- United States

- /

- Banks

- /

- NYSE:ASB

A Look at Associated Banc-Corp’s Valuation Following Strong Q3 Earnings and Record Net Interest Income

Reviewed by Simply Wall St

Associated Banc-Corp (ASB) just posted a strong third quarter, reporting record net interest income along with impressive growth in both loans and core deposits. The company’s results surpassed expectations and reflect management’s focused strategy and financial discipline.

See our latest analysis for Associated Banc-Corp.

Associated Banc-Corp’s upbeat third-quarter earnings and steady deposit growth have sparked renewed investor interest, helping fuel an 8.4% year-to-date gain in its share price. The stock’s solid momentum this year builds on a robust five-year total shareholder return of 128%, which highlights confidence in management’s strategy as well as the potential for further growth in 2026.

If you want to see what other companies are building strong track records, it’s a great time to discover fast growing stocks with high insider ownership

Given this track record of outperformance and a price target above current levels, investors must now ask: Is Associated Banc-Corp still undervalued, or is the market already pricing in all that future growth?

Most Popular Narrative: 10.5% Undervalued

The narrative consensus points to a fair value of $28.60, compared to the last close price of $25.59. This gap has investors questioning the optimism behind the numbers driving this target.

*The company's strategic pivot toward growing commercial and industrial (C&I) lending, replacing lower-yielding residential balances with higher-yielding, relationship-focused assets, is driving record net interest income and margin expansion. This positions the balance sheet for sustained profitability growth and is likely to positively impact revenue and net margins.*

Curious what kind of bold growth targets fuel this narrative? It is more than just loan growth or margin management. The real surprise is the earnings and profit leap expected in the next three years. Find out what dramatic projections underpin this upbeat valuation.

Result: Fair Value of $28.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a regional economic downturn or weaker-than-expected deposit growth could quickly derail even the most optimistic outlook for Associated Banc-Corp’s future earnings.

Find out about the key risks to this Associated Banc-Corp narrative.

Another View: Valuation by Comparison

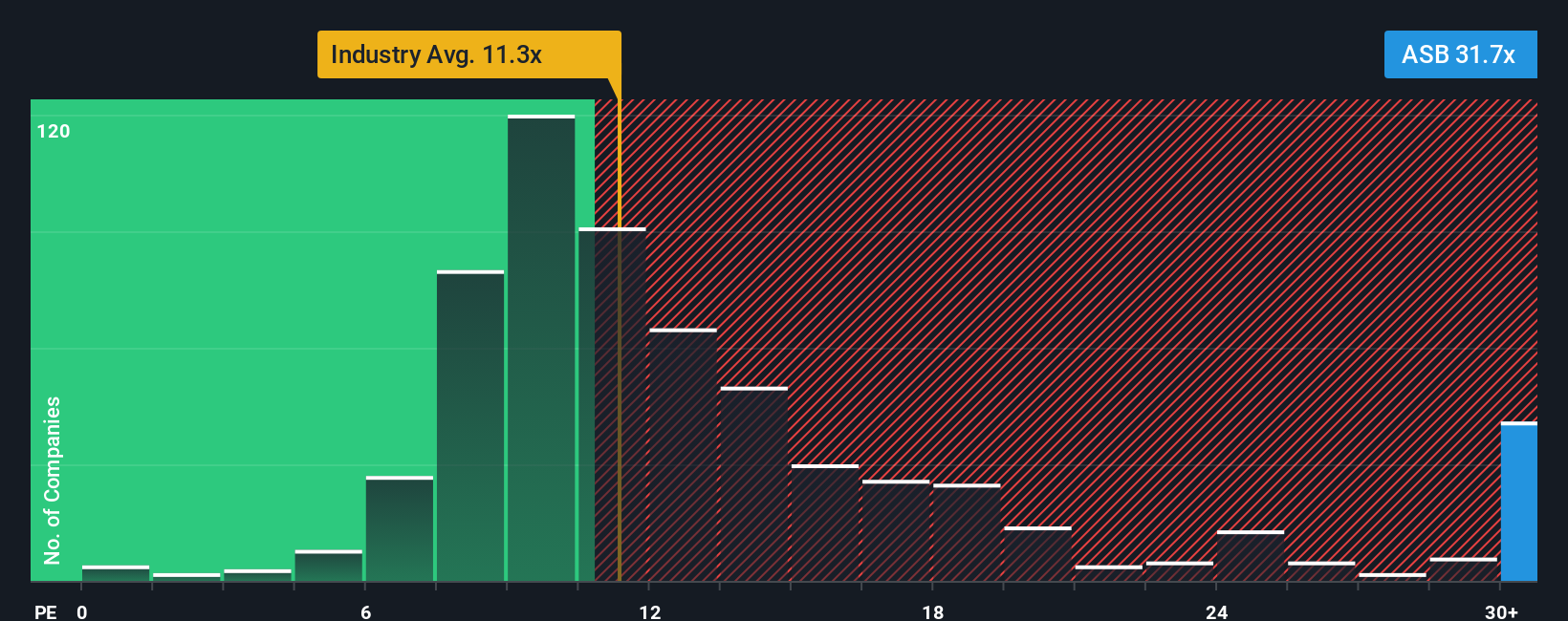

Looking through a different lens, Associated Banc-Corp currently trades at a price-to-earnings ratio of 25.5, which is higher than both the US Banks industry average of 11.2 and its closest peers at 22. This is also well above the fair ratio of 18.1 the market could move toward. These relative premiums may signal that investors are pricing in a lot of future growth, or could it be too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Associated Banc-Corp Narrative

If you see the story differently or want to take the data into your own hands, building your own view is quick and easy. Just Do it your way.

A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for long-term success by checking out more high-potential stocks that fit a range of strategies. Don’t miss these great starting points:

- Tap into the growth potential of breakthrough technology by staying ahead with these 27 AI penny stocks before the market catches on.

- Boost your portfolio’s stability and recurring income by seeing which companies currently offer yields above 3% through these 17 dividend stocks with yields > 3%.

- Position yourself early in transformative trends by finding tomorrow’s leaders among these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives