- United States

- /

- Banks

- /

- NYSE:ABCB

Assessing Ameris Bancorp (ABCB) Valuation Following Strong Q3 Results and Renewed Share Buybacks

Reviewed by Simply Wall St

Ameris Bancorp (ABCB) just posted a strong third-quarter update, delivering results ahead of forecasts. The bank’s solid deposit growth, rising noninterest income, and careful expense control caught the eye of investors this time around.

See our latest analysis for Ameris Bancorp.

This solid quarterly update has fueled interest in Ameris Bancorp, especially following its recent share buyback program and ongoing improvements in credit quality. After a steady climb this year, the stock’s 18.8% year-to-date share price return and 17.2% total shareholder return over the past year signal that momentum is firmly building for both short-term and long-term investors.

If you’re weighing where to look next after Ameris Bancorp’s strong showing, now could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares up nearly 19 percent year to date and the stock still trading more than 11 percent below analyst targets, the question is whether Ameris Bancorp is undervalued right now or if future growth is already fully accounted for in today's prices.

Most Popular Narrative: 9.2% Undervalued

With Ameris Bancorp last closing at $72.45 and the narrative fair value sitting notably higher, the current price reflects meaningful upside, according to the most widely followed valuation view. Analyst consensus points to improving fundamentals as the key support for this target, suggesting recent performance is not yet fully appreciated by the market.

In a market environment where deal stocks are often under pressure, Ameris stands out for its disciplined execution and resilient earnings profile. Analysts believe investors will continue to reward this with premium valuations.

Want to see what’s driving this premium price tag? The narrative hinges on ambitious growth expectations and assumptions about profit margins that could surprise even seasoned investors. Curious about which financial forecasts power this bullish scenario? The full breakdown may challenge your expectations about where Ameris Bancorp is heading next.

Result: Fair Value of $79.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition for deposits or a slowdown in cyclical loan sectors could quickly challenge Ameris Bancorp’s growth assumptions and profit outlook.

Find out about the key risks to this Ameris Bancorp narrative.

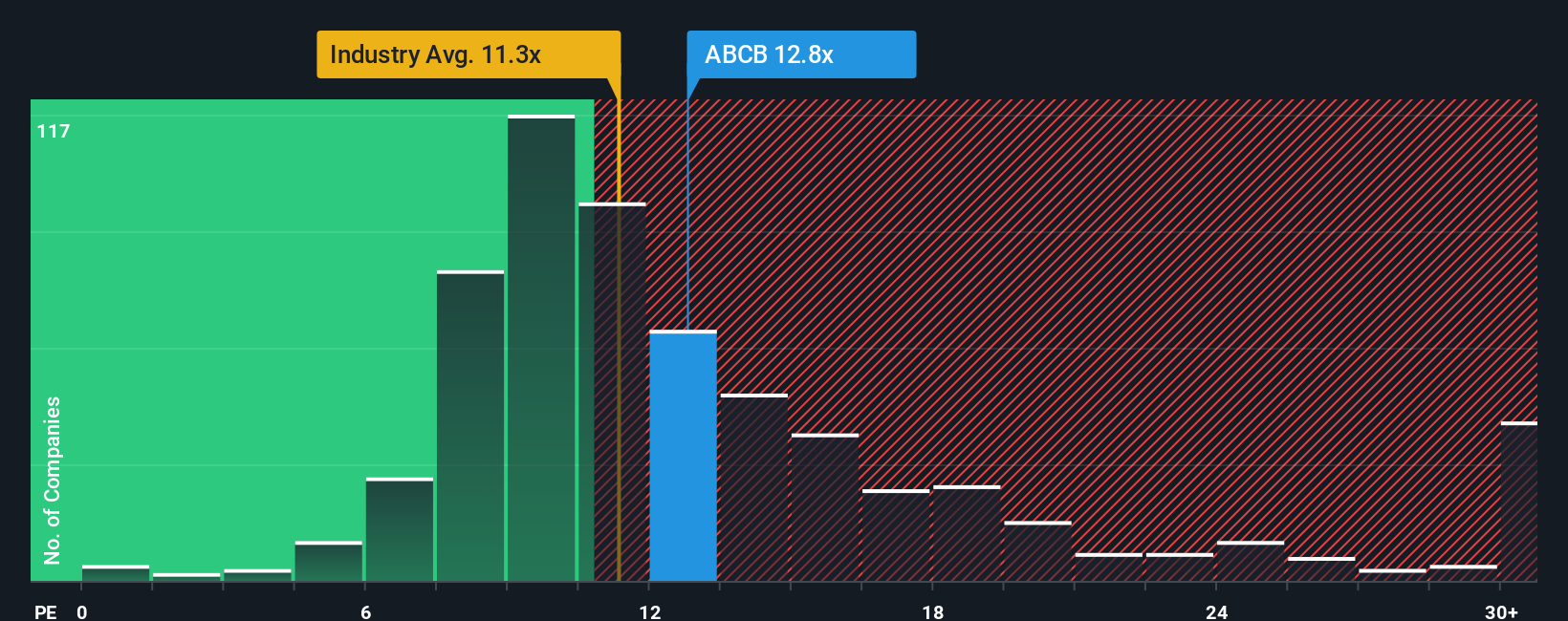

Another View: Market Ratios Paint a Different Picture

While longer-term fair value estimates hint at significant upside, the current price-to-earnings ratio of 12.4 places Ameris Bancorp as more expensive than both the US Banks industry average (11x) and peer group (11x). Even compared to its fair ratio of 11.2, the shares look on the pricey side. Does this valuation signal investor optimism or just a growing risk of disappointment if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameris Bancorp Narrative

If you think there’s more to the story or prefer to dive into the numbers yourself, you can shape your own Ameris Bancorp narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ameris Bancorp.

Looking for More Smart Investment Opportunities?

Ready to make your next move? Don’t let standout investments slip by while others seize tomorrow’s strongest trends. Scan these handpicked ideas and upgrade your strategy now:

- Amplify your earning potential by targeting consistent yield with these 20 dividend stocks with yields > 3% offering attractive payouts above 3 percent.

- Tap into the next digital revolution by tracking innovators among these 26 AI penny stocks capturing opportunity in artificial intelligence.

- Benefit from market mispricing by examining these 840 undervalued stocks based on cash flows that are primed for growth based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives