analysts are forecasting that Banc of California’s profit margins will climb from 11.4% today to 26.5% within three years, an aggressive target almost two and a half times its current level.

- According to the analysts' consensus view, this anticipated boost in margins is underpinned by expectations of digital transformation and successful integration of recent mergers.

- Consensus narrative notes that ramped-up technology investment and cost-saving synergies from the Pacific Western Bank merger are designed to accelerate efficiency and drive higher net interest margins.

- However, the speed and scale of these improvements hinge on management delivering consistent execution, especially as asset quality needs to keep pace with ambitious profitability goals.

- What’s striking is how such a jump in profitability could rapidly shift Banc of California’s return outlook, making margin follow-through a key indicator for upcoming quarters.

Curious where analysts see the most likely risks and rewards? Discover the full consensus take in the 📊 Read the full Banc of California Consensus Narrative.

Loan Mix Shifts Toward Lower-Risk Segments

- Consensus projections highlight how the bank’s ongoing repositioning toward lender finance, fund finance, and residential mortgages is meant to stabilize asset quality and reduce provisioning costs, in contrast to its legacy focus on California commercial real estate.

- The analysts' consensus view indicates strategic moves such as shifting the loan portfolio toward these less volatile categories and focusing on core business deposit growth are expected to provide a cushion against sector downturns.

- Consensus narrative flags that this lower-risk approach is seen as essential to support not just revenue growth (expected at 15.0% per year over 3 years) but also to help withstand regional shocks unique to Southern California’s commercial market.

- However, the bank’s heavy regional exposure and the complexity of integrating recent acquisitions still pose potential for surprises, so investors may want to keep a close watch as the transition unfolds.

Valuation Hovers Below DCF Fair Value

- Banc of California’s current share price of $16.54 stands well below its DCF fair value of $19.17 and even the analyst price target of $19.45, suggesting limited downside risk if earnings expansion holds.

- The analysts' consensus view points out that this valuation gap, combined with forecasts for above-market EPS and revenue growth, supports the idea that the stock could rerate higher if management delivers on profitability and cost-control promises.

- Analysts estimate earnings to reach $382.6 million by 2028, implying meaningful upside if targets are met and the company is eventually valued in line with the broader sector.

- Still, with a price-to-earnings ratio of 15.2x (below peer average but above the banking sector), the market appears to be waiting for concrete proof that these optimistic projections can be achieved without major setbacks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Banc of California on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the results another way? Put your take into words and shape your own view of Banc of California’s story in just minutes – Do it your way.

A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite strong growth forecasts, Banc of California’s transformation depends on flawless integration of acquisitions and steady asset quality, which creates some uncertainty around consistent performance.

If you’re looking for companies that have already proven their ability to deliver reliable results over time, focus on stable growth stocks screener (2090 results) to spot those with steady, predictable growth no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives