- United States

- /

- Banks

- /

- NYSE:ABCB

Assessing Ameris Bancorp (ABCB) Valuation as Analyst Sentiment and Earnings Outlook Turn More Positive

Reviewed by Simply Wall St

Ameris Bancorp (ABCB) has recently caught attention as analyst sentiment toward the company improves and expectations for future earnings become more positive. This shift stands out in an otherwise underperforming industry.

See our latest analysis for Ameris Bancorp.

Ameris Bancorp’s share price has climbed 21.6% year-to-date, reflecting renewed momentum as sentiment improves and confidence grows in its outlook. Over the longer term, the company has delivered a 124.5% total shareholder return in five years, showing consistent value creation for investors.

If Ameris Bancorp’s solid streak has you curious about broader opportunities, now is a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With strong share price gains and upbeat analyst sentiment, the question now is whether Ameris Bancorp’s current valuation leaves further upside for investors or if the market has already priced in all its growth potential.

Most Popular Narrative: 8% Undervalued

With Ameris Bancorp’s fair value set at $80.60, compared to a last close of $74.19, the narrative points to a moderate upside for the stock. Behind this assessment lies robust optimism in the bank’s ability to deliver consistent growth even in a competitive environment.

Industry disruption and bank consolidation in the Southeast create further potential for Ameris to capitalize on growth opportunities, both organic and selective M&A. The company may leverage strong capital and scale to enhance future earnings and efficiency ratios.

Want to know what bold assumptions drive this valuation? It hinges on a future profit multiple, steady earnings growth, and ambitious M&A plans. Curious about the exact numbers analysts are betting on? Discover the financial blueprint shaping this narrative and what could put it to the test.

Result: Fair Value of $80.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition for deposits and overreliance on Southeastern markets could challenge Ameris Bancorp’s growth narrative if economic conditions shift unexpectedly.

Find out about the key risks to this Ameris Bancorp narrative.

Another View: Is the Valuation Too Rich?

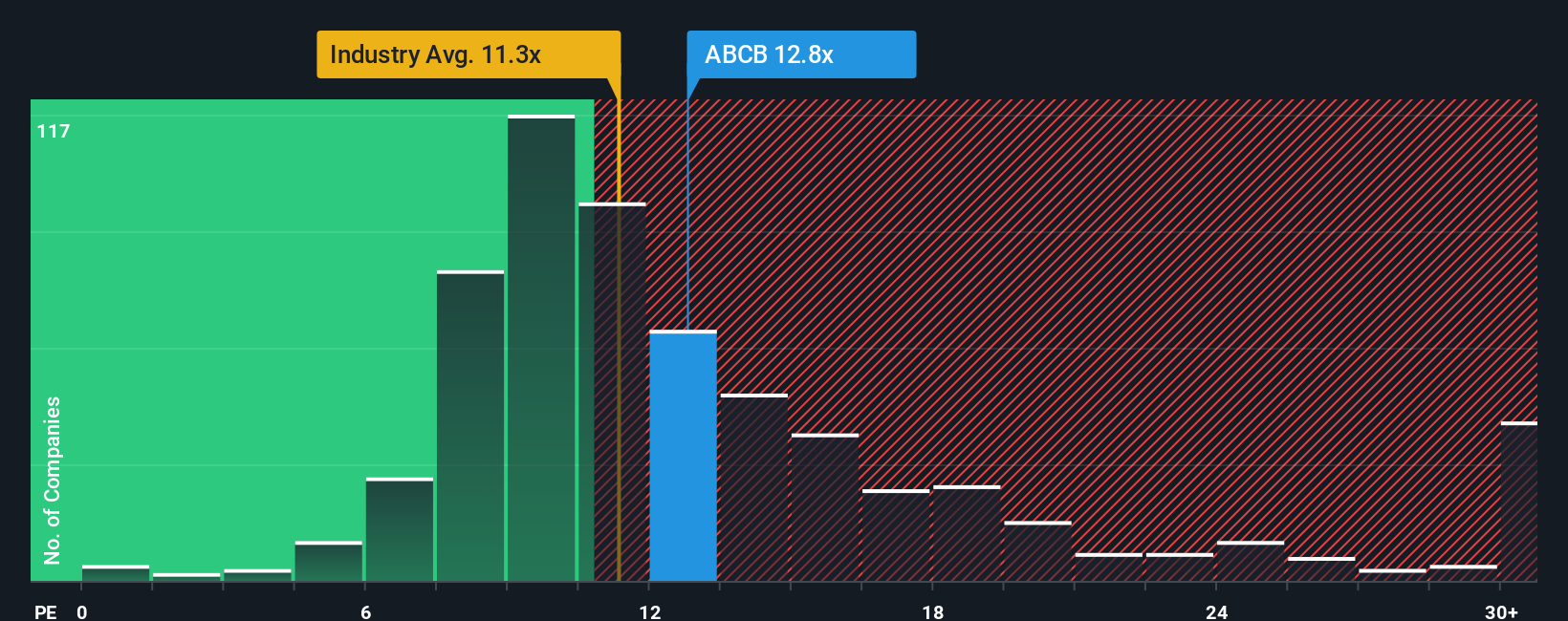

While the fair value narrative hints at an undervalued opportunity, a closer look at the company’s price-to-earnings ratio tells a different story. Ameris Bancorp trades on a 12.7x ratio, noticeably higher than the US Banks industry average of 11.2x and its peer average of 11.9x. Even the fair ratio, which the market could revert toward, is just 11.1x. As a result, investors are paying a premium, which could signal less upside or greater valuation risk. Is the optimism potentially outpacing the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameris Bancorp Narrative

If you want to dig into the data and construct your own investment case, you can analyze the numbers and shape the story yourself in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ameris Bancorp.

Looking for More Smart Investment Ideas?

Act now and broaden your portfolio by checking out other stocks with unique potential. Opportunities like these rarely wait around, and you don’t want to be left behind.

- Unlock steady passive income with attractive yields by checking these 16 dividend stocks with yields > 3%, featuring financially robust companies focused on rewarding shareholders.

- Jump ahead of mainstream trends and uncover deep value in under-the-radar companies through these 3598 penny stocks with strong financials, poised for breakout growth and surprising success stories.

- Seize the chance to capitalize on transformative tech by evaluating these 26 AI penny stocks, harnessing artificial intelligence for breakthrough innovation and explosive market potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives