- United States

- /

- Banks

- /

- NYSE:BAC

Did Launching 401k Pay Just Shift Bank of America's (BAC) Digital Innovation Narrative?

Reviewed by Sasha Jovanovic

- Bank of America announced the launch of 401k Pay, a digital solution designed to help participants convert 401(k) assets into retirement income with integrated recordkeeping, personalized advice, and real-time income management, available to eligible corporate clients and participants from November 17 at no additional cost.

- This product directly responds to rising employee demand for better retirement guidance, as highlighted in Bank of America's latest Workplace Benefits Report, and could strengthen the bank's appeal among institutional partners.

- We'll explore how the launch of 401k Pay reinforces Bank of America's digital innovation efforts within its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bank of America Investment Narrative Recap

For investors, the core case for Bank of America is its ability to deliver steady earnings growth through digital innovation, operational efficiency, and a diversified business model. The recent launch of 401k Pay illustrates the bank’s tech-driven approach, but its impact may take time to be felt and is unlikely to materially shift major short-term catalysts such as commercial loan growth. The biggest current risk remains economic uncertainty, which can influence credit quality and net margins.

Among recent announcements, Bank of America’s ongoing share repurchase program stands out. By buying back more than 5% of its outstanding shares over the past year, the company is providing a clear catalyst for potential value creation. While 401k Pay is a sign of innovation, the scale of the buyback ties more directly to short-term shareholder value and capital strength, supporting the investment narrative amid uncertain macroeconomic conditions.

However, investors should not overlook the potential effects of increased competition for deposits on net interest income, especially as...

Read the full narrative on Bank of America (it's free!)

Bank of America's narrative projects $122.0 billion revenue and $32.9 billion earnings by 2028. This requires 7.4% yearly revenue growth and a $6.3 billion earnings increase from $26.6 billion today.

Uncover how Bank of America's forecasts yield a $57.98 fair value, a 10% upside to its current price.

Exploring Other Perspectives

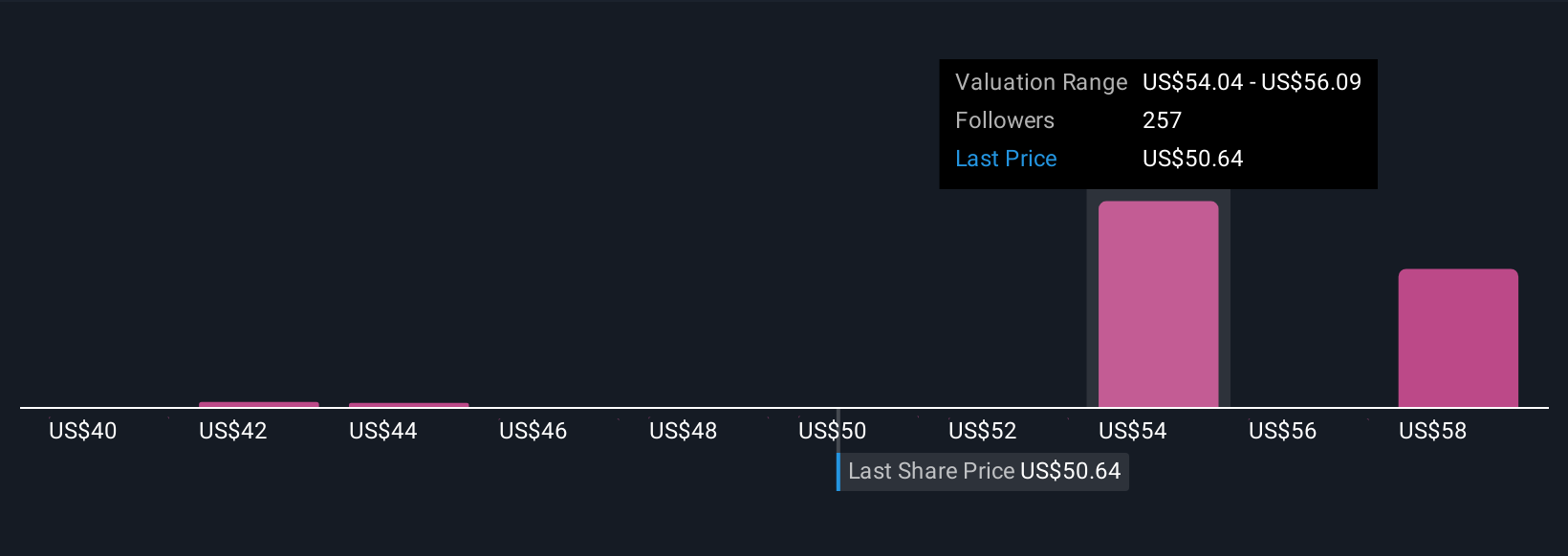

Thirteen fair value estimates from the Simply Wall St Community range from US$43.34 to US$57.98 per share. As digital innovation accelerates, market participants’ views can differ widely on future earnings power, so consider exploring several opposing viewpoints yourself.

Explore 13 other fair value estimates on Bank of America - why the stock might be worth 18% less than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives