- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Should WesBanco’s (WSBC) Tennessee Expansion Signal a Shift in Its Regional Growth Strategy?

Reviewed by Sasha Jovanovic

- WesBanco, Inc. recently expanded its Tennessee operations by opening a commercial loan production office in Knoxville and announcing its first retail banking center in Chattanooga, with Adam Thomas promoted to Regional President for the state to oversee this growth.

- This expansion leverages WesBanco’s established loan production office strategy and highlights the company’s ongoing investment in entering high-growth metropolitan markets adjacent to its existing footprint.

- We’ll now examine how WesBanco’s expansion into Tennessee’s fast-growing markets could reinforce its growth and regional diversification narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WesBanco Investment Narrative Recap

To be a WesBanco shareholder, one needs conviction in the company’s ability to drive sustainable growth by entering higher-potential markets and maintaining operational resilience. The recent Tennessee expansion aims to accelerate geographic diversification, a key near-term catalyst, but the core risk remains exposure to commercial real estate and market-specific slowdowns. This latest move, while a positive signal, does not materially alter the biggest risk of loan growth volatility driven by elevated payoff and refinancing rates.

Among recent announcements, the completed Premier Financial integration stands out, as it increases WesBanco’s exposure across new regions and expands its customer base. This reinforces the company’s growth narrative, especially as the Tennessee launch follows other entries into high-growth metro markets, supporting the ongoing shift away from reliance on a more concentrated Midwest footprint.

However, against this backdrop, investors should be mindful that if economic conditions shift in key new markets...

Read the full narrative on WesBanco (it's free!)

WesBanco's narrative projects $1.7 billion in revenue and $821.3 million in earnings by 2028. This requires 35.2% annual revenue growth and a $696.1 million increase in earnings from the current $125.2 million.

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 22% upside to its current price.

Exploring Other Perspectives

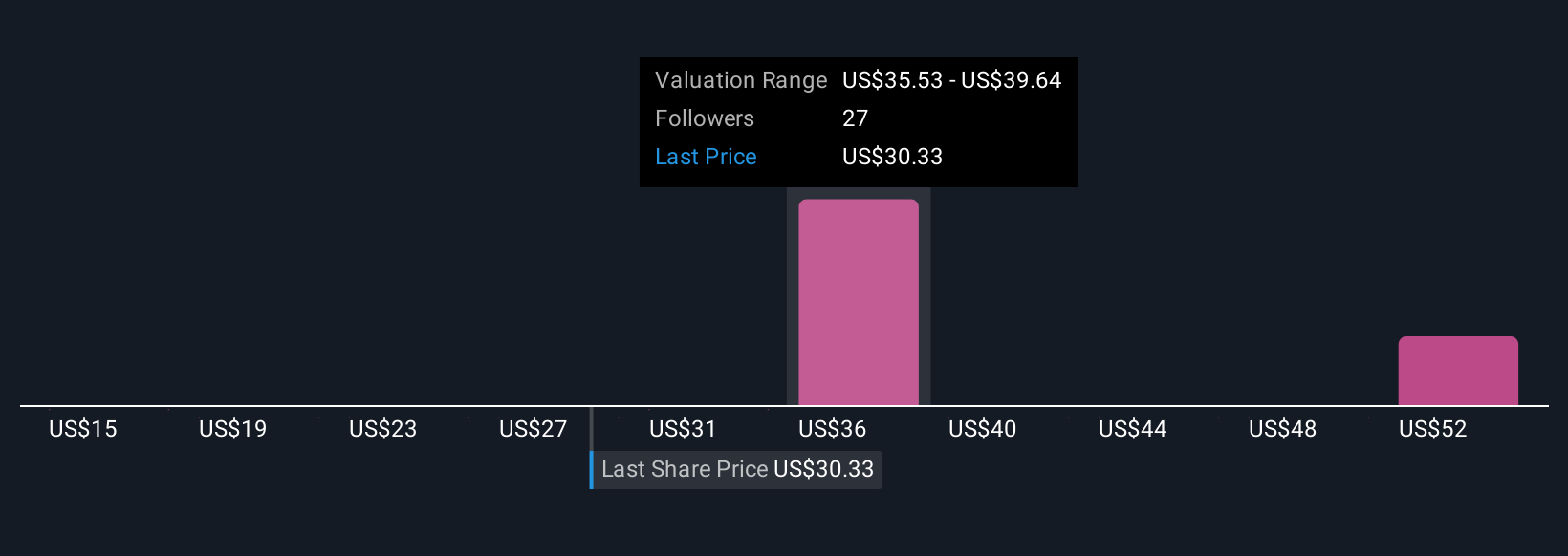

Six fair value opinions from the Simply Wall St Community range from US$14.98 to US$66.94 per share, reflecting wide differences in outlook. While recent expansion hints at broader growth, ongoing reliance on select regions still exposes WesBanco to swings in local economies.

Explore 6 other fair value estimates on WesBanco - why the stock might be worth over 2x more than the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives