- United States

- /

- Banks

- /

- NasdaqGS:WTFC

Here's Why I Think Wintrust Financial (NASDAQ:WTFC) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Wintrust Financial (NASDAQ:WTFC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Wintrust Financial

How Fast Is Wintrust Financial Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Wintrust Financial managed to grow EPS by 4.1% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

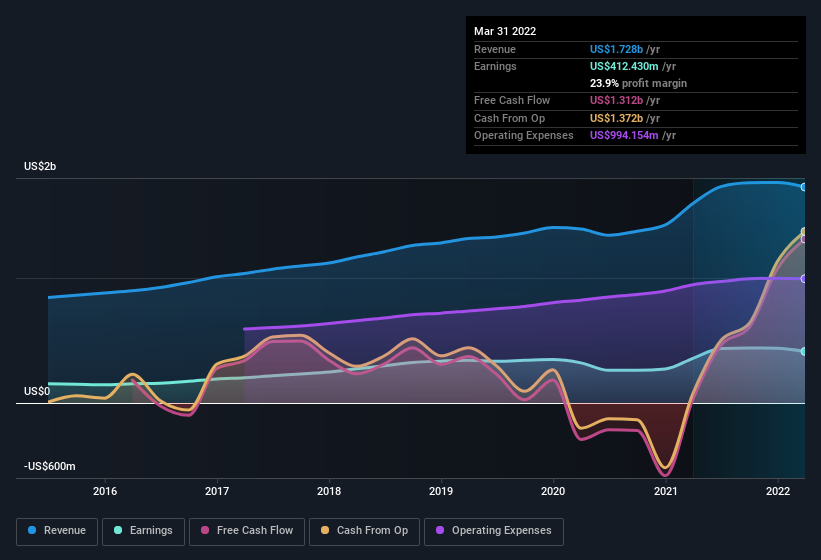

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Wintrust Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Wintrust Financial maintained stable EBIT margins over the last year, all while growing revenue 8.2% to US$1.7b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Wintrust Financial?

Are Wintrust Financial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -US$608k worth of sales, Wintrust Financial insiders have overwhelmingly been buying the stock, spending US$859k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Independent Chairman of the Board H. Hackett who made the biggest single purchase, worth US$456k, paying US$91.23 per share.

The good news, alongside the insider buying, for Wintrust Financial bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$45m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Ed Wehmer, is paid less than the median for similar sized companies. For companies with market capitalizations between US$4.0b and US$12b, like Wintrust Financial, the median CEO pay is around US$8.3m.

Wintrust Financial offered total compensation worth US$7.1m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Wintrust Financial To Your Watchlist?

One positive for Wintrust Financial is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Wintrust Financial that you should be aware of.

The good news is that Wintrust Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wintrust Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WTFC

Flawless balance sheet established dividend payer.