- United States

- /

- Banks

- /

- NasdaqGS:WSFS

WSFS Financial (WSFS): Valuation Perspective Following Q3 EPS Growth and Analyst Upgrade

Reviewed by Simply Wall St

WSFS Financial (WSFS) reported a 27% rise in third quarter earnings per share for 2025, which was driven by better asset quality, strong net interest income, and careful expense management. This signals ongoing strength in the company's fundamentals.

See our latest analysis for WSFS Financial.

WSFS Financial’s latest share price of $54.37 reflects a steady upward trend amid notable events, including the appointment of Michelle Hong to its board and a recent analyst upgrade that highlights stronger earnings expectations. While the company’s 4.68% share price return year-to-date shows momentum building lately, the total shareholder return of 17.27% over three years underscores that longer-term holders have still benefited from the bank’s resilience and growth strategy.

If this kind of momentum and boardroom evolution has you curious, now is the perfect time to expand your perspective and discover fast growing stocks with high insider ownership

But with shares up for the year and analyst upgrades boosting sentiment, investors may wonder whether the market is underestimating WSFS Financial’s future potential or if the recent good news has already been fully priced in, leaving limited upside for new investors.

Most Popular Narrative: 15.7% Undervalued

WSFS Financial's current share price of $54.37 sits noticeably below the most popular narrative’s projected fair value. This disconnect has sharpened investor focus, and now the key drivers behind this optimism demand a closer look.

WSFS is leveraging population growth and household formation in key U.S. suburban and mid-Atlantic markets, which is driving consistent year-over-year increases in both consumer and commercial deposits, as well as growth in residential mortgage origination. This positions the company to see continued revenue expansion and deposit growth as these demographic trends persist.

What’s the secret sauce that has analysts this bullish? The foundation of this valuation is built on bold assumptions, including robust top-line expansion, transformative digital investments, and future profit margins that push the envelope. Want to see the underlying projections that point to a premium future multiple? Prepare to be surprised by the high-conviction figures that anchor this consensus view.

Result: Fair Value of $64.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration missteps from acquisitions or a regional economic setback could quickly challenge these upbeat projections and shift sentiment around WSFS Financial's outlook.

Find out about the key risks to this WSFS Financial narrative.

Another View: What Do the Ratios Tell Us?

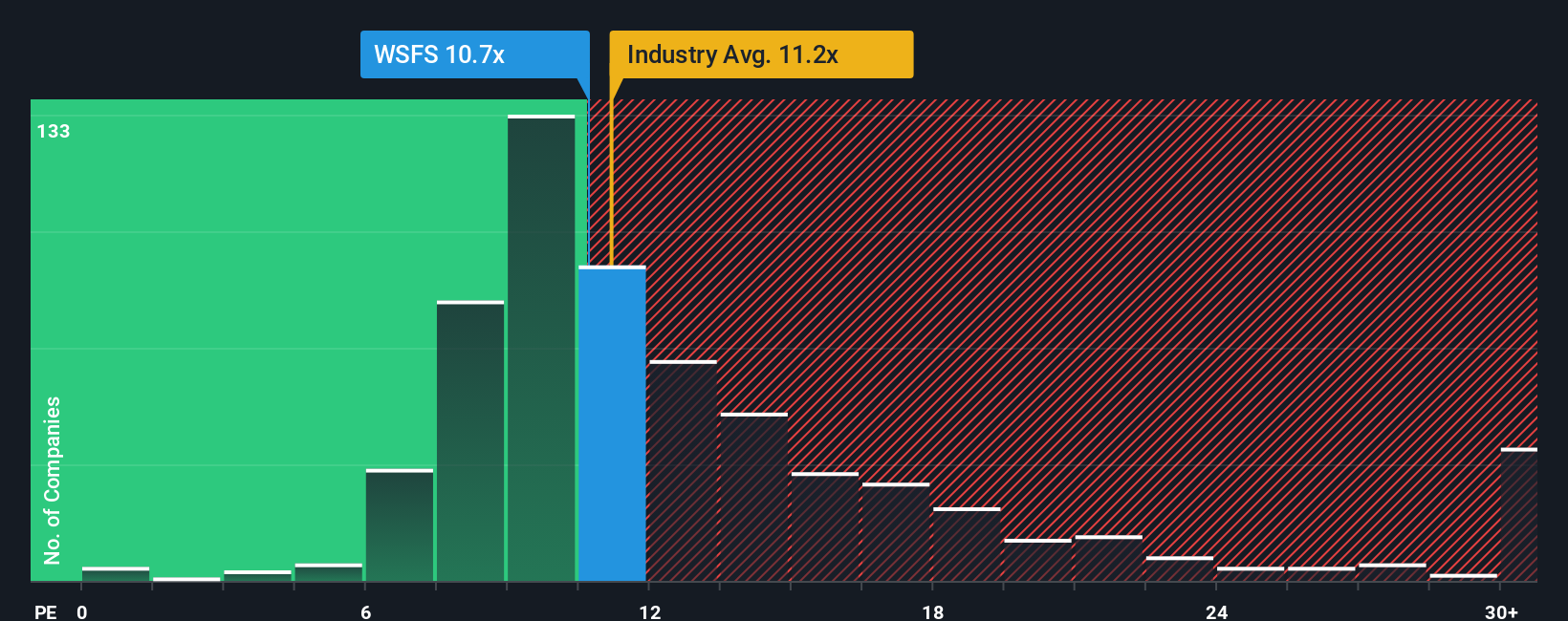

While the fair value calculation points to WSFS Financial being undervalued, a look at its price-to-earnings ratio paints a different picture. WSFS trades at 10.7x earnings, which is higher than its fair ratio of 9.9x and not much lower than the wider industry average. This gap could signal limited upside and introduces valuation risk. Can WSFS justify this premium if growth tapers off?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WSFS Financial Narrative

If these perspectives don't quite fit your view, or you want to take the analysis into your own hands, you can dig into the data and craft your own insights in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WSFS Financial.

Looking for more investment ideas?

Smart investors always keep an eye out for new opportunities. Don’t miss your chance to find other stocks that offer growth, value, or future-proof themes.

- Tap into the potential of emerging technologies by checking out these 28 quantum computing stocks, which is developing game-changing solutions in computing and security.

- Grab steady income streams with these 16 dividend stocks with yields > 3%, featuring companies with strong yields and reliable long-term performance.

- Fuel your watchlist with these 875 undervalued stocks based on cash flows, where overlooked bargains based on cash flows are waiting for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WSFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSFS

WSFS Financial

Operates as the savings and loan holding company for the Wilmington Savings Fund Society, FSB that provides various banking services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives