- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (BAC): Assessing Valuation Following Strong Q3 Results and Positive Rate Outlook

Reviewed by Simply Wall St

Bank of America (BAC) is attracting attention after reporting strong third-quarter results, with revenue and earnings up double digits. The company also notes a clear path for further gains as the Federal Reserve cuts rates.

See our latest analysis for Bank of America.

Bank of America has seen renewed momentum lately, fueled by standout third-quarter results and a series of strategic moves, including new bond issuances, product launches like 401k Pay, and initiatives supporting clients after recent wildfires. Shares have climbed steadily to $52.99, with a 1-year total shareholder return of 13.5% reflecting not just near-term resilience but an encouraging long-term trend, as three- and five-year total returns exceed 50% and 100% respectively. The recent uptick signals growing optimism around BAC’s growth potential and risk profile thanks to falling rates and strong business fundamentals.

If watching banks capitalize on changing markets has you curious, now is the perfect moment to discover fast growing stocks with high insider ownership.

With BAC now trading at a discount to analyst targets and up over 13% in the past year, investors are left to consider whether today’s price reflects future upside or if a genuine buying window remains open.

Most Popular Narrative: 10% Undervalued

With Bank of America closing at $52.99 and the widely followed narrative suggesting a fair value near $58.94, observers are weighing whether a nearly 10% upside is justified. This view factors in a blend of continued business momentum and sector-wide developments, all while reflecting slightly bullish analyst sentiment.

“Bank of America’s continued investment in digital engagement and AI-driven efficiencies is expected to enhance customer acquisition and retention, potentially increasing revenue and net margins over time. The company’s focus on growing commercial loans and adding new clients, particularly in sectors like international markets and healthcare, suggests potential future revenue growth as these investments mature.”

Think you already know why analysts are bumping up their price target? The real twist is that this fair value leans on bold assumptions about future earnings power and margin shifts. What exactly powers this upgrade? The full breakdown reveals which growth bets and profit drivers are fueling the optimism. Find out before the market does.

Result: Fair Value of $58.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks such as market volatility and increased litigation costs could still challenge the bank’s upbeat outlook and earnings trajectory in the months ahead.

Find out about the key risks to this Bank of America narrative.

Another View: Comparing Market Ratios

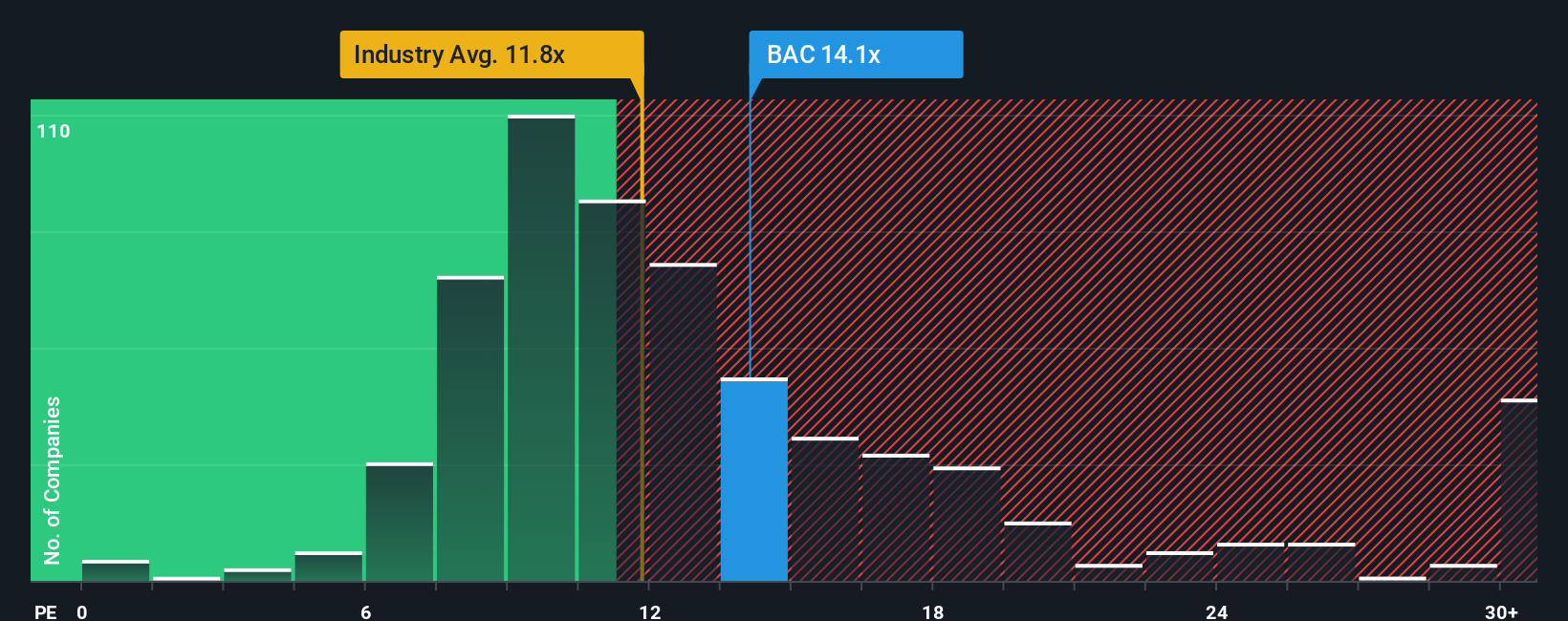

While the consensus price target and current share price suggest Bank of America is undervalued, there is another angle to consider. The company trades at a price-to-earnings ratio of 13.7x, which is slightly above the industry average of 11.4x and just above peers at 13.5x. However, it remains below our fair ratio estimate of 14.7x. This subtle premium may raise questions about valuation risk if expectations change, or it could highlight an opportunity if the market moves toward that fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of America Narrative

If you think there’s more to the story or want to investigate the details for yourself, it’s never been easier to build your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of America.

Looking for More Investment Ideas?

Unlock tomorrow’s winners today by seizing new trends, chasing real value, and putting your portfolio at the forefront of innovation with these handpicked strategies.

- Accelerate your income potential by targeting high yields with these 15 dividend stocks with yields > 3% and identify companies delivering robust, reliable returns above 3%.

- Expand your exposure to breakthrough medical innovation and growth by tapping into these 30 healthcare AI stocks, spotlighting businesses at the intersection of healthcare and artificial intelligence.

- Capitalize on undervalued gems primed for upside. Start with these 927 undervalued stocks based on cash flows and track opportunities where strong fundamentals and low prices meet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success