- United States

- /

- Banks

- /

- NYSE:AVBC

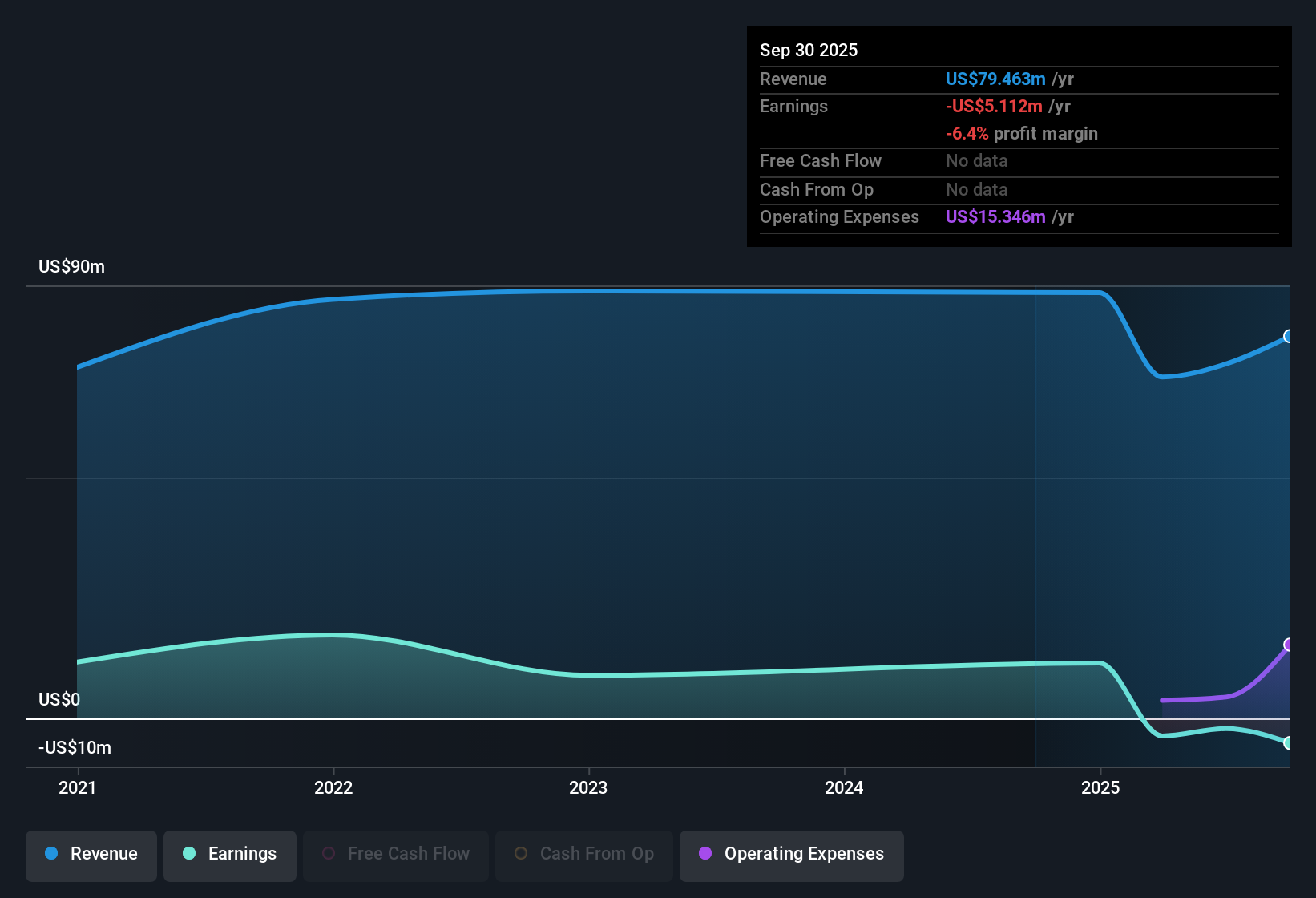

Avidia Bancorp (AVBC): Losses Worsen at 43.1% Annual Rate, Underscoring Persistent Profitability Concerns

Reviewed by Simply Wall St

Avidia Bancorp (AVBC) remains unprofitable, with losses accelerating at an average annual rate of 43.1% over the past five years. Net profit margin has shown no improvement in the last year, and there have been no reports of profitability during this period.

See our full analysis for Avidia Bancorp.The real test is how these numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Book Ratio Reflects Investor Skepticism

- Avidia Bancorp's price-to-book ratio sits at 0.8x, which is not only below the US Banks industry average of 1x but also under the peer group average of 0.9x. This signals that the market is discounting the company more heavily than its peers.

- The prevailing view emphasizes how a low price-to-book may look attractive at first glance, but for AVBC, this discount intensifies questions about the unprofitability trend.

- While some may interpret a 0.8x ratio as a bargain compared to industry and peers, the lack of positive earnings momentum drives investors to question if the discount is justified.

- Persistent net losses and an accelerating five-year negative trend weigh more heavily than simple valuation. Until fundamentals show signs of turnaround, the low multiple amplifies market caution.

No Signs of Turnaround in Profit Margins

- Net profit margin has failed to improve over the last year, and AVBC has not reported profitability at any point during this period, reinforcing the negative earnings trend from recent years.

- Prevailing market analysis points to the absence of both short-term and structural margin gains, making hopes of a near-term rebound hard to support.

- Losses accelerating by 43.1% on average over five years underline structural issues, so even a stable margin would be notable. In this case, no such stability appears.

- The sharp annualized decline in earnings power makes it difficult for bulls to argue for a pending turnaround on margins alone.

Lack of Growth Signals Heightens Risk Focus

- Company filings and risk data identify no anticipated growth in revenue or earnings, and there are no noted rewards for shareholders based on current indicators.

- The current stance highlights that investors remain focused on future growth signals, but none have emerged, raising the bar for any positive re-rating.

- The persistent lack of profitability and revenue expansion means risk factors dominate the conversation, and potential upside remains firmly tied to the company breaking this cycle.

- Until evidence of a shift appears, either in the form of revenue stabilization or improved margins, the company’s risk profile is likely to overshadow any faint valuation appeal.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Avidia Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Avidia Bancorp continues to struggle with persistent losses, stagnant profit margins, and an absence of growth or turnaround signals in its recent performance.

If you want to avoid unprofitable companies with weak growth prospects, shift your focus to firms showing reliable expansion and resilience by checking out our stable growth stocks screener (2099 results) results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVBC

Avidia Bancorp

Operates as the bank holding company for Avidia Bank that provides various financial services to individual and corporate customers.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives