- United States

- /

- Banks

- /

- NYSE:BAC

Will Strong Q3 Earnings and AI-Powered CashPro Adoption Shift Bank of America's (BAC) Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Bank of America announced robust third-quarter earnings growth, with record net interest income and surging adoption of its AI-driven CashPro tools among corporate clients. This combination of financial performance and enhanced digital banking capabilities showcases the bank’s expanded role in providing innovative treasury solutions for business customers.

- We’ll examine how this momentum in digital client engagement may influence Bank of America’s broader investment narrative going forward.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bank of America Investment Narrative Recap

Bank of America’s investment story centers on its strategy to drive growth through digital innovation, scale, and a diverse portfolio of financial services. The latest surge in AI-powered CashPro adoption and record earnings highlight strong execution but do not appear to materially shift the biggest short-term catalyst, continued digital engagement nor the main risk, potential legal costs from ongoing litigation.

Among the recent announcements, the class action lawsuit alleging prime rate fixing by major US banks, including Bank of America, is especially relevant to short-term concerns. This legal development raises near-term risk for the bank, as potential litigation costs could affect future net margins and operational flexibility.

But while the fundamentals look promising, investors should also be mindful of unresolved legal challenges that could quickly change the outlook if…

Read the full narrative on Bank of America (it's free!)

Bank of America's outlook points to $122.0 billion in revenue and $32.9 billion in earnings by 2028. This forecast assumes a 7.4% annual revenue growth rate and a $6.3 billion increase in earnings from the current $26.6 billion.

Uncover how Bank of America's forecasts yield a $57.23 fair value, a 9% upside to its current price.

Exploring Other Perspectives

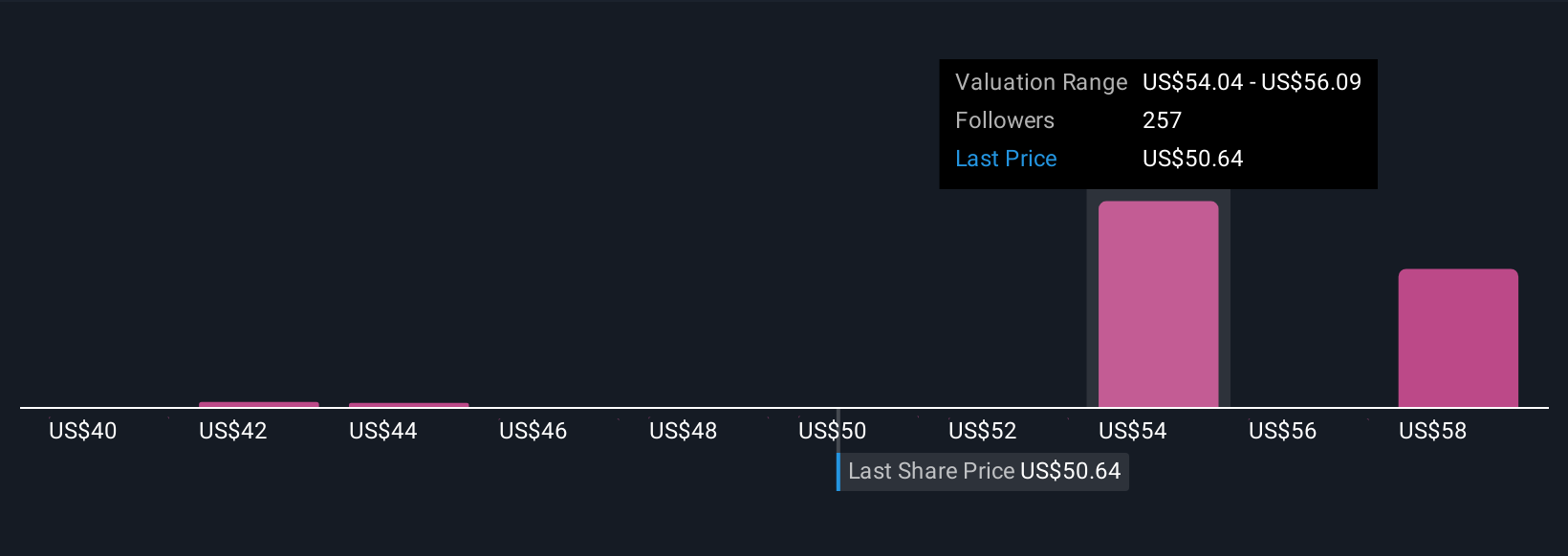

Seventeen members of the Simply Wall St Community set Bank of America’s fair value from US$43.34 to US$62.20 per share. With pending litigation among the top concerns, these opinions reflect just how differently investors weigh earnings momentum against risk, see what other investors are factoring into their forecasts.

Explore 17 other fair value estimates on Bank of America - why the stock might be worth as much as 18% more than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

No Opportunity In Bank of America?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives